Trends to Watch

[Ocean – TPEB]

- Ocean volumes have rebounded after Golden Week but overall demand in the market remains flat over the last month. The General Rate Increase (GRI) has been withdrawn, and ocean freight rates have been extended through the end of October, with some mitigation on specific lanes.

- Space is available to both the East Coast and West Coast, as the ILA strike impact has been mitigated. All related surcharges have been waived.

- Fixed rates remain in place, with Peak Season Surcharges (PSS) still applicable and expected to extend beyond Golden Week, subject to further changes.

[Ocean – FEWB]

- Carriers are preparing for a GRI in November. Recovery post-Golden Week has been slow, but bookings for weeks 43 and 44 are increasing as shippers look to avoid potential rate hikes. Space is filling up for the second half of October, following a 15% capacity cut due to blank sailings.

- Three alliances have already announced blank sailings for November, primarily due to vessel delays and efforts to balance supply and demand, preventing further market collapse.

- The Shanghai Containerized Freight Index (SCFI) fell by $210/TEU after the Golden Week holiday, but should the anticipated GRI be successfully implemented, it may stabilize and even increase in November.

- While the equipment shortage is improving overall, some ports of loading (POLs) that are less directly serviced still anticipate occasional equipment shortages due to rerouting and blank sailings.

[Ocean – TAWB]

- All carriers have postponed their disruption charges, given that the ILA strike has concluded. While carriers are still operating at full capacity on certain services, particularly to New York, delays and congestion are beginning to normalize. The backlog created during this period is currently estimated at 2-3 weeks.

- Some carriers have announced further rate increases for November, following increases in September and October. Equipment availability is generally not a challenge across Northern and Southern Europe, with the exception of Southern Germany and the Hinterlands.

[Air – Global] Mon 30 Sept. – Sun 06 Oct 2024 (Week 40):

- Spot rate increases: Global air cargo spot rates rose to US$2.84 per kilo, the highest in 2024, with a +1% week on week (WoW) increase from 30 September to 6 October. This was driven by rises in rates from the Asia-Pacific (+1% WoW), Africa (+2% WoW), and Central and South America (+5% WoW).

- Tonnage decline: Worldwide tonnages fell by -5% WoW, primarily due to a -7% drop in Asia-Pacific tonnages, linked to China’s Golden Week holidays. The Middle East and South Asia (MESA) (-9% WoW), Europe (-4% WoW), and North America (-3% WoW) also saw declines in origin tonnages.

- Intra-Asia-Pacific traffic impact: Intra-Asia-Pacific traffic fell by -14% WoW, mainly driven by a -21% drop in ex-China intra-Asia tonnages. This accounted for 68% of the Asia-Pacific’s -7% WoW decline, explaining 56% of the global tonnage decrease.

- MESA region performance: Despite a -9% WoW drop in MESA origin tonnages, the region’s air cargo volumes increased year on year (YoY) by +8%, and rates were up by +54% YoY. MESA was affected by regional ocean freight disruptions and flight diversions, with a -13% drop in volumes to North America being the biggest factor in the WoW decline.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

