Trends to Watch

[Hurricane Milton Watch]

- The hurricane is expected to cause widespread flooding and destruction along the West Coast of Florida, particularly in the Tampa Bay area.

- While ports can generally withstand hurricane-force winds, there will likely be equipment damage, containers blown over, and destruction caused by storm surge and flooding.

- U.S. Gulf Coast ports will begin port assessments 24-48 hours after the storm passes. The Port of Tampa suspended all inbound and outbound vessel traffic on Tuesday, October 8.

[Customs]

- The Merchandise Processing Fee (MPF), imposed by U.S. Customs and Border Protection (CBP) on formal entries (goods whose monetary value exceeds $2,500, or commercial textile shipments (clothes/materials) regardless of value), increased on October 1. In particular, the minimum fee has increased from $31.67 to $32.71, the maximum fee has risen from $614.35 to $634.62, and the ad valorem rate remains unchanged at 0.3464%.

- Additionally, other fee increases can be found here.

- In Canada, the Canada Border Services Agency (CBSA)’s Assessment and Revenue Management (CARM) system will go live on Monday, October 21. There, importers can pay duties and other taxes to the CBSA.

[Ocean – TPEB]

- Demand remains flat following the resolution of the port strike. Market capacity continues to exceed demand, and a space crunch is not anticipated during the cleanup of backlog vessels at U.S. East and Gulf Coast ports.

- With the ILA strike suspended and container operations in motion again, ocean carriers have waived or canceled their East/Gulf Coast emergency congestion surcharges.

- Fixed rates and Peak Season Surcharges (PSS) will remain unchanged through the first half of October.

[Ocean – FEWB]

- Recovery has been slow since operations resumed after the Golden Week holiday, however, vessels are being reported as well-utilized by liners amid the announced blank sailings in the market.

- Floating rates have remained frozen for two weeks due to the Golden Week holidays, with expectations that liners will continue proactively reviewing rates to optimize vessel utilization.

- THE Alliance has already announced three void sailings for November, while 2M and Ocean Alliance are still evaluating their options. If recovery continues to lag and demand remains flat from the Far East to Europe, more void sailings may be introduced to better manage supply and demand and prevent further market collapse.

- Equipment shortages have largely been resolved, although some ports of loading (POLs) with fewer direct calls are still experiencing occasional shortages due to rerouting via the Cape of Good Hope (COGH).

[Ocean – TAWB]

- The ILA strike, which ended on October 4, is expected to have created a booking backlog of 2 to 3 weeks. The majority of carriers have canceled their disruption charges, since the strike has concluded. Additionally, the strike in Montreal has also ended, with operations returning to normal.

- Many clients have diverted their shipments to services via Canada or the U.S. West Coast to avoid delays and congestion that persist at U.S. East Coast and Gulf Coast ports.

- Carriers anticipate reduced capacity for October, but this is highly dependent on operations and delays at the main U.S. East Coast ports. There may also be a potential shortage of chassis and trucks. It’s advisable to review detention and demurrage (D&D) application rules by carrier.

[Ocean – U.S. Exports]

- Operations at ports and terminals affected by the ILA strike have resumed, leading to an anticipated surge in new bookings. This influx is likely to create a backlog that may persist through the end of October and into November.

[India Subcontinent and North America]

- The market continues to soften following the temporary resolution of labor disruptions on the U.S. East Coast. Ocean carriers had initially planned for rate increases to both the U.S. East Coast and U.S. West Coast during the latter half of October, but all these plans have now been canceled.

- As demand declines, capacity has opened up on both coasts, though the U.S. East Coast has significantly more available capacity than the U.S. West Coast.

- Additionally, ZIM has joined MSC in operating the INDUSA and INDUS EXPRESS services, which were previously standalone. These services focus on India to U.S. East Coast trades, where capacity is at an all-time high due to new vessel-sharing agreements and services launched since May.

[Air – Global] Mon 23 Sep – Sun 29 Sep 2024 (Week 39):

- Rates and demand surged in September as anticipation began to build for a strong peak season.

