Trends to Watch

[Customs]

- Last Friday, September 13, the Biden Administration issued an executive action that could deny de minimis treatment for all U.S. imports covered by Section 301, 201, and 232 tariffs (including a wide range of products originating from China).

- Businesses may see additional duty costs and increased documentation requirements for de minimis shipments as soon as (or even before) Black Friday.

- In the short term, businesses may be required to start providing HTS classifications down to the 10-digit level for all products. Check out our detailed guide to the de minimis executive action on our blog, where you’ll also find live updates.

- Additionally, last Friday, the U.S. Trade Representative (USTR) outlined final modifications to Section 301 tariffs imposed on certain products originating from China.

- Based on public comments on the agency’s preliminary announcement on May 14, there will be additional §301 duties on several categories of goods. See our blog update for a comprehensive breakdown of these tariffs—some of which will be implemented as soon as September 27, 2024.

- Flexport is committed to helping our clients stay on top of these changes. Please reach out to your customs rep at CustomsBD@flexport.com if you have any questions.

[ILA Work Stoppage Watch]

- The International Longshoremen’s Association (ILA)’s master contract with the United States Maritime Alliance (USMX) is set to expire on September 30. If they fail to finalize a new contract by then, the union intends to proceed with a work stoppage on October 1.

- An ILA work stoppage could upend U.S. supply chains, and even lead to pandemic-level bottlenecks. Beyond strained U.S. West Coast ports (where many shipments will be rerouted), we could see chassis shortages, skyrocketing trucking and air freight rates, and a number of other dire outcomes.

- See our live blog for a comprehensive guide to the situation, including detailed guidance for Flexport customers. There, you’ll also find live updates from our experts. Flexport will continue to provide timely updates and work closely with our customers to take proactive action and plan ahead in the event of a potential ILA work stoppage.

[Ocean – TPEB]

- As we approach Golden Week, we see no signs of an uptick in volume for the pre-Golden-Week rush.

- In response to a potential ILA work stoppage, we’re seeing some BCOs shift volume to the U.S. West Coast (or via the U.S. West Coast) as a contingency plan. A few carriers are looking at implementing East Coast / Gulf port surcharges for mid-October in the event of an ILA work stoppage.

- Should an ILA work stoppage occur, expect carrier-side surcharges, disruptions to operations, port congestion, and vessel deployment impacts for East Coast / Gulf Coast schedules and returns. Additionally, we may see potential equipment shortages at origin, depending on the duration of the potential work stoppage.

- Floating rates have been extended until the end of September, with some fine-tuning and further mitigation. East Coast / Gulf surcharges will possibly be implemented by carriers in October, depending on the potential ILA work stoppage post-Golden-Week.

- Fixed rates: Peak Season Surcharges (PSS) will remain unchanged until the end of September, and will extend into October (through Golden Week).

[Ocean – FEWB]

- Demand is trending downwards and becoming slack. Volume for the last week of September might pick up a bit, but we do not anticipate there to be any space issues.

- Floating rates for 2H September dropped further, but remain higher compared to early 2024. To optimize vessel utilization, carriers are being more proactive than before in adjusting rates. The SCFI dropped by another $618/TEU last week; over the last 3 weeks, the SCFI dropped from $4,400/TEU to $2,841/TEU.

- Long-term named account business still faces carrier restrictions on space and equipment priority. Carriers are gradually (but conservatively) becoming open to negotiations again.

- Equipment shortages are getting better, but some ports of loading (POLs) with fewer direct calls still foresee potential equipment shortages for certain container types, such as 20’GPs and 45’HCs. Weight restrictions, especially for overweight 20’GPs, are still pending acceptance per loading port policies and vessel size requirements.

[Ocean – TAWB]

- We’re approaching the 30th of September, when the ILA’s contract with the USMX is set to expire. In the absence of an agreement, a work stoppage may begin on October 1. Carriers have not announced a contingency plan.

- All carriers implemented increases in the first and second halves of September. They have announced similar increases for October.

- Carrier utilization looks good in all regions of Europe, plus the West Mediterranean and East Mediterranean.

- Equipment deficits in certain areas of South/East Germany and the Hinterlands remain an issue.

- We advise that you keep booking 2-3 weeks in advance to protect space/equipment.

[Ocean – U.S. Exports]

- Heading into October, rates are increasing on base port lanes involving the U.S. East Coast and U.S. Gulf Coast ports as POLs.

- Changing earliest return dates (ERDs) continue to result in operational challenges during the origin operations sequence.

- Service strings relying on feeder services to final ports of discharge (PODs) are losing capacity as appropriate vessels are being shifted to headhaul trades and congestion continues to deteriorate the repeat serviceability of the feeder lane.

- To ensure the smoothest loading experience, we recommend booking 2 weeks in advance for bookings loading at a coastal port, and 3-4+ weeks in advance for bookings loading at an inland rail point.

