Trends to Watch

[Customs]

- The Canada Border Services Agency (CBSA) Assessment and Revenue Management (CARM) project, a digital platform to assess and pay duties and taxes on imported commercial goods, went live on Monday (October 21).

[Ocean – TPEB]

- Due to robust demand following Golden Week, carriers have announced a general rate increase (GRI) for Freight All Kinds (FAK) effective November 1, along with adjustments for the first half of the month.

- Floating rates have stabilized and are no longer trending downward for the second half of October.

- Demand returned sharply following Golden Week.

- Fixed rates and Peak Season Surcharges (PSSs) remain unchanged heading into the first half of November.

[Ocean – FEWB]

- Space is filling up in the second half of October due to the upcoming November general rate increase, coupled with capacity cuts from October blank sailings. As a result, bookings are being expedited to avoid higher freight costs for later departures.

- Ten services have blanked for November, resulting in a 15-18% reduction in capacity.

- The Shanghai Containerized Freight Index (SCFI) dropped $90 per TEU for week 43, reflecting the rates for the second half of October, but an increase is anticipated for weeks 44 and 45 once the GRI is successfully implemented and maintained.

- As space becomes limited, carriers will reintroduce premium services starting November 1, priced at $2,000 per container, for those requiring guaranteed space with earlier estimated times of departure (ETDs) or specific service and transit times.

[Ocean – TAWB]

- Demand in Northern Europe is stabilizing, as the backlog from the ILA strike has diminished. New York remains the only port experiencing high demand. Space is currently available, and carriers are extending their rate levels for November.

- In the West East Mediterranean, demand is increasing. Coupled with blank sailings in the region, carriers are achieving full vessel utilization, prompting GRIs and PSSs for November.

- In terms of equipment, there are no significant challenges in Northern and Southern Europe, except for certain areas in Central Europe and Southern Germany.

[Ocean – U.S. Exports]

- Volume surges for containerized rail movements through Los Angeles/Long Beach (LA/LB) in both directions are causing rail-dwell-related congestion at LA/LB rail operations, impacting U.S. export cargo scheduled to move from inland points via LA/LB.

- Currently, there are restrictions on the number of containers moving westbound from inland rail points to LA/LB. These restrictions are expected to last 7-10 days to allow the network to recover and return to regular performance levels.

- Customers exporting from the U.S. via LA/LB may experience longer transit times and delays.

[Air – Global] Mon Oct. 7 – Sun Oct. 13, 2024 (Week 41):

- China-USA Tonnages: In week 41, tonnages from China to the USA increased by just +1% week-on-week (WoW) after dropping -20% in week 40. Year-on-year (YoY), China-USA tonnages were down by -19%, marking the biggest YoY percentage drop this year, primarily driven by increased customs checks at LAX and Golden Week impacts.

- Worldwide & Asia Pacific Recovery: Global air cargo tonnages rose +2% WoW in week 41, placing them +8% above last year’s levels. Asia Pacific region recovered more strongly, rising +6% WoW after a -10% drop in week 40, bringing tonnages +12% higher than the same time last year.

- China-LAX Effect: China-LAX tonnages were down -39% YoY in week 41 due to both Golden Week and increased customs checks since July. When looking at September as a whole, China-LAX tonnages were down -19% YoY, while overall China-USA tonnages fell -8% YoY.