- Global demand rebounds (week-on-week, WoW): In the final week of September, global chargeable weight increased by +2% WoW, recovering from a -2% decline the previous week due to holidays. Tonnages in week 39 were approximately +10% higher than the same week last year, driven by significant recoveries in the Asia-Pacific (+6%), Central and South America (+4%), and the Middle East and South Asia (MESA, +2%).

- Rates increase (year-on-year, YoY): Average worldwide rates rose by +1% WoW to $2.61 per kilo, with a YoY increase of +10%. Global spot rates saw a +4% WoW rise, reaching $2.86 per kilo, which is +20% higher than last year’s levels. Notably, spot rates from the Asia-Pacific and MESA are up +26% and +86% YoY, respectively.

- Bangladesh market disruptions: Due to ongoing political and logistics challenges, Bangladesh-to-Europe tonnages dropped by -15% YoY in September, while spot rates remained high at $5.11 per kilo, marking a +138% YoY increase. Bangladesh to USA tonnages surged by +50% YoY, with spot rates consistently above $7 per kilo—more than three times last year’s levels.

- Third-quarter (Q3) growth: Q3 saw a +1% increase in worldwide chargeable weight compared to Q2, with an +11% YoY increase. Rates were also up by +1% QoQ, and +10% YoY, driven primarily by the Asia-Pacific and MESA markets, which are anticipated to remain pivotal as peak season demand rises in Q4.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