[Air – Global] Mon 02 Sep – Sun 08 Sep 2024 (Week 36):

- Q4 rates are creeping up amid NPIs, ILA negotiations, and the ongoing Red Sea crisis, adding to the anticipated seasonal spike in demand. eCommerce also remains a focal point, with the de minimis executive action expected to potentially impact the holiday season.

- Global air cargo rates: Average global spot rates rose +6% week-over-week (WoW) to $2.85 per kilo in week 36, with a +30% year-on-year (YoY) increase, driven by +41% from the Asia-Pacific and +101% from MESA.

- Global tonnage decline: Worldwide tonnages decreased -1% WoW, primarily due to a -12% drop in North American volumes linked to the Labor Day holidays in the U.S. and Canada.

- Asia-Pacific & Intra-Asia market: Intra-Asia-Pacific tonnages surged +11% (2Wo2W), with tonnages from the Asia-Pacific to Europe up +6%, contributing to a +9% rise in global chargeable weight and +15% higher average rates YoY.

- MESA spot rates: Spot rates from MESA to Europe rose +7% WoW (to $3.42 per kilo) and +116% YoY, including increases from Dubai (+8% WoW) and Bangladesh (+5% WoW).

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

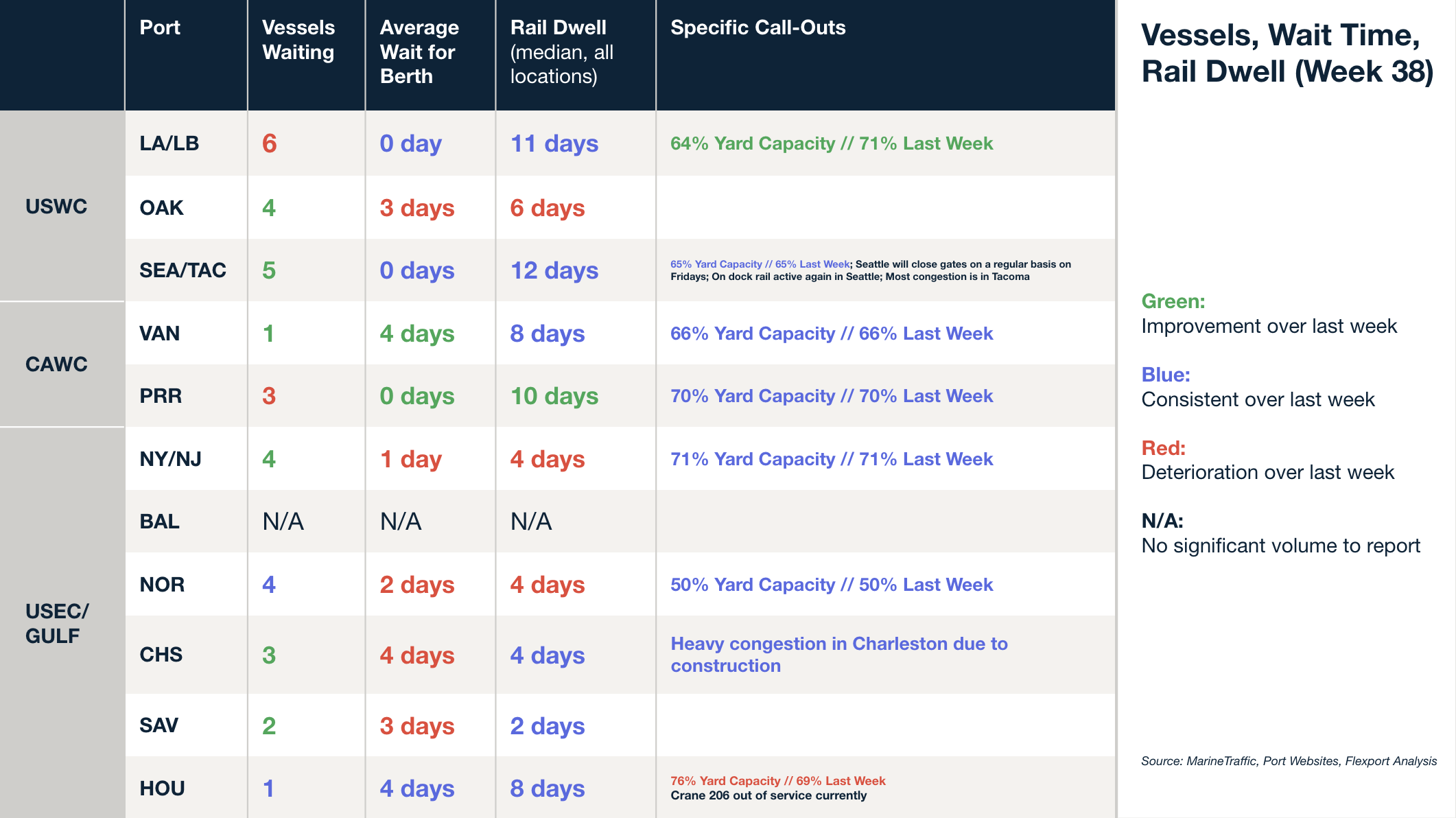

North America Vessel Dwell Times

Webinars

Navigating the New Executive Action on De Minimis Imports

Click the link above to watch yesterday’s webinar on demand.