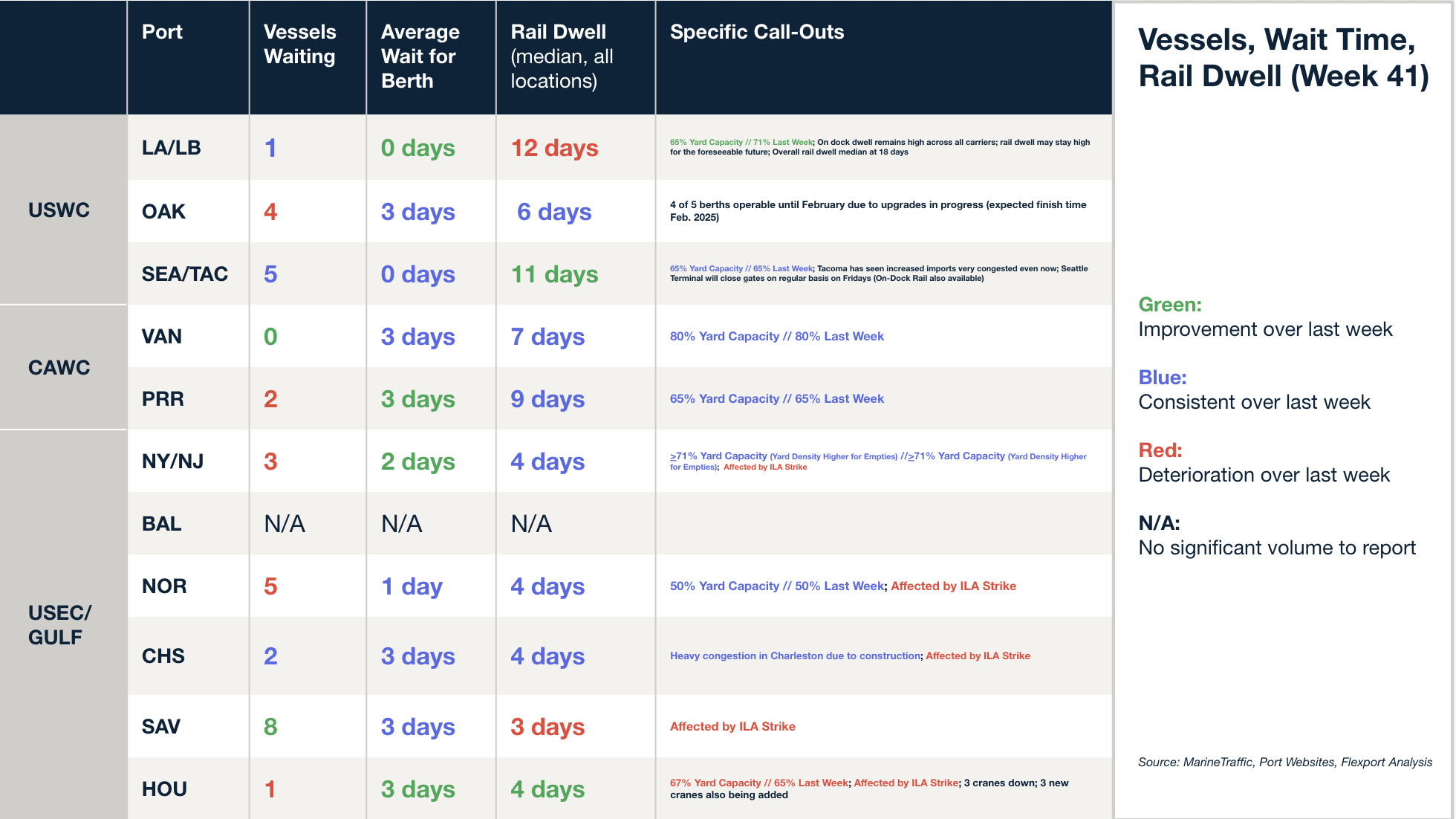

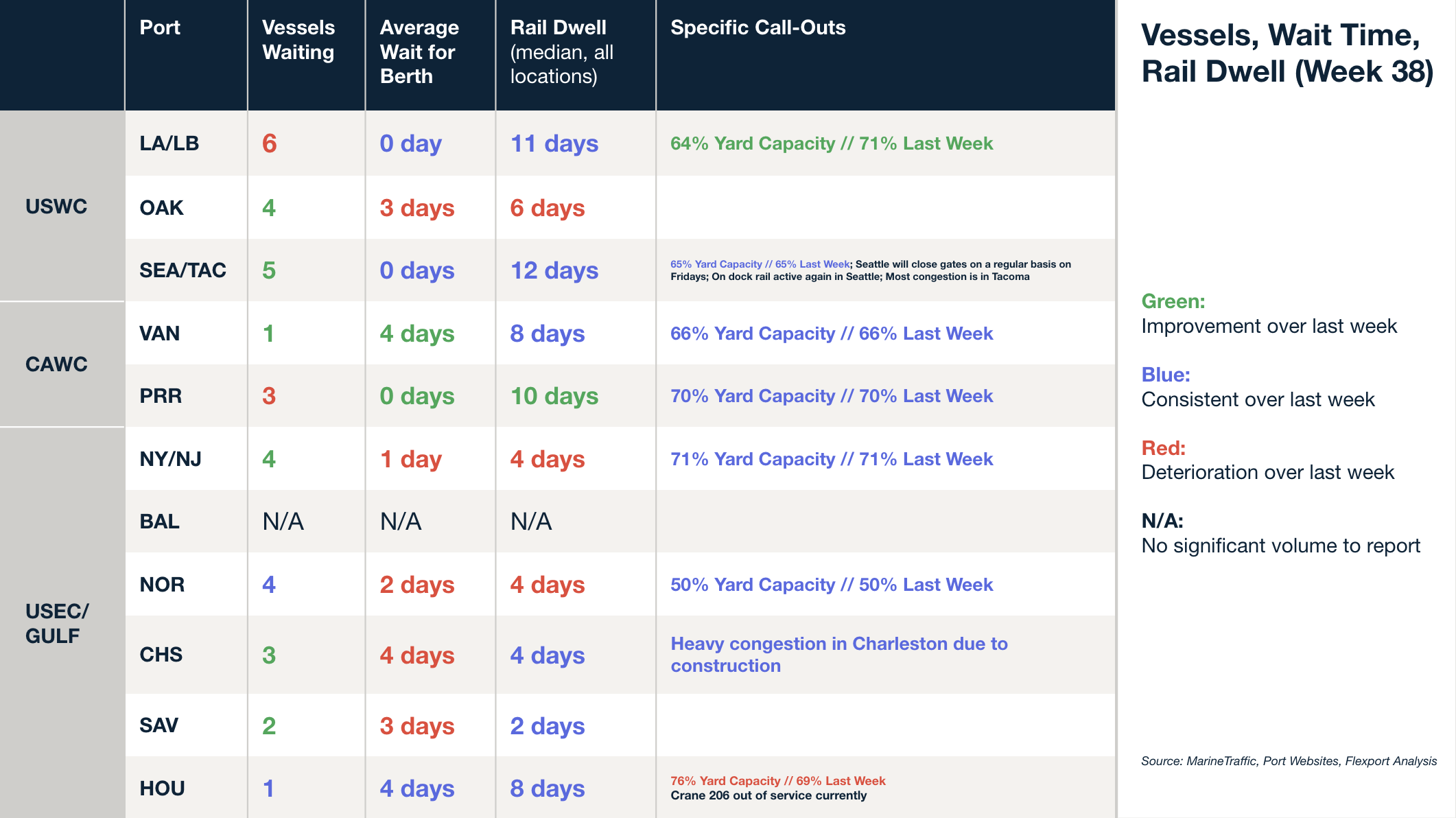

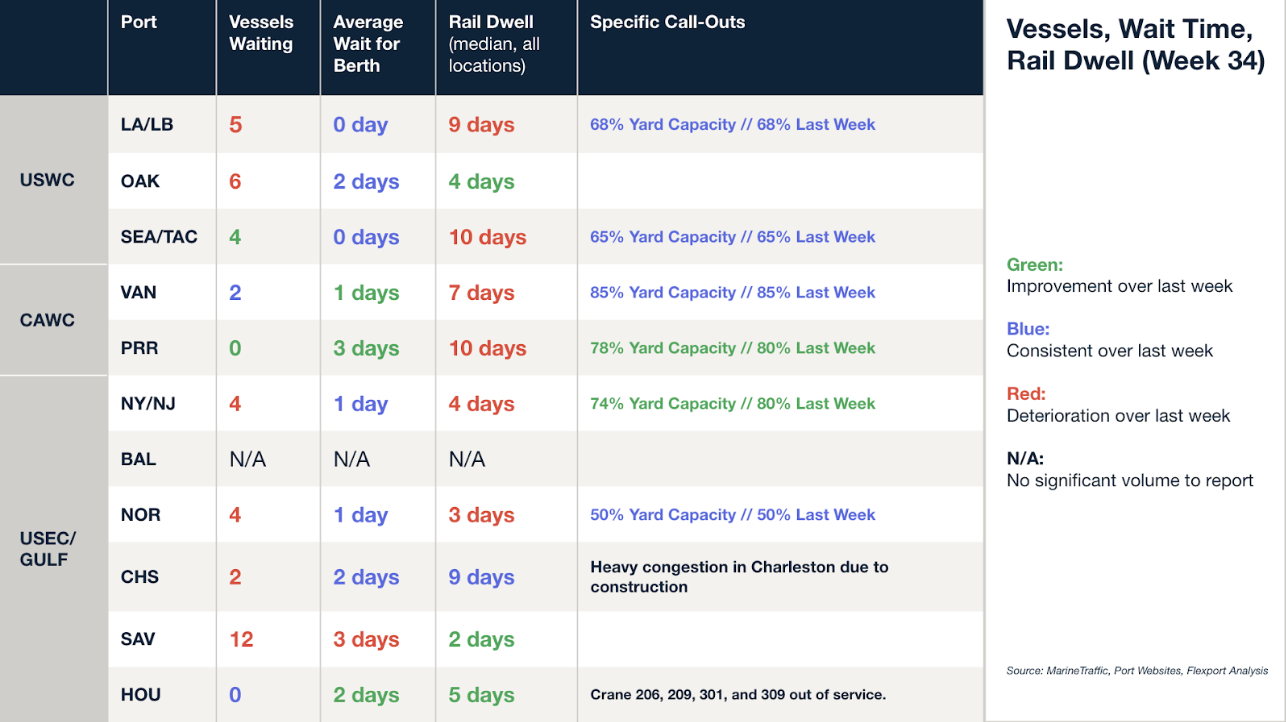

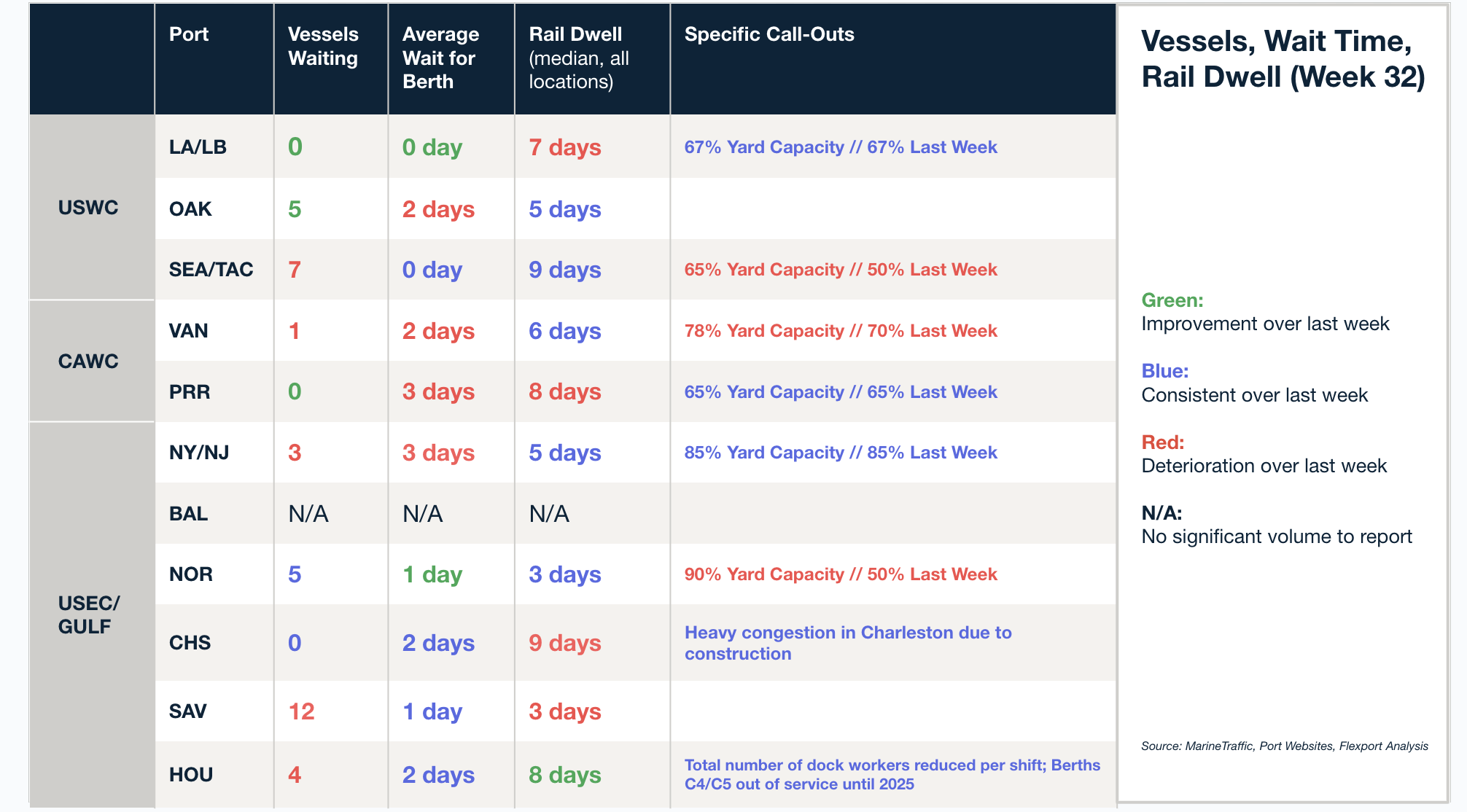

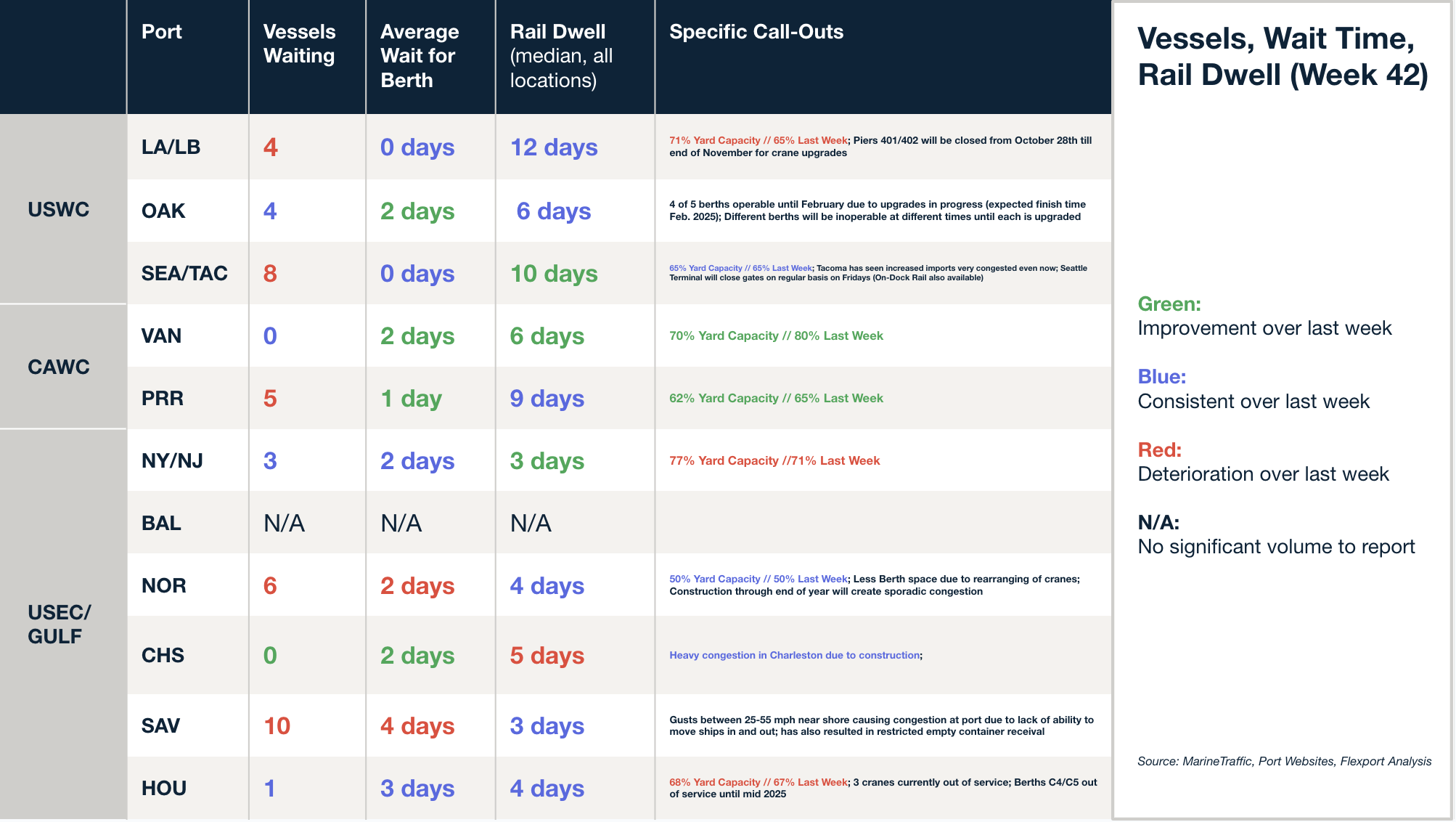

North America Vessel Dwell Times

This Week in News

Holiday Season Will Bring Lower Prices, Leaner Supply Chains, Survey Finds

A recent survey of consumers, retailers, and supply chain executives revealed that inflation is a major concern for both shoppers and businesses heading into the holiday season. To combat rising prices, consumers are planning their shopping earlier and prioritizing deals and discounts. Retailers are responding by offering increased sales, discounts, and flexible payment options, while also adopting new technologies to optimize operations and reduce costs.

Flexport CEO Ryan Petersen talks holiday shopping and supply chain

Flexport CEO Ryan Peterson discussed the current challenges retailers face this holiday season due to a shorter shopping window between Thanksgiving and Christmas, compounded by disruptions like port strikes and hurricanes. He noted that many retailers are sitting on excess inventory because they over-prepared for a potentially longer strike, likely leading to discounts to move products.

Navigating Peak Season 2024: Challenges, Expectations and Consumer behavior

Supply chain issues, including capacity constraints, price increases, and labor shortages, are expected to continue impacting retailers. Consumer behavior has also shifted, with a growing preference for e-commerce and faster delivery. Rising inflation and economic uncertainty are prompting consumers to become more price-sensitive.

