Trends to Watch

[Labor Disputes Update]

- Canadian ports in Montreal and Vancouver are set to reopen after Canadian Labour Minister Steven MacKinnon took decisive action to end lockouts on November 12.

- Meanwhile, the British Columbia port workers union announced plans to challenge both the Canada Industrial Relations Board’s order to end the job action and the Minister’s forced arbitration. Read our blog to learn more.

- In the U.S., the ILA announced on Wednesday (November 13) that it broke off talks with USMX after Tuesday’s negotiations in New Jersey stalled over proposals concerning automation and semi-automation at ports. The two sides had aimed to reach an agreement on a new six-year master contract. Read more here.

[Ocean – TPEB]

- Volumes from Asia have remained strong through the first two weeks of November, driven partly by anticipated tariff increases and the potential ILA strike expected in early January, along with the early Lunar New Year in 2025. Rates continue to vary across routes between China and Southeast Asia, though we’re seeing increased pressure on routes to the U.S. West Coast.

- East Coast volumes are normalizing, but certain carriers and service routes are already fully booked or facing capacity constraints through November.

- Fixed rates and Peak Season Surcharges (PSS) have been steady in the first half of the month, though some PSS adjustments may occur given the highly volatile short-term market.

[Ocean – FEWB]

- Space will remain tight in the second half of November due to ongoing blank sailings and a continuously growing roll pool. With bookings being deferred to avoid arrivals during the Christmas and New Year holidays in Europe, the November GRI may not materialize, and carriers are instead preparing for a December GRI, projected at $3,900/$6,000/$6,000.

- In tandem with the anticipated rate increase, the SCFI rose by $100/TEU to $2,541/TEU for week 46. Another slight increase is expected in the coming week, with rates likely stabilizing or decreasing based on December GRI developments.

- Equipment shortages are occurring sporadically at major ports in China but remain manageable. For those needing firm space with earlier estimated times of departure (ETDs) or specific service and transit times, premium options are available.

[Ocean – TAWB]

- In Northern Europe, demand remains stable and strong. Most services to New York are fully booked, while there is more available capacity in the main Southeast ports. Rates have held steady through the second half of November.

- In the Western Mediterranean, carriers are overbooked, with utilization exceeding 100%. Most carriers successfully implemented rate increases in November and are now assessing the market for December adjustments.

- In the Eastern Mediterranean, capacity is tight due to high demand in recent months. However, the market remains highly competitive, with carriers reviewing rate increases to ensure alignment with market conditions.

[Air – Global] _Mon 28 Oct – Sun 03 Nov 2024 (Week 44)___:

- Global rate rise: In week 44 (28 Oct – 3 Nov), worldwide air cargo rates increased by +2% WoW to $2.71 per kilo, up +12% YoY. Asia-Pacific and Europe rates rose +2% WoW to $3.56 and $2.13 per kilo, respectively, with Africa rates up +3% to $1.98 per kilo. Rates in North America, CSA, and MESA stayed stable.

- Regional rate jumps: Spot rates from China to Europe increased +12% WoW to $4.68 per kilo, and Japan to Europe by +8% to $4.58 per kilo (+26% and +42% YoY). China to the USA reached $5.90 per kilo (+3% WoW), and MESA to Europe rose +4% to $3.29 per kilo—nearly double YoY.

- Capacity cuts drive rates: A -6% WoW capacity reduction from Europe raised load factors and westbound transatlantic rates, responding to reduced bellyhold capacity. Last year’s rates didn’t see this spike.

- Tonnage dips despite YoY growth: Week 44 tonnages were down WoW due to holidays, though up +5% YoY, with significant growth from the Asia-Pacific (+6%), North America (+6%), and MESA/CSA regions (+8%).

