Trends to Watch

[Air – Global](Data Source: World ACD/Accenture)

- From January 1-28, 2024, global international air cargo capacity increased by 10% compared to 2019.

- Over the last four weeks, global international air cargo capacity decreased by 4% compared to the four weeks prior.

- Air cargo capacity out of China and Hong Kong around Lunar New Year is expected to drop by 30-40% this year, in line with previous years.

- Yields for Transpacific and Asia-Europe routes have increased in the last weeks of January due to the Red Sea crisis and the anticipation of the Lunar New Year, even though average yields for January 2024 remain lower than those of January 2023.

- A consistent rise in air freight volumes has been observed over recent months, significantly fueled by strong e-commerce activity originating from the Asia Pacific region since the last quarter of the previous year, alongside a noticeable shift of some goods from sea freight to air and combined sea-air transport, attributed to recent disturbances in container shipping operations in the Red Sea.

[U.S. Exports]

- Inland rail yards and export loading points are seeing less, or increasingly spotty, equipment levels. Customers are advised to place bookings 3-4 weeks in advance of cargo ready date (CRD). If that’s not achievable, consider truck and transload to load at a coastal port to avoid ongoing equipment concerns.

[Ocean – FEWB]

- Asia-North Europe: the Red Sea crisis continues to impact freight market development. CMA CGM suspended Red Sea transits again until further notice due to security risks.

- With vessel delays back to Asia, equipment is getting tight prior to Lunar New Year departures. Most carriers are arranging container repositioning to get shipments moved as planned. We highly recommend shippers be flexible and accept container substitution to avoid further delay as well as arrange empty pick-up as early as possible. Carriers are offering extended origin free time to mitigate Lunar New Year impact.

- Demand is expected to remain flat for the second half of February. Carriers are further adjusting rates down to cater fresh cargo from the first half of February, preparing for rollpool to fill second half of February vessels. Even though massive void plans have been announced (WK08/09 cut by 30% in average), Ocean Alliance announced seven more voids, with three planned for February departure and the rest in March. We foresee more void plans will be released soon by the other two alliances.

- To mitigate the disruption of operational challenges (sailing schedule adjustment, vessel downsized, equipment shortages, rollover, etc.), shippers can explore premium services offered by liners with higher cost to get guaranteed space and equipment and to shorten delays.

- Asia-Med: Following North Europe, MED floating rates remained on the higher side. They are trending slightly lower from Week 06 onwards in a push to get more cargo to fill up ships before Lunar New Year and also rollpool preparation for 2H February onwards due to the weak demand and holidays in Asia.

Please reach out to your account representative for details on any impacts to your shipments.

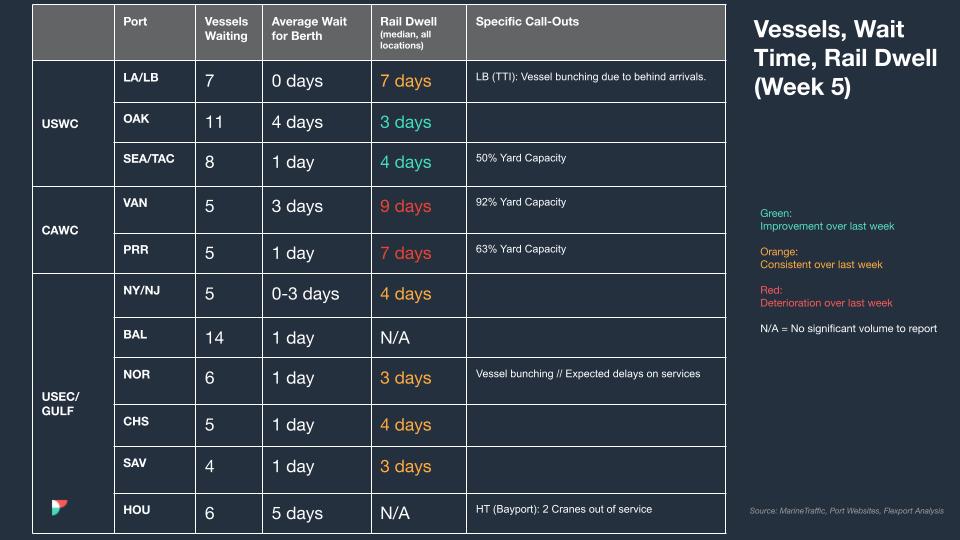

North America Vessel Dwell Times

This Week In News

Q4 U.S. Bank Freight Payment Index Shows Annual Freight Shipment And Spending Declines

The U.S. Bank Freight Payment Index for the fourth quarter revealed declines in freight payments and expenditures, with the shipment index down 10.9% from the third quarter and 15.7% annually, marking the largest decline since the index’s inception in 2017. Regionally, the Southeast, Northeast, and West experienced the steepest annual shipment declines.

Port Of Virginia Cargo Volumes Dip 2% In December

In December, container volumes at the Port of Virginia declined by 2% year-over-year to 268,107 total TEUs, marking the eleventh consecutive month of decreasing cargo volumes at the port. Despite the recent dip, container volumes were 19% higher compared to pre-pandemic levels, indicating long-term improvement despite the lull experienced in 2023.

Retailers Are Planning To Shake Things Up In 2024, Survey Finds

A new survey from Carl Marks Advisors reveals that mid-market retail and consumer packaged goods companies are planning changes to their supply chain strategies. The survey involved 250 responses from executives at mid-market retail and CPG companies with annual revenues between $25 million and $300 million.

Source from Flexport.com