Maersk on Sunday said it would pause any further transits through the Red Sea for at least 48 hours after one of its container ships was attacked twice within 24 hours by Houthi rebels who do not appear deterred by the presence of a multinational naval force meant to restore security in the region.

The second attack against the Maersk Hangzhou this weekend represented an escalation in hostilities as Houthis used small boats to get within 65 feet of the 14,000-TEU vessel in an attempt to board the ship, which Maersk said was not damaged by missiles fired by the attackers. Until Sunday, the Iran-backed Houthis have attacked ships by firing missiles and launching drones from southern Yemen.

“Maersk can…confirm that after the initial attack on the vessel, four boats approached the vessel and engaged fire in an expected attempt to board the vessel,” the carrier said in a statement Sunday. “A helicopter was deployed from a nearby navy vessel, and in collaboration with the vessel’s security team, the boarding attempt was successfully repelled.

“In light of the incident – and to allow time to investigate the details of the incident and assess the security situation further – it has been decided to delay all transits through the area until 2nd January,” Maersk added.

Maersk said the vessel, bound for Port Suez after initially departing Singapore, was continuing its sailing northbound.

Responding to the 23rd attack on a commercial ship since Nov. 19, US Navy helicopters sank three of the four small vessels involved, killing the crews, the US Central Command said Sunday.

The attacks against the Maersk Hangzhou came one week after the carrier, responding to the creation of the naval task force, said it would resume some sailings through the Red Sea and Suez Canal once operationally possible. But Maersk warned in its Dec. 24 announcement that its resumption of Suez transits could change if the security situation deteriorated further.

Naval escorts not a sufficient deterrent yet

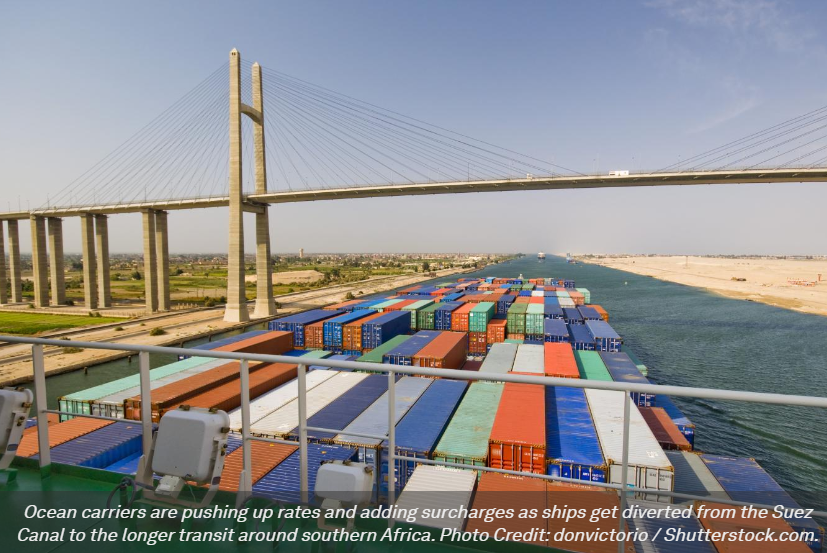

It was not immediately known what effect the Maersk attacks would have on other carriers, namely Cosco and CMA CGM, that had also been sending some of their ships through the Suez. At first blush, it is likely to send even more capacity diverting around the Cape of Good Hope in southern Africa.

At the very least for ocean carriers, it means that a protection regime has not materialized that guarantees freedom of navigation through the Bab al-Mandab strait and eliminates or significantly reduces the risk of attack in the area. No organized system of naval escorts or convoys has come into existence, nor have land-based threats been eliminated or seriously confronted. Rather, senior ocean carrier executives tell the Journal of Commerce, the Operational Prosperity Guardian coalition is relying on deterrence created by its physical presence and its ability, for the most part successfully thus far, to intercept air-based weapons to keep the Suez route open to at least some shipping traffic.

But it’s clearly not enough, illustrating the difficulties the US is facing in balancing its desires to protect freedom of navigation while seeking to avoid escalating the Israeli-Hamas war into a full-blown regional conflict. As long as broader US goals conflict with those of protecting shipping and an effective protective regime fails to materialize, ships will continue to be diverted around the much longer Cape of Good Hope route, disrupting supply chains.

Geopolitical analysts warn that the patrols can help shield vessels, but the Houthi rebels are well-placed to keep up attacks via relatively cheap drones and missile attacks from the shore of southern Yemen. S&P analysts and container lines carriers tell the Journal of Commerce that earlier suspicions that rebels were targeting vessels tied to Israel were incorrect, putting any ships – regardless of shipowner — in danger.

“If the Houthis keep up the pace of attacks and have a steady supply of drones and missiles (which seems likely), the cost of maintaining a naval escort operation — including the costs of operating the ships at distance — will rapidly rise into the tens of billions of dollars,” Bruce Jones, a geopolitical analyst and TPM23 speaker, wrote in Foreign Policy.

