Trends to Watch

[Air – Global] (Data Source: WorldACD/Accenture)

- Dubai to Europe air cargo tonnages have seen a substantial increase, with a +205% rise compared to last year and a +7% increase from the previous week, driven by disruptions in Asia-Europe container shipping while overall global demand stabilized.

- Key Asia-Europe sea-air hubs, including Dubai, Colombo, and Bangkok, have experienced significant air cargo demand to Europe since early 2023, with Dubai-Europe tonnages more than doubling year-on-year due to the Red Sea situation.

- While Bangkok to Europe demand continues to rise, with a +33% year-on-year increase in week 10, Colombo to Europe demand shows signs of softening, with a growth of +20% compared to +35% the previous week.

- Globally, air cargo tonnages stabilized with a slight increase in average rates to $2.32 per kilo in week 10, following a post-Lunar New Year recovery in demand, particularly from the Asia Pacific region.

- Worldwide air cargo capacity is up by +9% year-on-year, with significant increases from Asia Pacific and Central & South America, while average rates remain above pre-COVID levels, indicating a robust recovery in the sector.

[Ocean – FEWB]

- Asia-North Europe: For Asia-Europe trade, most vessels continue to reroute via the Cape of Good Hope. Some carriers are investigating the possibility of routing back to the Suez Canal, but so far no further announcements. The news indicates that vessels in the Indian Ocean and the Cape of Good Hope may also be impacted by the situation. We’re closely monitoring and following up with carriers.

- After Maersk & Hapag Lloyd announced the Gemini Cooperation commencing in 2025, Ocean Alliance (CMA CGM Group, COSCO Shipping, Evergreen, and OOCL) confirmed the renewal of The Ocean Alliance partnership for another 5 years. Following the renewal, effective April 2024, there will be some service adjustments. Details to follow once we learn more. So far, the new deployment plan shared by Ocean Alliance for Asia to Europe would be:

- 6 services between Asia and Northern Europe.

- 4 services between Asia and the Mediterranean.

- The floating market rate keeps dropping. Some carriers are preparing to implement GRI for April by $600-800 per FEU. While demand remains flat at the moment, more discussion is ongoing about current offerings and long-term finalizations, especially if the current Red Sea Surcharges will be upheld by carriers.