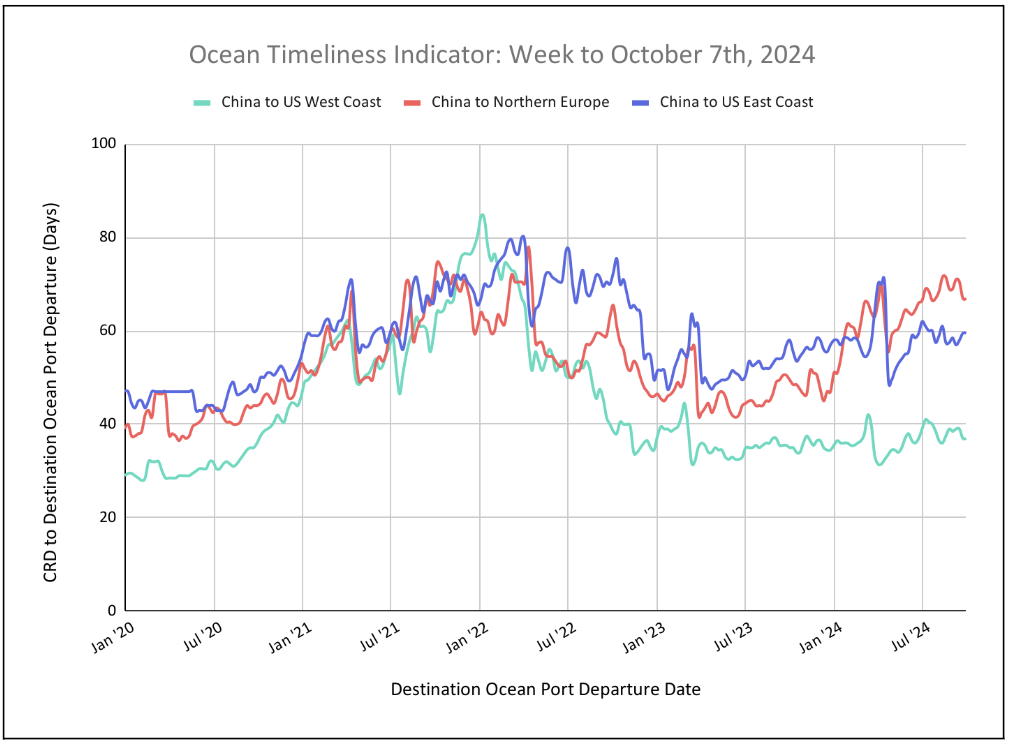

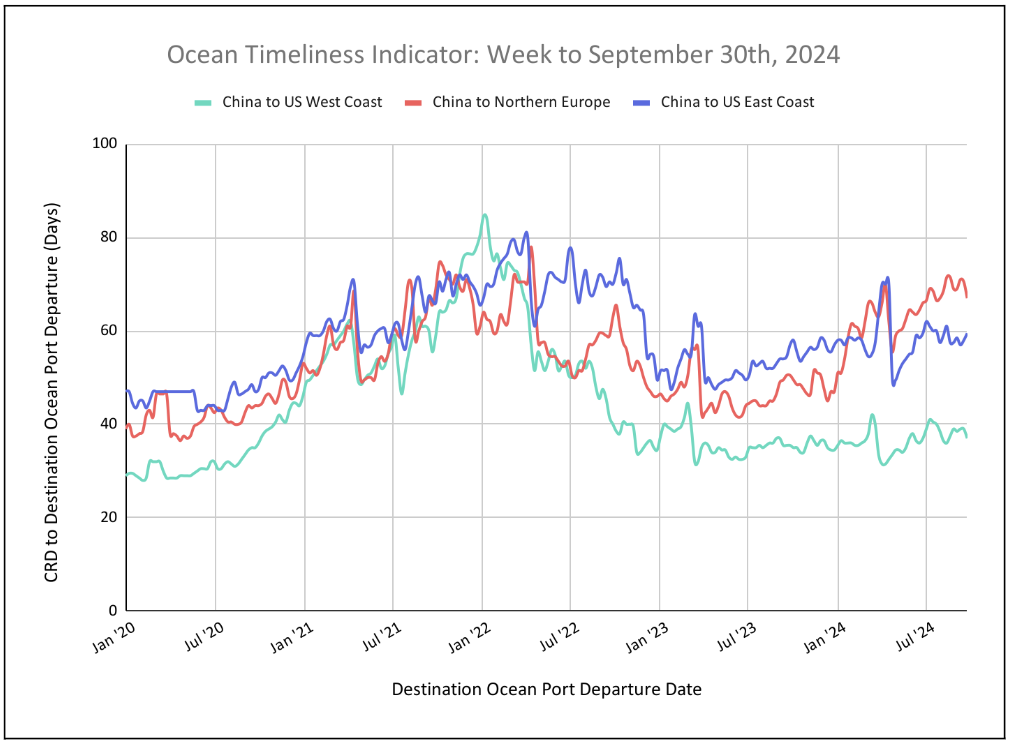

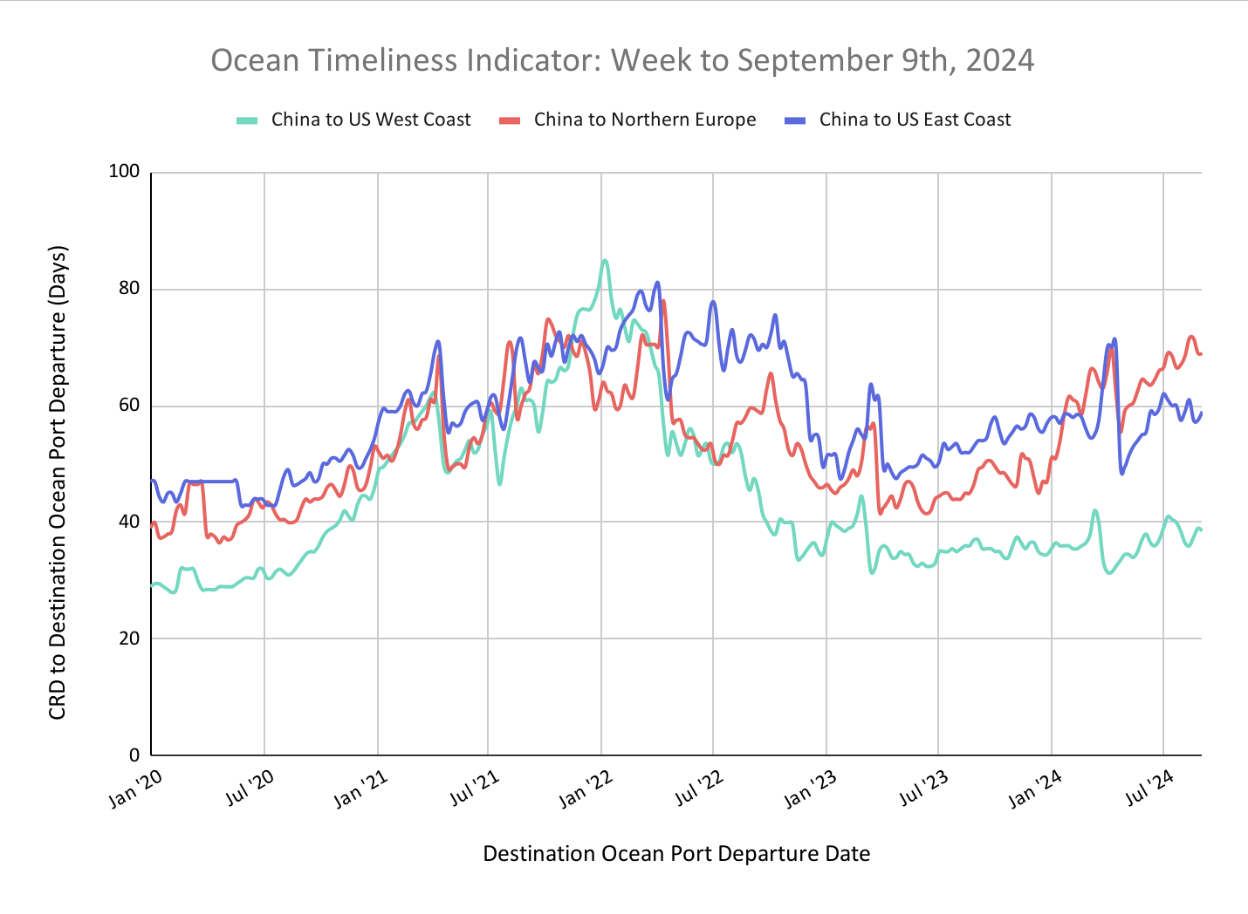

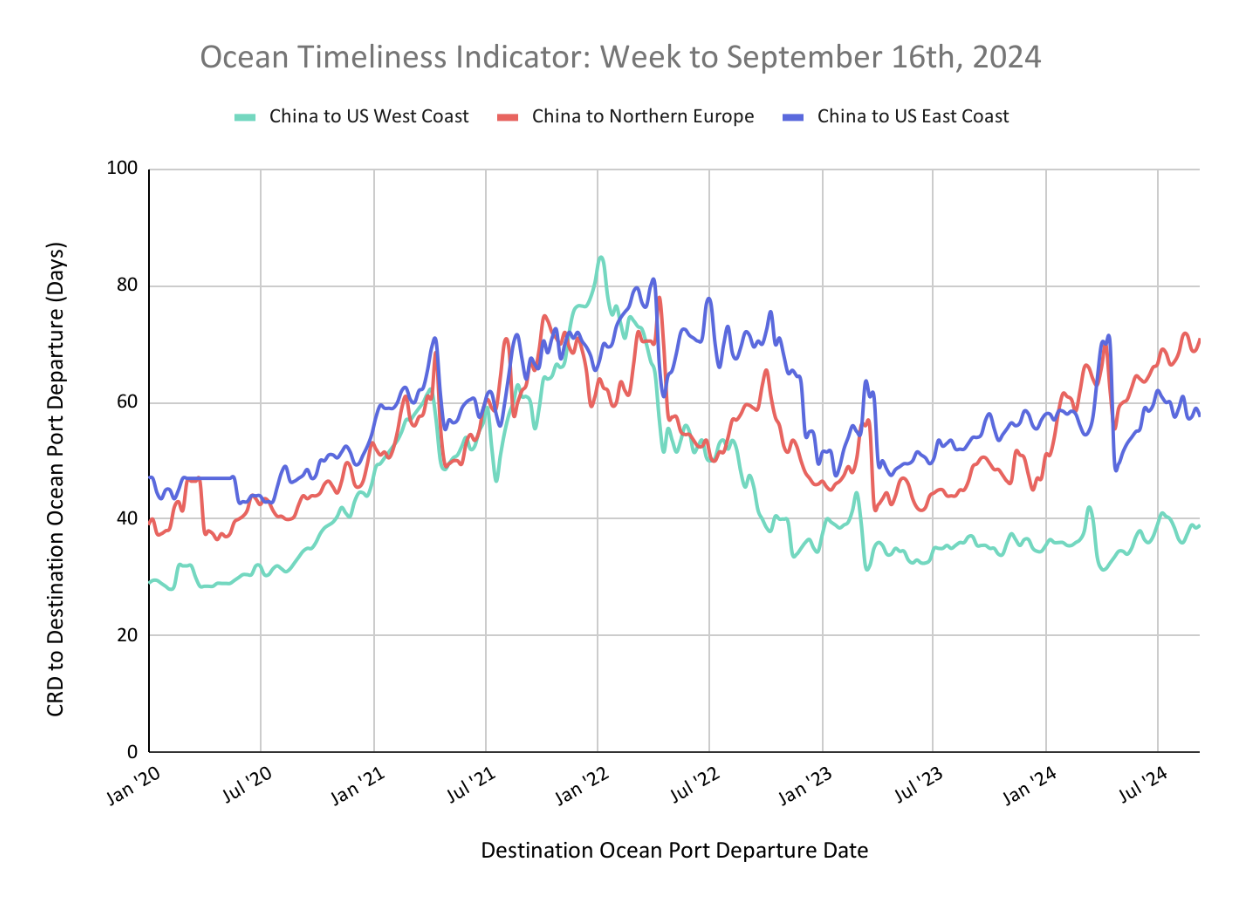

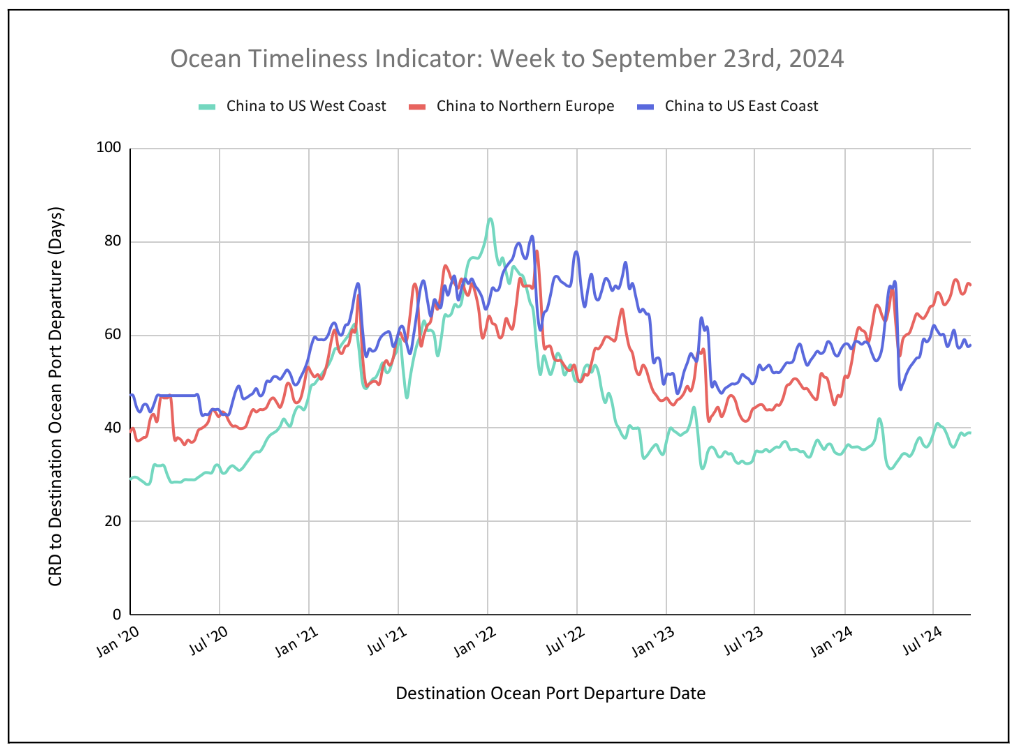

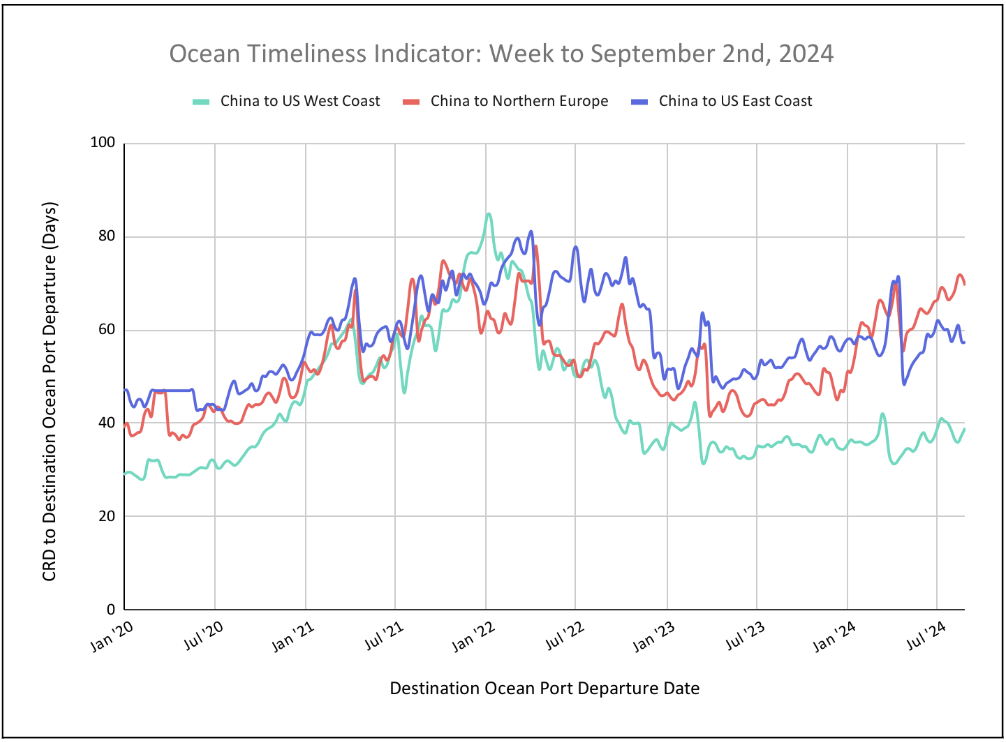