- Pricing Trends: Average worldwide rates remained stable at $2.58 per kilo, +12% YoY. Spot rates from China to the USA rose +8% WoW to $5.28 per kilo, rebounding from a previous -7% drop. Asia Pacific to USA spot rates increased +3% WoW to $6.11 per kilo, up +45% YoY.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

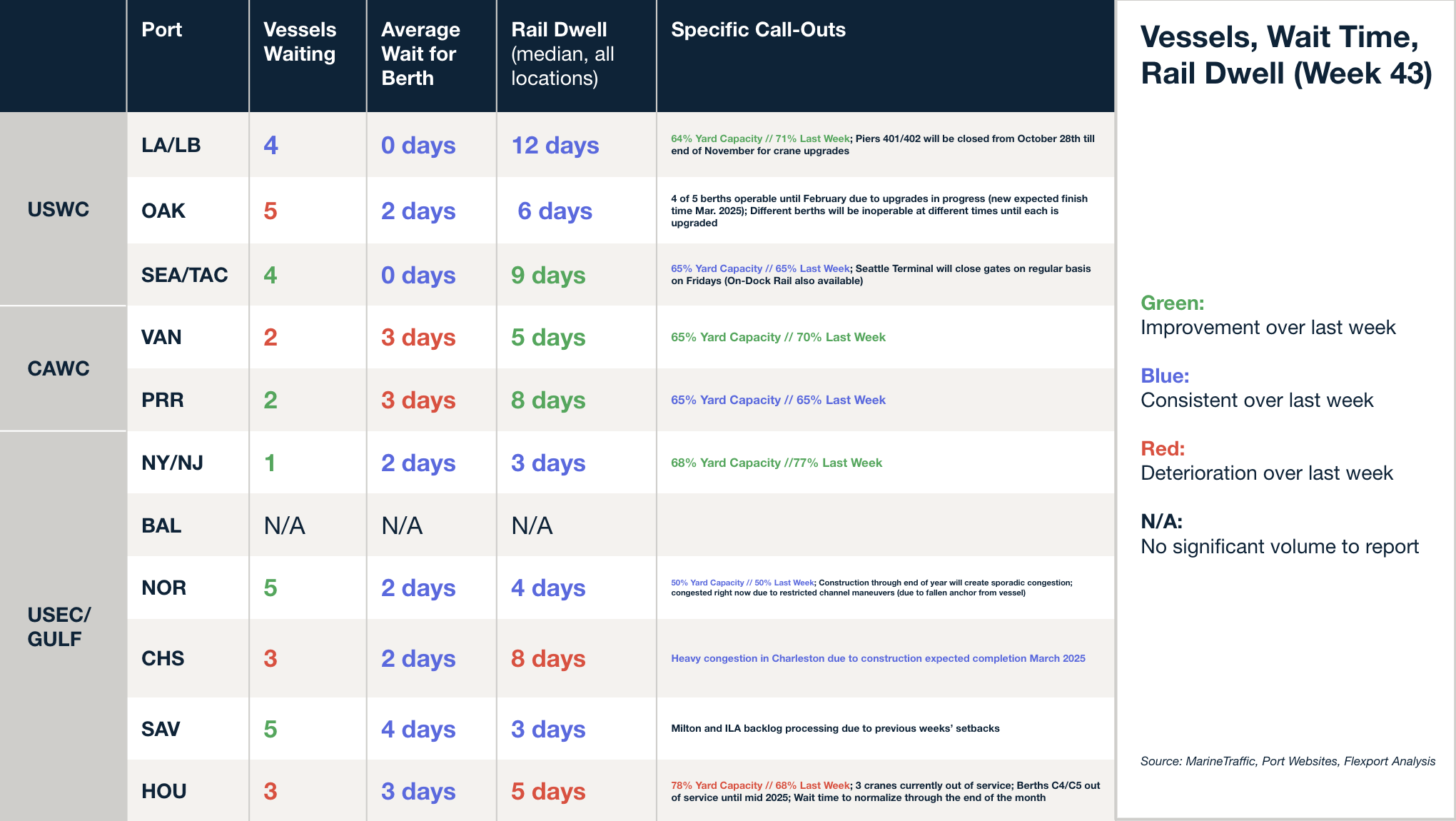

North America Vessel Dwell Times

This Week in News

Stability in Freight Markets Is Reviving Logistics Dealmaking — The Wall Street Journal

Mergers and acquisitions in the logistics sector are rebounding as market volatility from the pandemic subsides. After a two-year slowdown, companies are actively seeking purchases or considering sales, driven by stabilized valuations. Notable deals include DSV’s $12 billion acquisition of DB Schenker, and UPS’s sale of Coyote Logistics for over $1 billion.