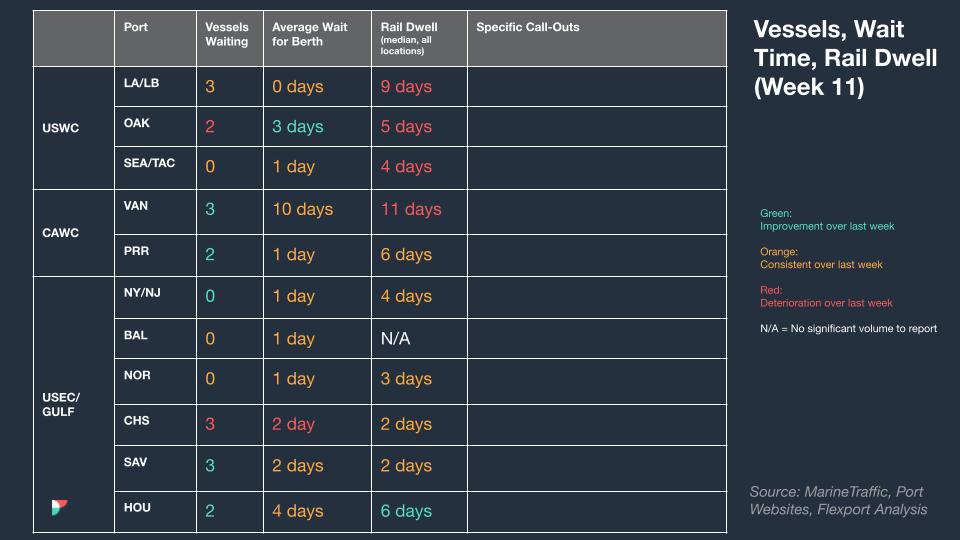

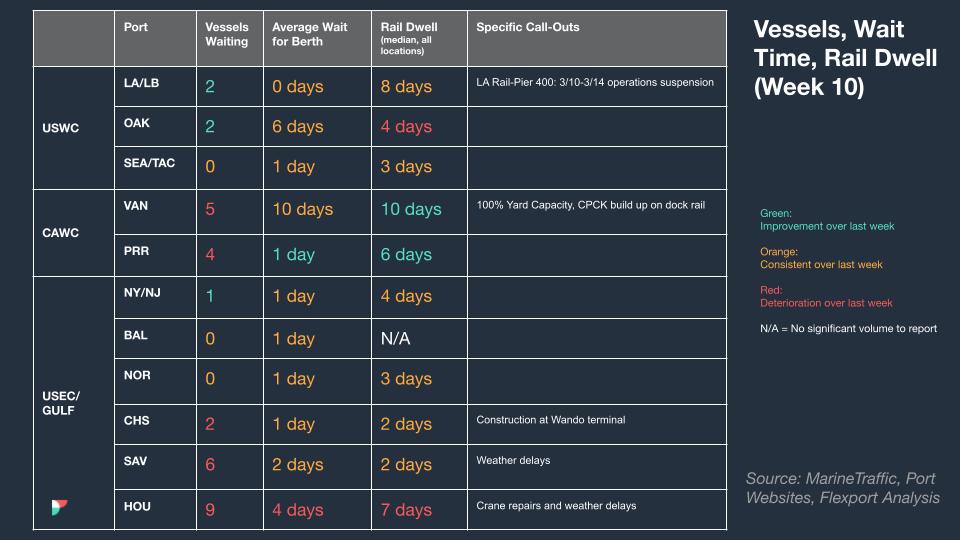

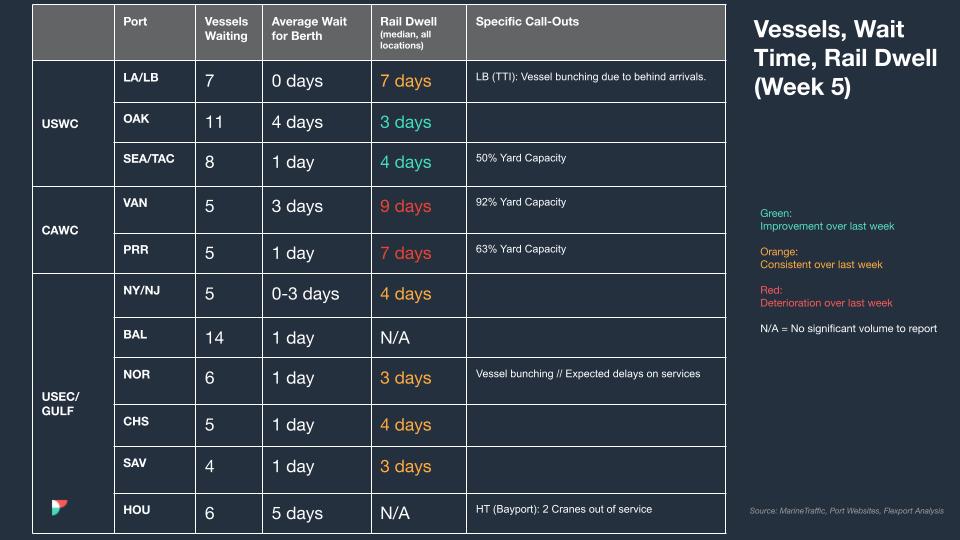

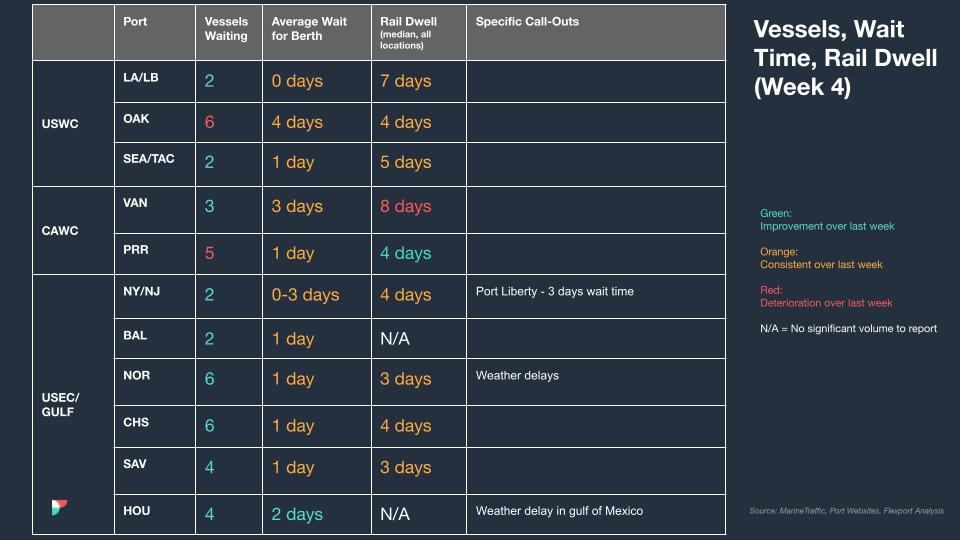

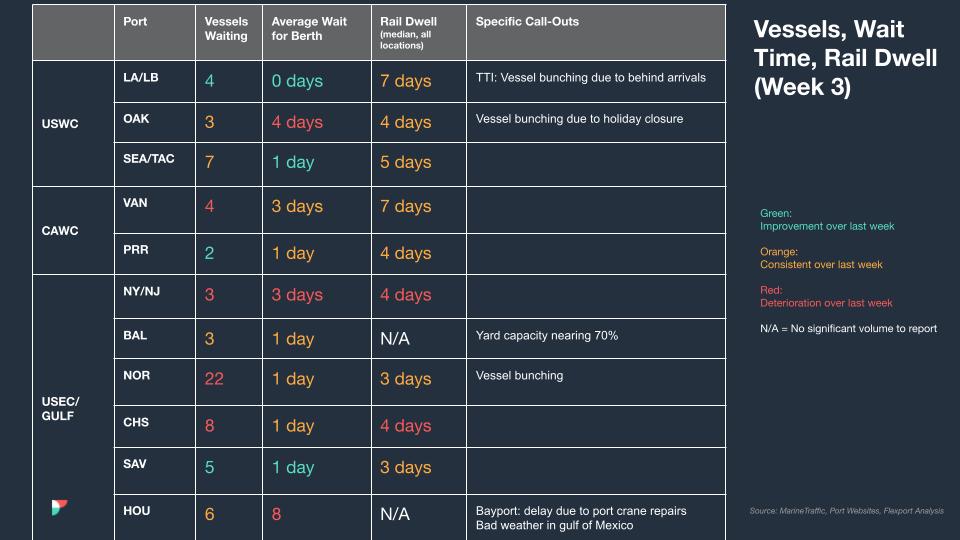

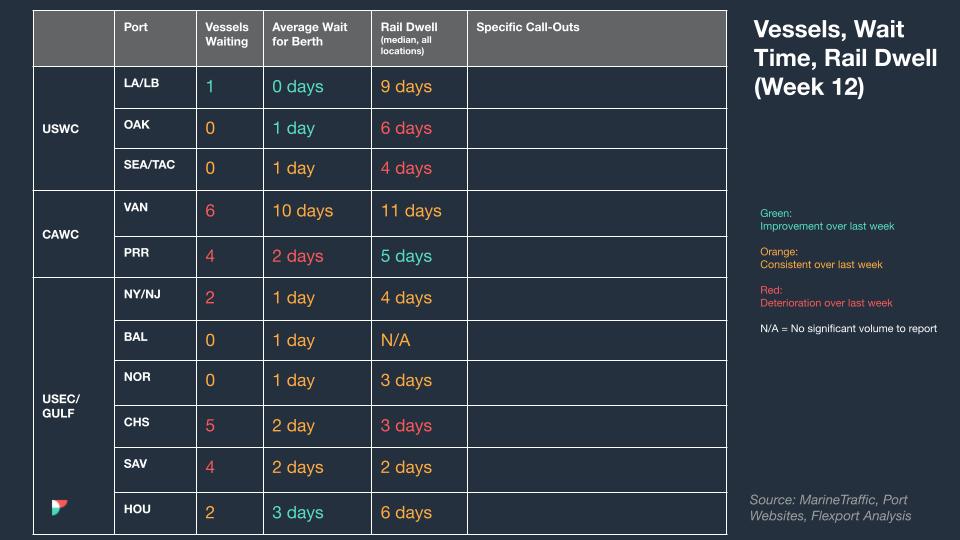