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

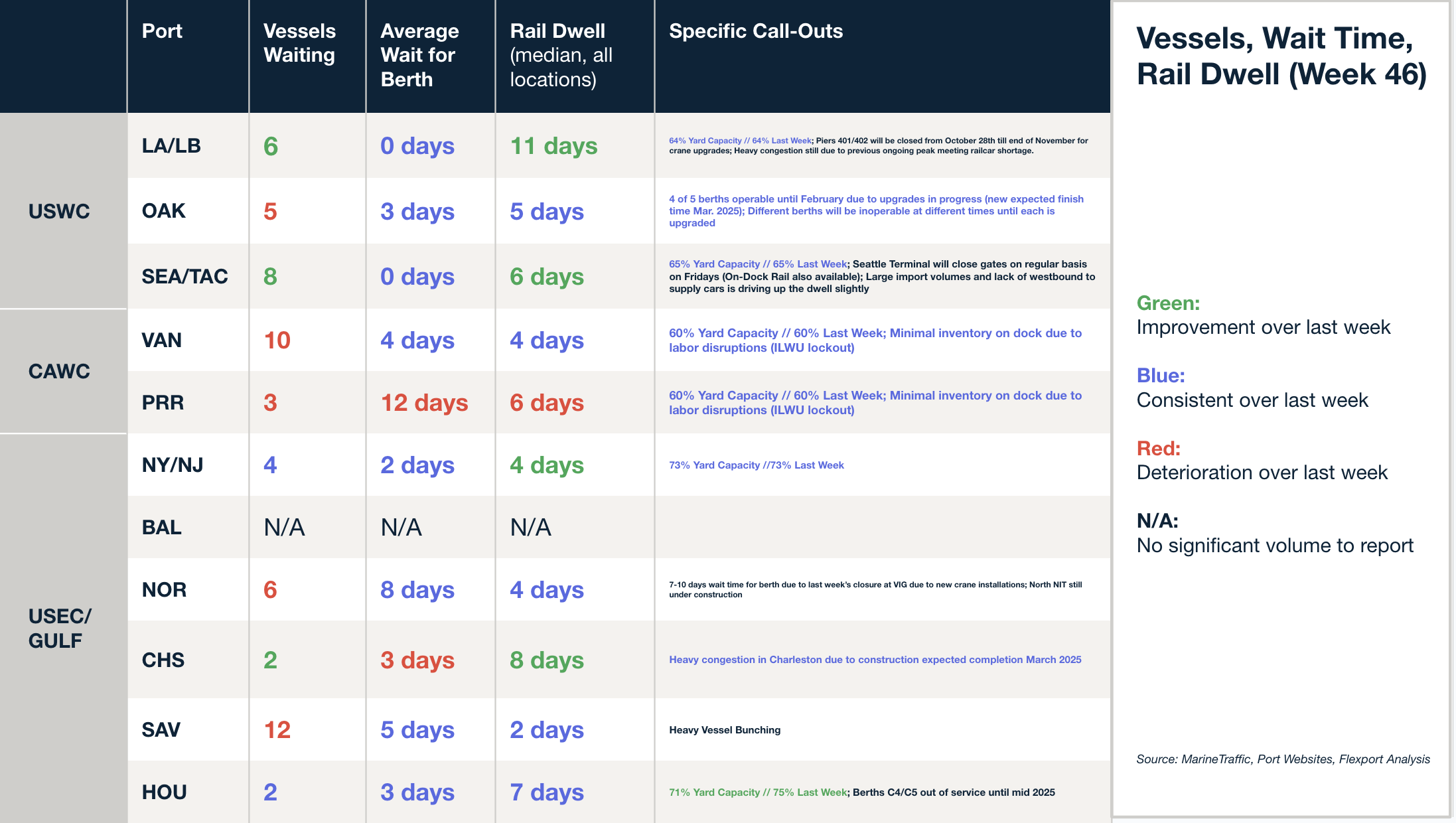

North America Vessel Dwell Times

This Week in News

Flexport CEO Ryan Petersen Discusses Possible Tariffs Impact on Global Trade

Flexport CEO Ryan Petersen appeared on Bloomberg Surveillance to discuss the potential impact of President-Elect Trump’s win, including possible new tariffs, ongoing ILA-USMX negotiations, a potential port strike, global manufacturing shifts, and other key issues. Petersen commented, “We’ve seen this movie before,” as Trump reiterated his plan to raise tariffs in his next term.

U.S. retailers ramping up year-end imports ahead of strike, tariff threats

To prepare for a potential East and Gulf Coast dockworkers’ strike in January and high tariffs from President-Elect Trump, U.S. retailers plan to import 350,000 more TEUs than expected in November and December. Revised projections from the Global Port Tracker show November imports up 13.6% year-over-year, with December up 6.1%. Concerns over supply chain disruptions are prompting retailers to frontload merchandise before January.

The U.S. Air Force Strategy That Flexport Uses to Move Billions in Merchandise

When Ryan Petersen launched Flexport in 2013, he approached the problem from a customer’s perspective. Early in his career, he had worked at his brother’s import-export business, sourcing and selling ATVs, scooters, and dirt bikes from Asia to markets around the world. Today, Flexport’s technology moved over $32 billion’s worth of merchandise. Listen to the story here.

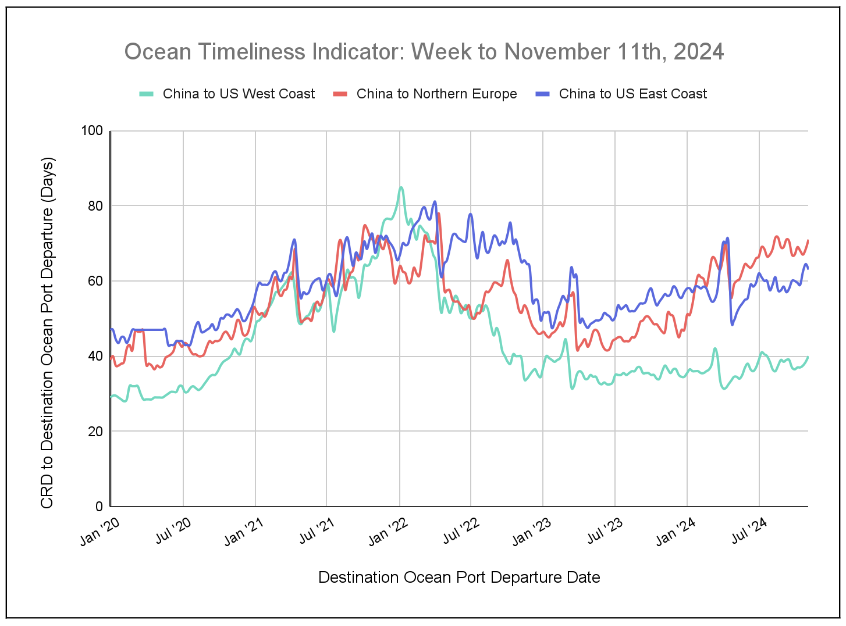

Flexport Ocean Timeliness Indicator

This week, the Flexport OTI has increased from China to the U.S. West Coast and China to Northern Europe, and decreased from China to the U.S. East Coast.

Week to November 11, 2024

This week, the Ocean Timeliness Indicator (OTI) has increased from China to the U.S. West Coast and from China to Northern Europe, moving from 38.5 to 40 days and 68.5 to 71 days, respectively. Meanwhile, the OTI decreased from China to the U.S. East Coast, falling from 64.5 to 63 days.