Delay in Europe’s deforestation rule does not address key issues: Palm oil industry — Journal of Commerce

The European Union’s decision to delay the Deforestation Regulation (EUDR) by at least 12 months will not alleviate concerns for small farmers, particularly in the Southeast Asian palm oil industry. Experts argue that without amending traceability requirements to exempt smallholders, these farmers will remain barred from European markets. The delay, which pushes the implementation date for large companies from December 31, 2023, to December 30, 2025, and June 30, 2026, for small businesses, does not resolve concerns regarding the regulation’s traceability requirements, particularly for small-scale farmers.

Roaring volume has Port of Los Angeles eyeing $1 trillion in imports — FreightWaves

The Port of Los Angeles is experiencing unprecedented growth, with a record 954,706 TEUs handled in September, contributing to a total of 2.85 million TEUs in the third quarter—up 27% year-over-year. Driven by strong consumer spending and an early start to holiday imports, the port’s import value reached $990 billion for the quarter, with expectations of soon hitting $1 trillion.

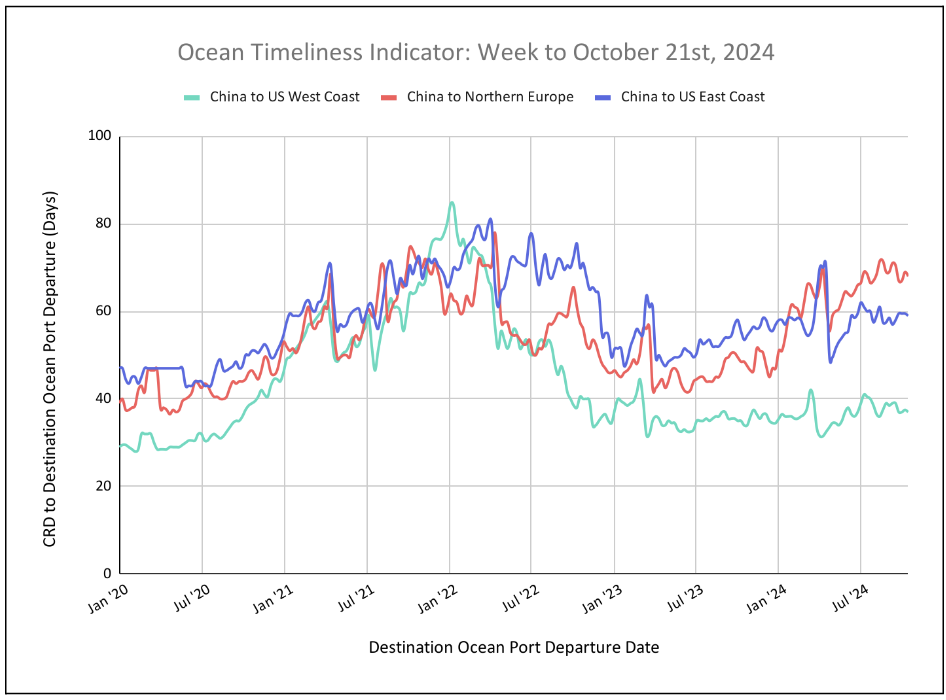

Flexport Ocean Timeliness Indicator

OTIs have demonstrated a small decrease across the board, showing signs of stabilization at current levels.

Week to October 21, 2024

This week, the Ocean Timeliness Indicator (OTI) has shown small downward movements across the board. China to the U.S. West Coast went from 37.5 to 37 days, China to North Europe from 69 to 68 days, and China to the U.S. East Coast from 59.5 to 59 days.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

Source from Flexport.com