North America Vessel Dwell Times

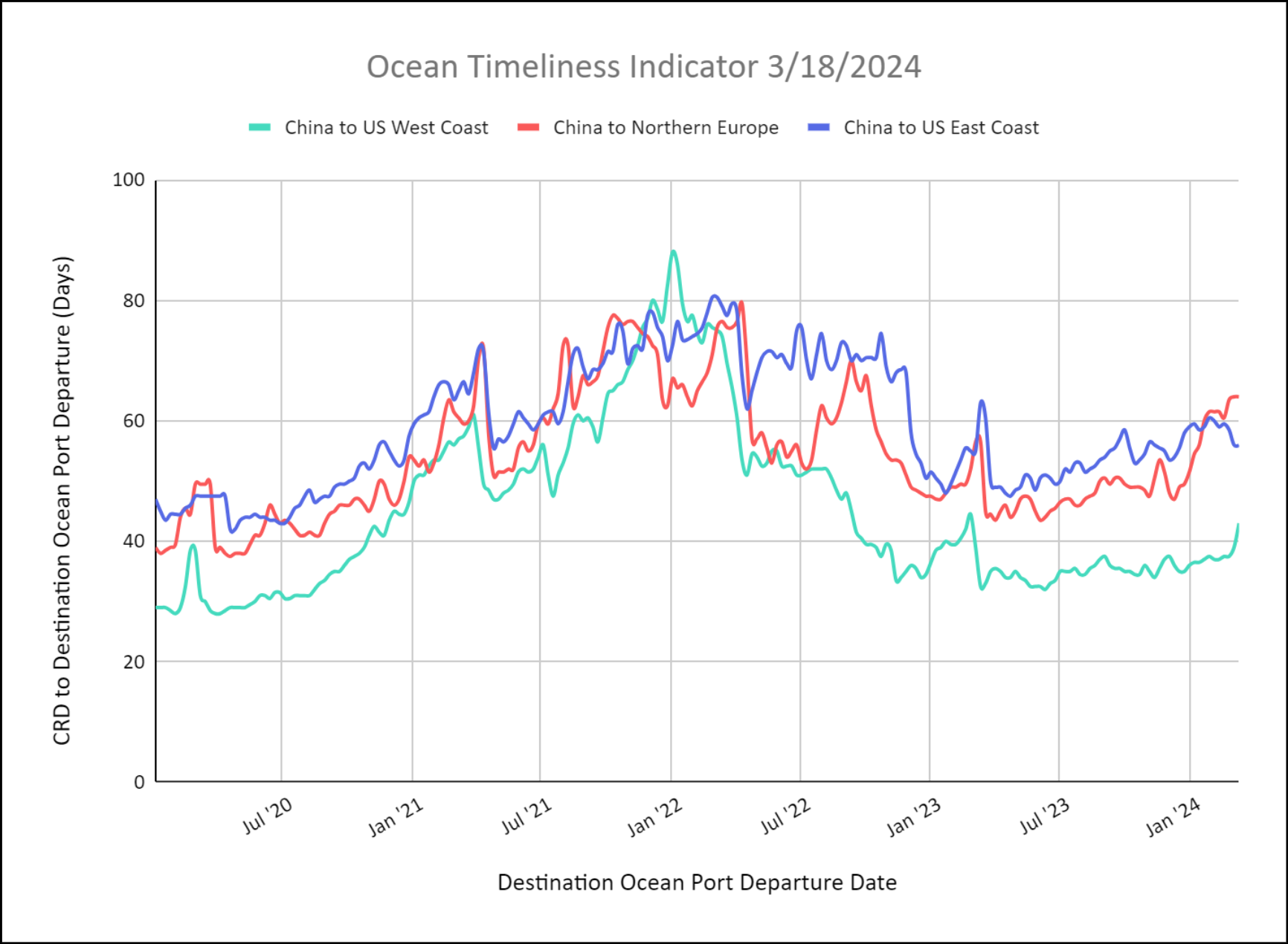

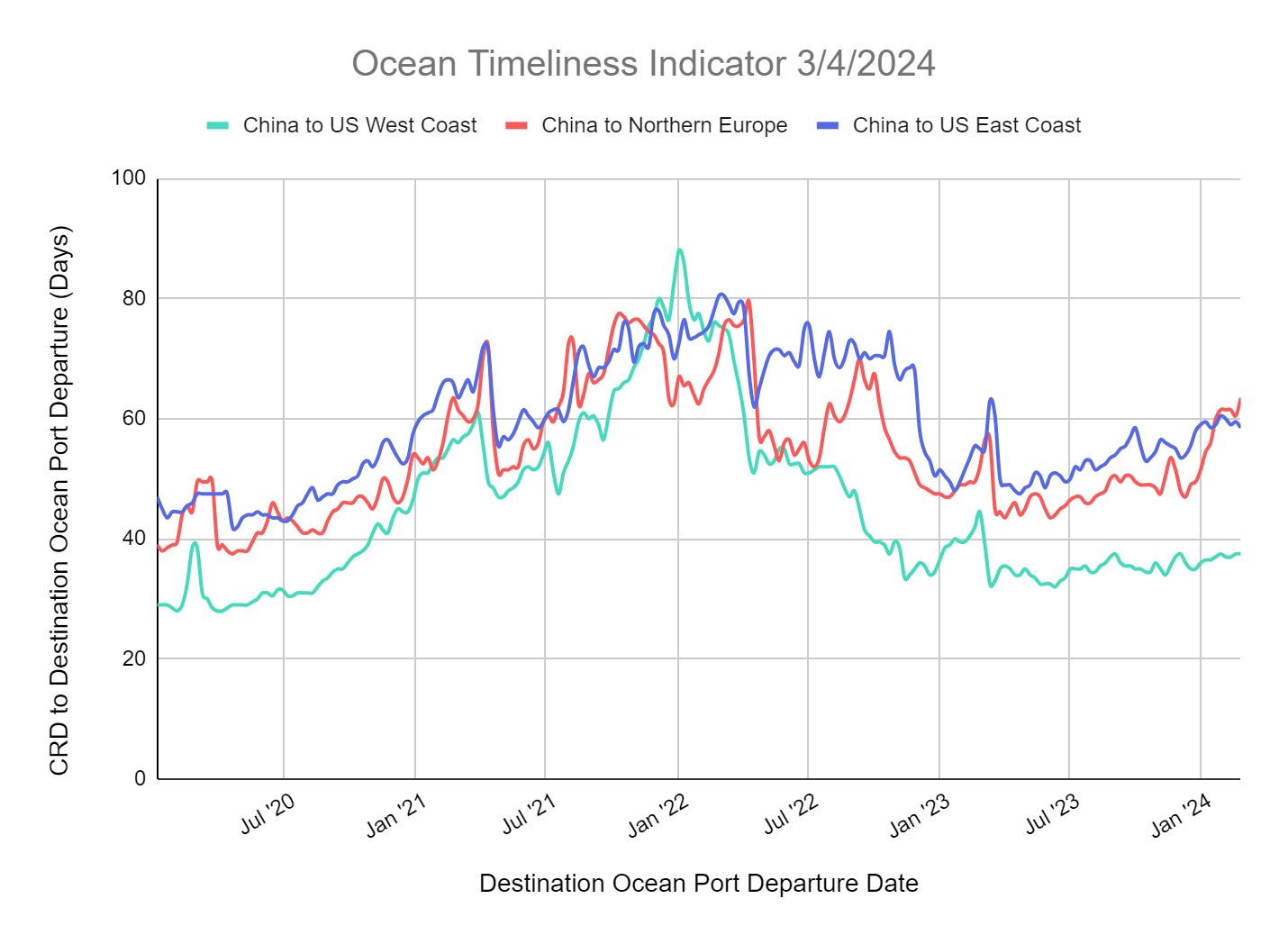

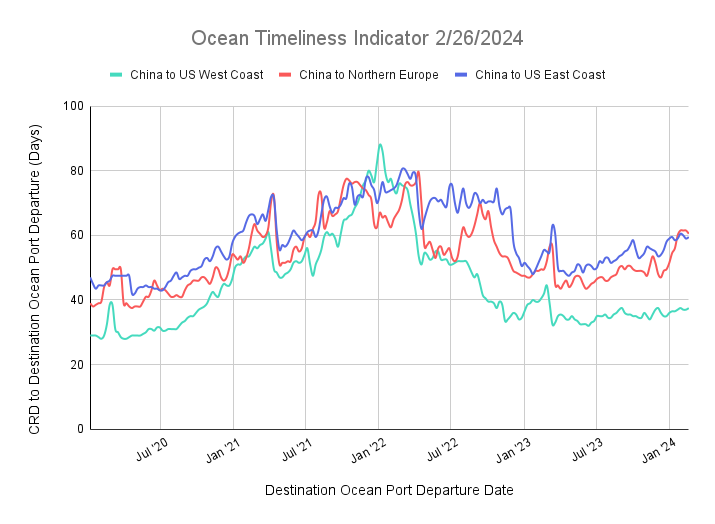

Flexport Ocean Timeliness Indicator

Ocean Timeliness Indicators for China to Northern Europe and China to the U.S. East Coast Remain Steady. Indicators for China to the U.S. West Coast Increase.

Week to March 18, 2024

This week, the OTI for China to Northern Europe remains steady at 64 days due to carrier re-routings from the Suez Canal around the Cape of Good Hope. The OTI for China to the U.S. East Coast also remains elevated, yet steady, at 56 days as some carriers route westward around Cape of Good Hope while most have decided to use the Panama Canal despite continued slot restrictions. The OTI for China to the U.S. West Coast increased to 43 days.