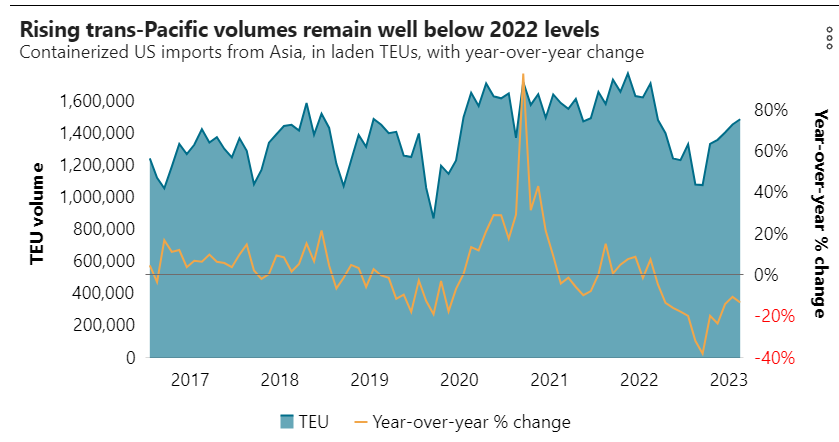

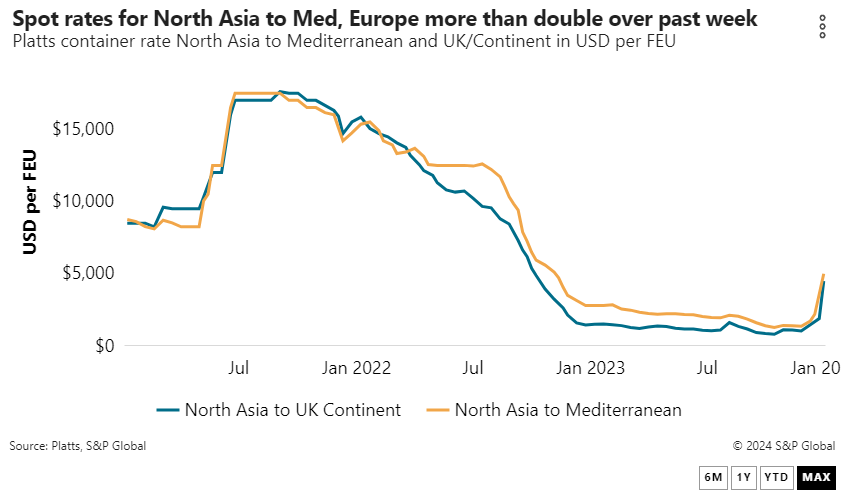

Rates, meanwhile, are spiraling upwards. Spots rates for North Asia to Europe have more than doubled over the past week, from $1,900 per FEU to $4,500 per FEU as of Dec. 28, according to Platts, a sister company of the Journal of Commerce within S&P Global. Rates to Mediterranean ports have jumped to $5,000 per FEU from $2,300 a week ago.

Hapag-Lloyd and Mediterranean Shipping Co., both of which have seen their ships attacked, say they’ll keep diverting cargo around the Cape of Good Hope. Ocean Network Express is continuing to reroute as well. One of the major ocean carriers said it on-hired 150,000 containers to offset the absorption of container equipment tied up in the longer sailings around the Cape of Good Hope.

“It’s unfortunate to have to admit, but this sea lane is not safe for our seafarers,” Bud Darr, executive vice president of maritime policy and government affairs at MSC Group, wrote on LinkedIn on Thursday. “I genuinely hope the military operators and diplomats can change that very soon, but for now, no seafarers should have to endure what ours did during this extensive attack (Tuesday).”

CMA CGM is also diverting some, but not all, of its ships around Africa.

Carriers weighing options

Container lines are adjusting networks to the longer transits, with MSC tightening up so-called free time for containers and Cosco offering to route East Coast cargo through the West Coast via rail. The moves by MSC and Cosco join a host of rate increases going into effect in January as ocean carriers seek to recover the higher operating costs for the longer voyage around the Cape of Good Hope.

Seeing the risk of equipment shortages, MSC will reduce free time for containers in North America from 10 to seven days starting Jan. 1, according to a notice from an Asia-based freight consolidator. The move is in effect through the first half of January. Other ocean carriers generally offer 10 days of free time.

A US-based agent for the consolidator said that the reduction in free time increases the risk that shippers will have to pay detention charges on a container. Some shippers have negotiated free time of up to 15 days, the source said.

“Most big retailers need 10 days out free,” the agent said.

James Caradonna, vice president at MCL-Multi Container Line, told the Journal of Commerce that the transit around the African cape means that it will take longer to return empty containers to Asia, setting the stage for further delays due to equipment imbalances.

MSC “foresees equipment shortages in light of the extended transits stemming from the issues in the Red Sea,” Caradonna said. “The fact that they are a huge player on the Asia-Europe trade means they will likely encounter container shortages in Asia at some point in the coming month.”

Cosco, meanwhile, will offer moves to the US East Coast from Chinese load ports via intermodal service from the West Coast, according to a notice from the company, which said it is looking to price the service at $7,600 per FEU.

Source from JOC.com