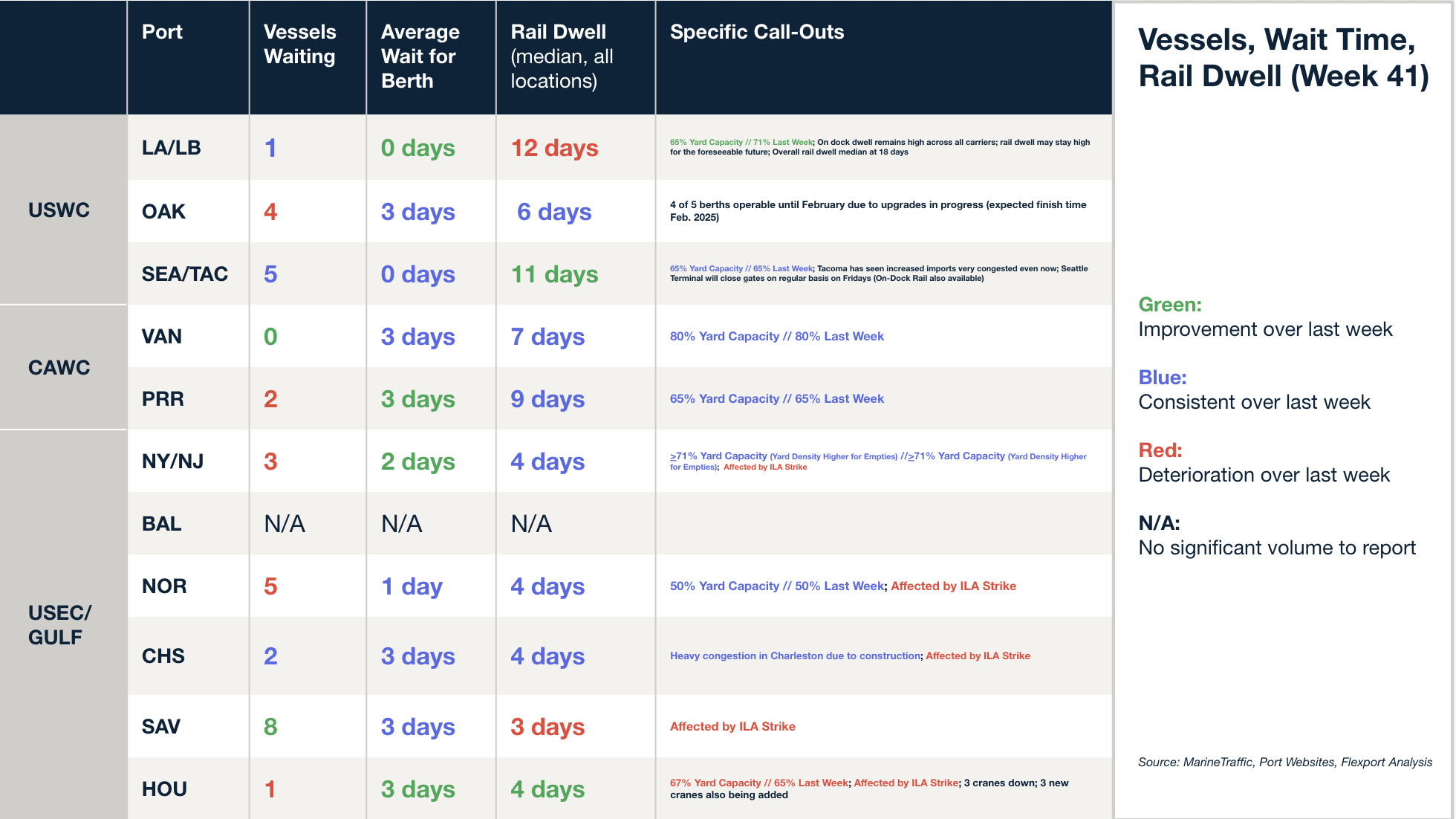

North America Vessel Dwell Times

Webinars

North America Freight Market Update Live

(Today) Thursday, October 10 @ 9:00 am PT / 12:00 pm ET

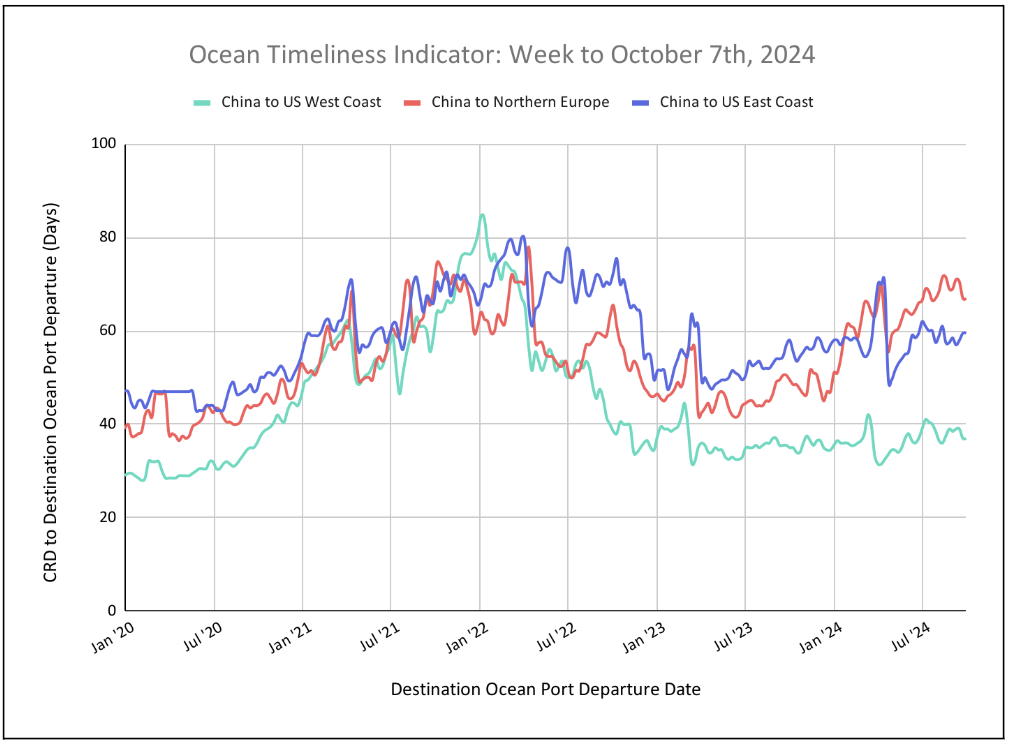

Flexport Ocean Timeliness Indicator

OTIs from China to the U.S. West Coast, China to North Europe, and China to the U.S. East Coast have reached a plateau.

Week to October 7, 2024

This week, the Ocean Timeliness Indicator (OTIs) for China to the U.S. West Coast, China to North Europe, and China to the U.S. East Coast have not shown any movement. They remain at 37, 67, and 59.5 days, respectively, as U.S. port strikes have concluded for the time being.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

Source from Flexport.com