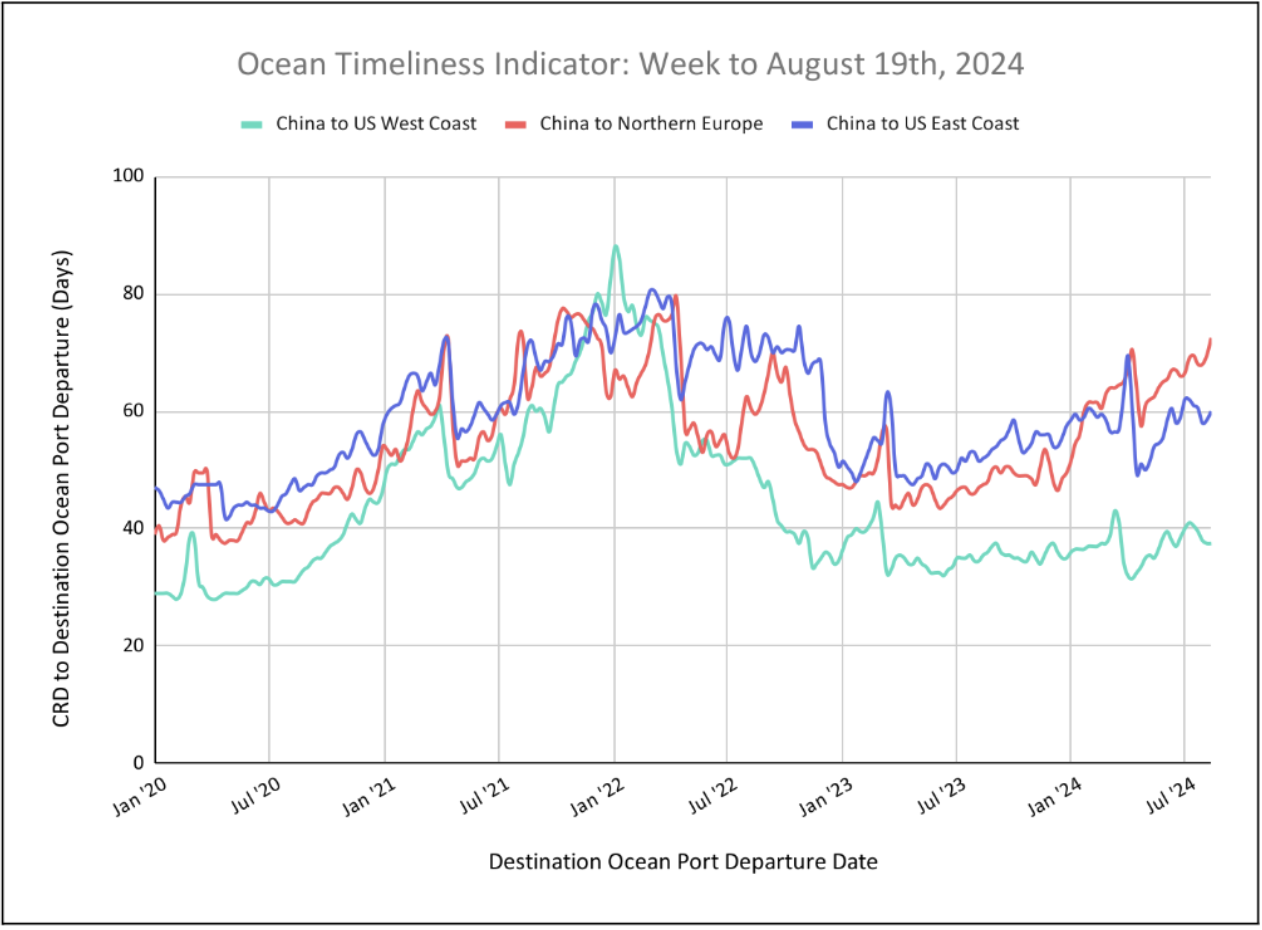

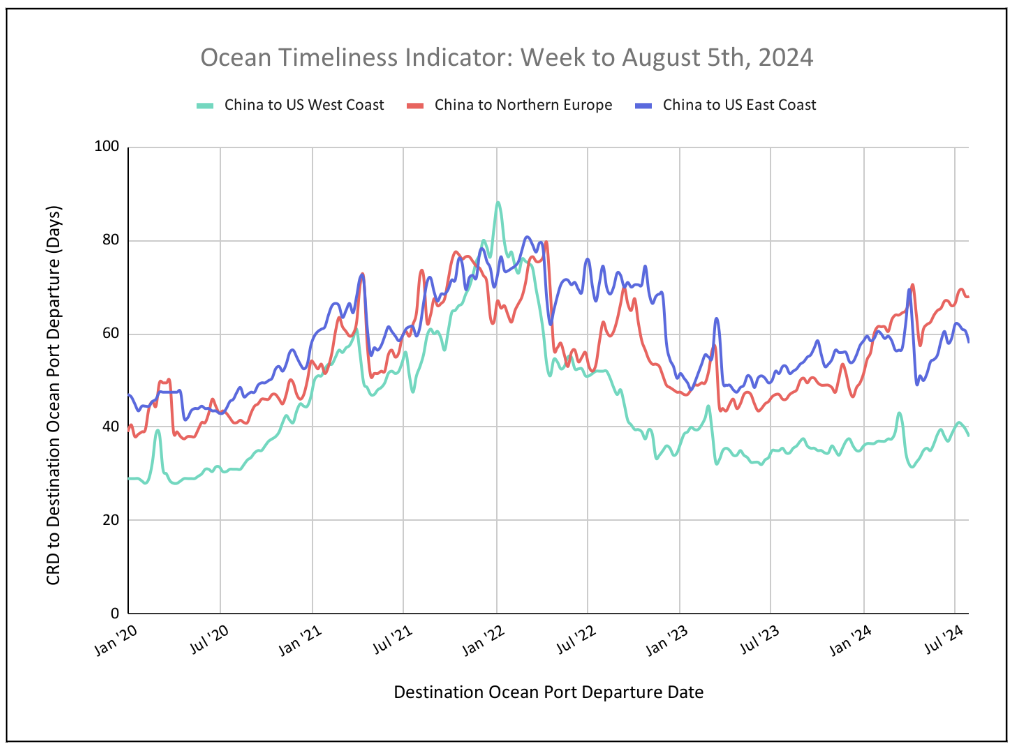

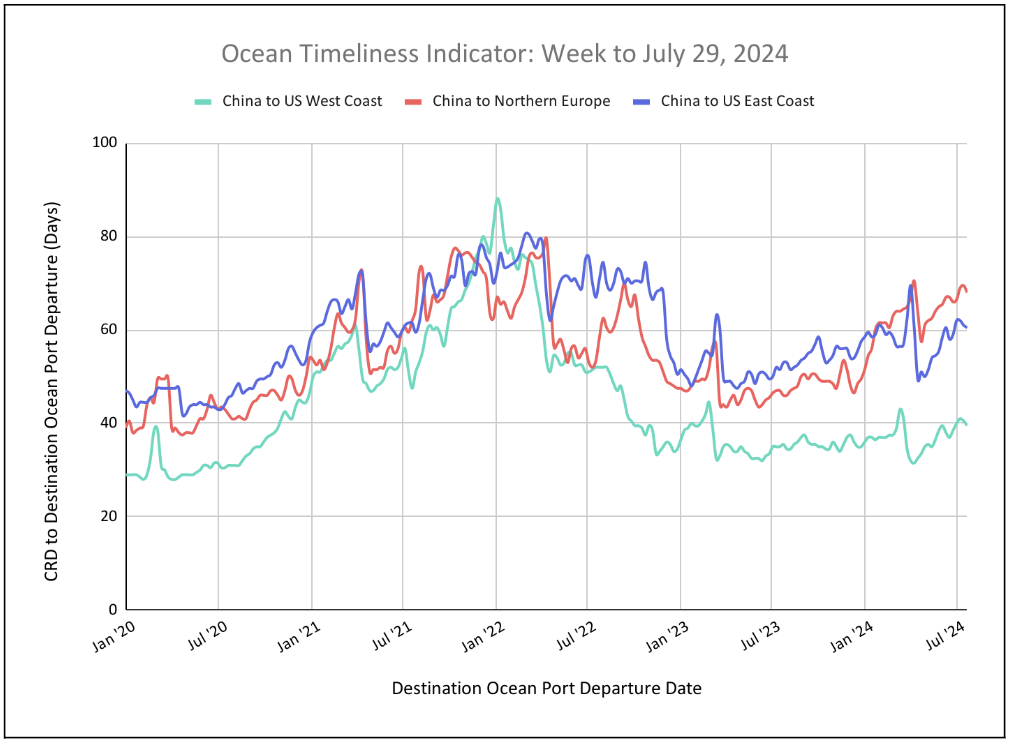

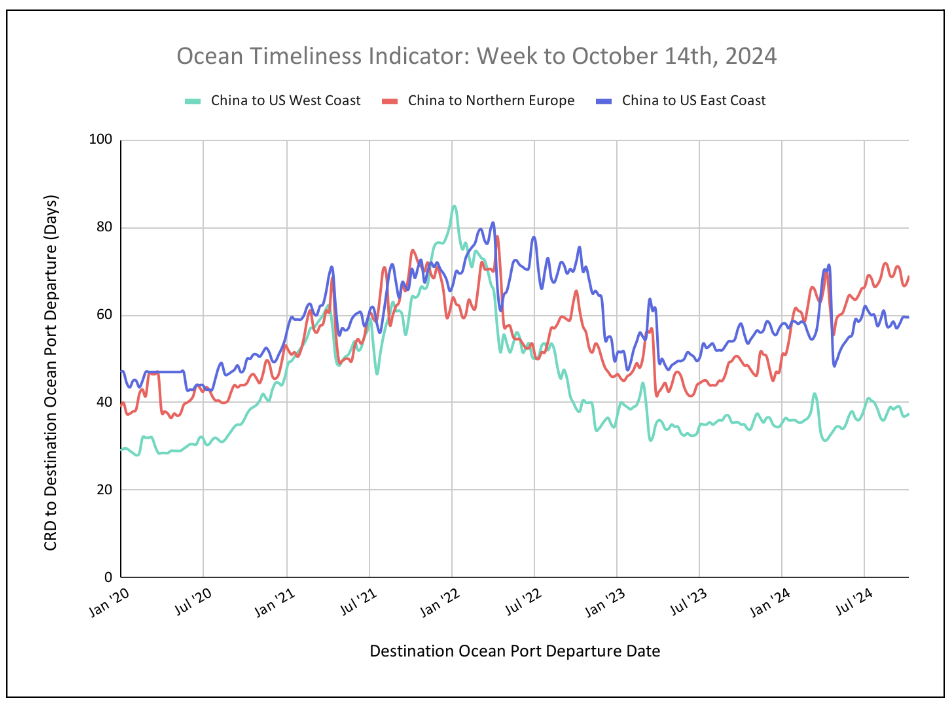

Flexport Ocean Timeliness Indicator

OTIs have demonstrated a slight uptick from China to the U.S. West Coast, and a major increase for China to North Europe. China to the U.S. East Coast remains unchanged.

Week to October 14, 2024

This week, the Ocean Timeliness Indicator (OTIs) for China to the U.S. West Coast have shown a small uptick, rising from 37 to 37.5 days. Meanwhile, China to North Europe has seen a major increase, moving from 67 to 69 days. China to the U.S. East Coast, however, has not shown any movement, remaining at 59.5 days.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.