Trends to Watch

[Ocean – TPEB]

- We have entered peak conditions for Transpacific Eastbound Ocean freight in the month of May. May imports are up +6.8% YoY and we do not expect this increase in demand to subside through the traditional peak season (expect June imports to be 10.7% higher YoY).

- Floating rates: The 1H May $1000 GRI stuck, and we expect another $1000 GRI is being implemented on all Transpacific Eastbound gateways based on the peak conditions we are seeing in May. Carriers expect these rate hikes to stick and accelerate in the short term since vessels leaving Asia are expected to be full through May/June – Pacific Southwest is full, Pacific Northwest is close to full into EOM and into June. Particularly Vietnam + South/East China (Yantian/Shanghai/Ningbo) into the Pacific Southwest is especially tight

- Fixed rates: Starting June 1, carriers will implement a Peak Season Surcharge (PSS), and it is likely that the PSS will be increased again on June 15th. More updates to come later this month as plans are finalized.

- Importers expect a tough peak season, and are trying to head ahead of uncertainties. For more insights, read this thread by Ryan Petersen, CEO of Flexport on X.

[Ocean – FEWB]

- The market continues to tighten and space is constrained at least up until mid-June. Multiple factors are at play including port congestion, equipment shortages and the continued delays on vessels rerouting via Cape of Good Hope resulting in low reliability and blank sailings reported out of Asia intensifying the situation (three from Ocean Alliance as voided and one from MSC as slide-down).

- Demand continues to be stronger than usual and rates rose again as the 2nd half May rate increases stuck. We expect the increase in demand to be driven not only by consumer demand but also by companies building stock due to the longer than anticipated lead times and companies trying to secure space. Further rate increases are announced for the first half of June ($1,000 per 40-foot container), which considering the situation, are expected to hold.

- Shippers continue to push cargo for earlier departure to avoid further freight cost increase. Unless space has already been secured, all vessels are full. To push cargo on sooner ETD (estimated time of departure) and avoid delays, more carriers are open to Premium options to get cargo loaded on the first available departure date with higher equipment priority.

- Flexport continues to monitor the situation and we advise to book early, place bookings in smaller slots and pick up empty containers as soon as possible.

- Read more about the situation in Why Ocean Freight Rates are Surging: A Look at the Supply Shock after the Red Sea Disruptions.

[Ocean – U.S. Exports]

- Container availability for inland U.S. exporters is becoming much more challenging. This is a result of the global disruptions in container shipping and their subsequent impact to the flow of laden and empty containers.

- The extended transit times seen due to routing around Cape of Good Hope, growing port congestion at key ports, further devolves the container equipment situation for U.S. exporters, especially shippers loading at inland rail points.

- To ensure the smoothest loading experience, recommend booking 3-4 weeks in advance.

[Operations – Canada]

- The Teamsters Canada Rail Conference initiated industrial action against Canadian National Railway and Canadian Pacific Kansas City following five months of failed negotiations, prompting Minister of Labour Seamus O’Regan to seek clarity from the Canadian Industrial Relations Board on essential rail services, with a decision expected by May 31, thereby preventing a strike on May 22.

- The BC Maritime Employers Association and International Longshore and Warehouse Union Ship and Dock Foreman Local 514 engaged in negotiations last week with the support of the Federal Mediation and Conciliation Service. The 21-day cooling-off period ended on May 10 and now both sides are free to initiate a strike or lockout with 72-hour notice. As of May 23, neither party has issued a 72-hour notice for strike or lockout, ensuring uninterrupted cargo and passenger operations at British Columbia’s ports.

[Air – Global] (Data Source: WorldACD)

- Tonnage and Demand Volatility: Air cargo demand from Asia Pacific partially rebounded in week 19, but the rebound was weaker compared to last year. Global tonnages remained higher YoY, despite the volatility caused by holidays such as China’s Labor Day, Easter, and Eid.

- Weekly Tonnage Analysis: Worldwide tonnages were flat in week 19, following a -9% drop in week 18 due to public holidays. This contrasts with last year’s +9% rebound in week 19 after a -9% decline in week 18.

- Regional Tonnage Trends: Asia Pacific tonnages showed an +8% recovery in week 19 after a -13% decline in week 18, with significant YoY growth (+14% in week 19). North America and MESA (Middle East & South Asia) saw minor week-on-week recoveries (+1%), while Africa, Europe, and CSA (Central & South America) experienced further declines.