Navigating Peak Season: Expert Insights on Ocean and Air Shipping Trends

Wednesday, September 25 @ 10:00am PT / 1:00 pm ET

North America Freight Market Update Live

Thursday, October 10 @ 9:00 am PT / 12:00 pm ET

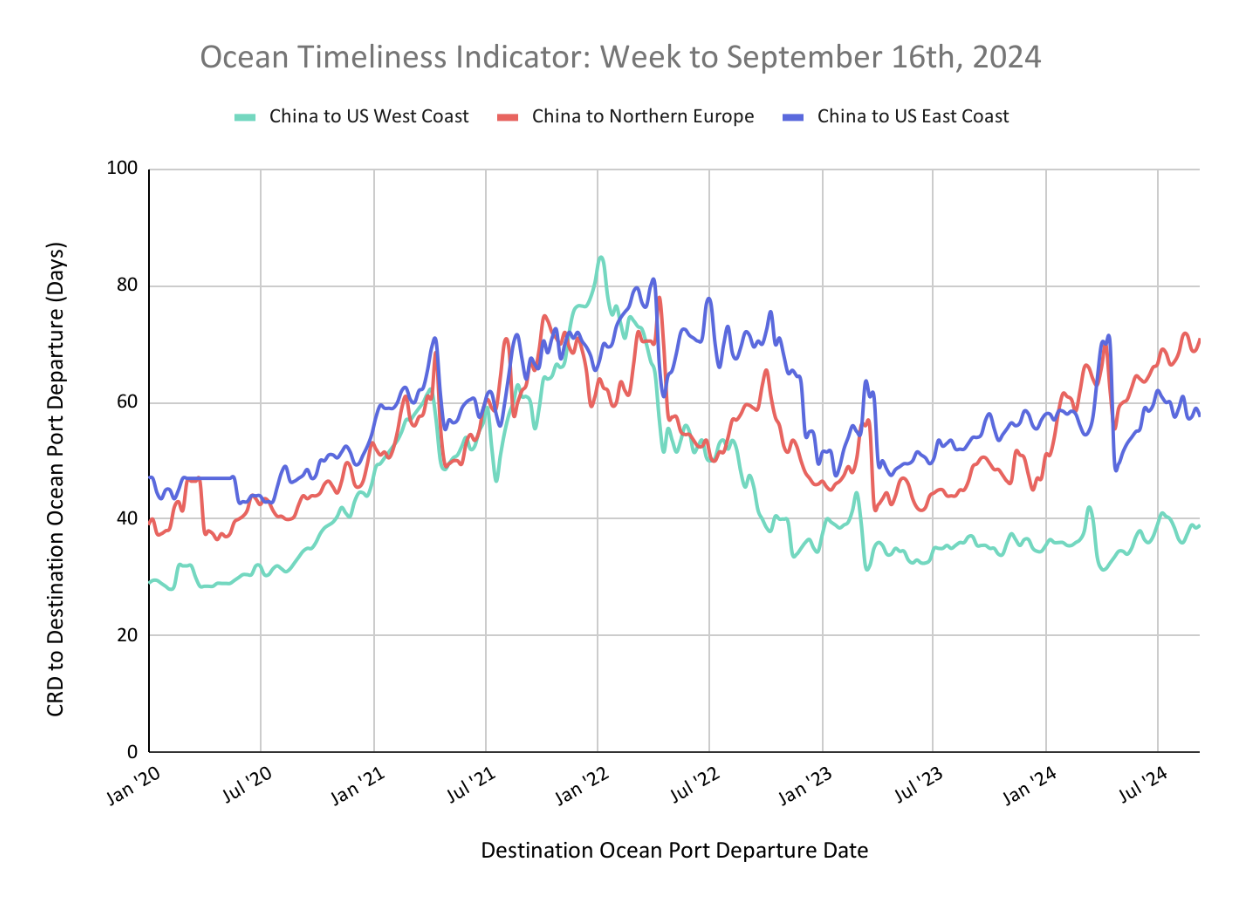

Flexport Ocean Timeliness Indicator

The Ocean Timeliness Indicator has shown some oscillations this week, with a slight uptick for China to the U.S. West Coast and China to Europe, and a small decrease for China to the U.S. East Coast.

Week to September 16, 2024

This week, the Ocean Timeliness Indicator (OTI) for China to the U.S. West Coast and China to North Europe demonstrated a slight uptick, rising from 38.5 to 39 days and 69 to 71 days, respectively. Meanwhile, China to the U.S. East Coast has fallen back to its earlier position from two weeks ago, dropping from 59 to 57.5 days.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

Source from Flexport.com