- Pricing Trends: Average worldwide rates remained stable at $2.49/kg in week 19, a +2% increase YoY and +41% above May 2019 levels. Combined global rates for weeks 18 and 19 were up slightly on both a 2Wo2W (+1%) and YoY (+3%) basis, with significant YoY increases from MESA (+44%) and Asia Pacific (+12%).

Please reach out to your account representative for details on any impacts to your shipments.

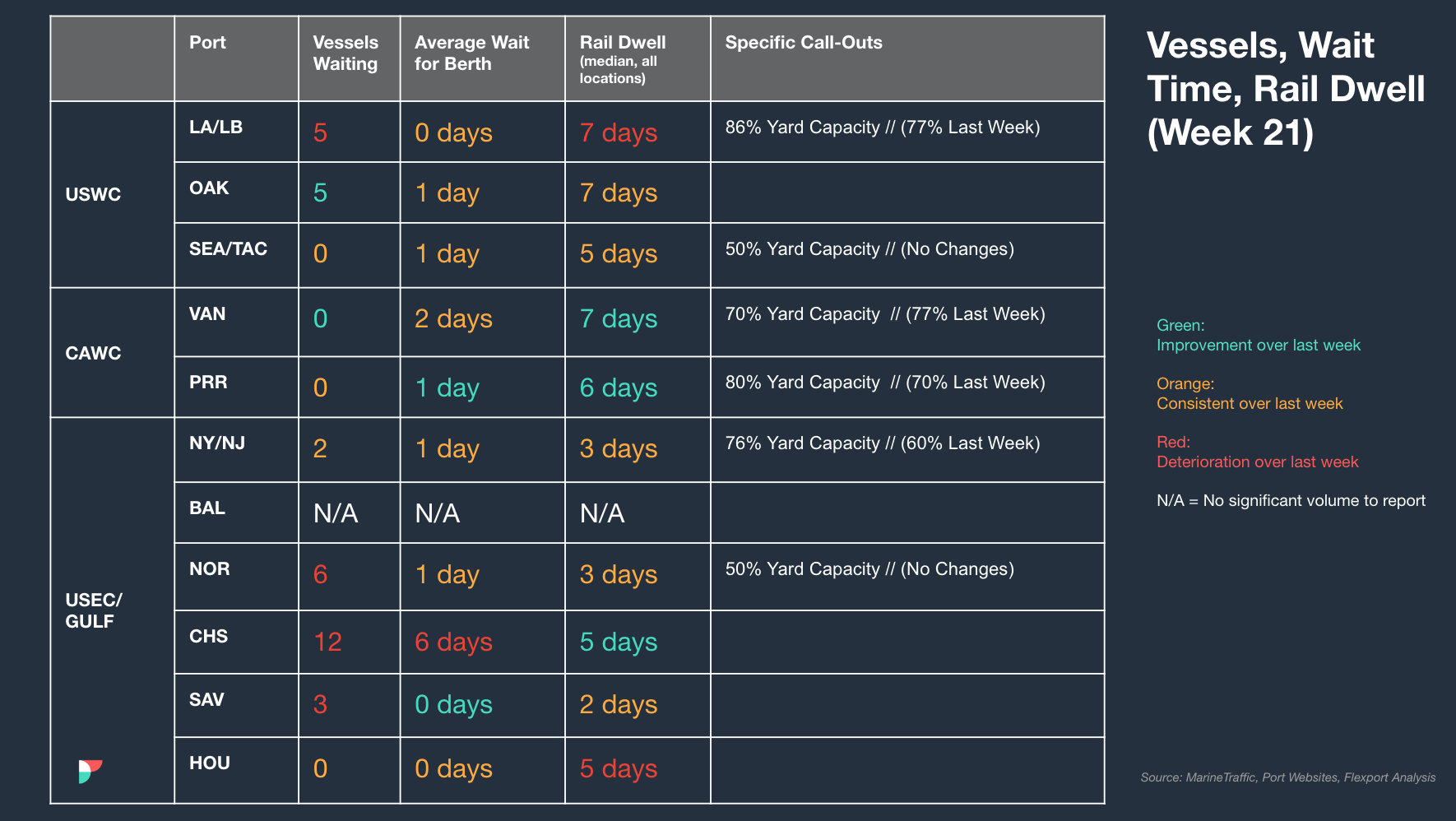

North America Vessel Dwell Times

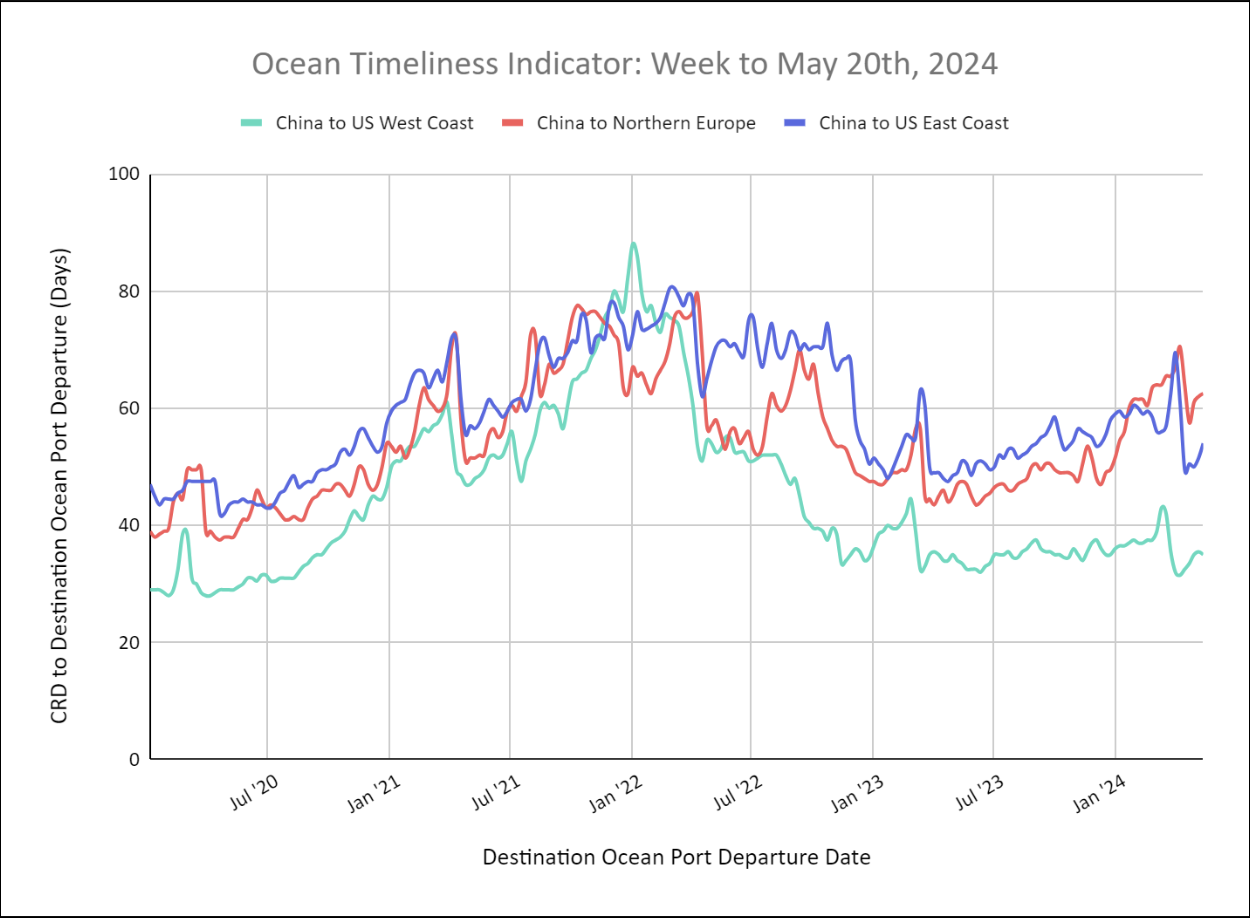

Flexport Ocean Timeliness Indicator

Ocean Timeliness Indicators for China to US East Coast Increases While Other Major Trade Lanes Remain Stagnant

Week to May 20, 2024

This week, the OTI for China to the US East Coast increased to 54 Days while China to Northern Europe remained stagnant at 62 days due to routing around the Cape of Good, and the OTI for China to the U.S. West Coast remained at 35 days.

Source from Flexport.com