Trends to Watch

[Tariffs Update]

- On Tuesday, President Donald Trump told reporters that he may impose 25% tariffs on automobiles, pharmaceuticals, and semiconductors as early as April 2.

- However, he did not specify whether the tariffs would apply to all imported vehicles, or target specific countries.

- If implemented, the tariffs could significantly impact major auto-exporting countries to the U.S., including Mexico, Japan, and Canada.

- For more details on the latest tariff updates, read our blog.

[Ocean – TPEB]

- Capacity and market: Capacity is recovering after the Chinese New Year (CNY), currently at over 90%. Demand is also increasing, but hasn’t yet reached pre-CNY levels. Currently, there is ample space available compared to before CNY. This suggests that while things are getting back to normal after the holiday slowdown, demand is still somewhat soft.

- Rates trends: Floating rates are decreasing rapidly for the rest of February and into March. General Rate Increases (GRIs) are unlikely for March. This indicates downward pressure on pricing, likely due to the increased capacity and relatively lower demand.

- Equipment: Equipment availability has improved and is now sufficient at most Asian gateways compared to pre-CNY. This is a positive sign, suggesting that logistical bottlenecks related to equipment are easing.

[Ocean – FEWB]

- Space outlook: Several blank sailings have been announced, impacting capacity from late February to early March. Overall recovery on the FEWB trade lane remains slow.

- Destination port congestion: Carrier reports indicate ongoing congestion at destination ports. Notably, Rotterdam is experiencing ETA delays of 5-9 days for vessels awaiting berth.

- GRI announcement: At least three carriers within the Gemini and Ocean alliances have announced a GRI for March, exceeding 50% based on current market offers. While rates for the second half of February remain stable at lower levels, carriers aim to push rates higher in early March through this GRI. This announcement may also incentivize shippers to advance their cargo to the latter half of February.

- Predictions and suggestions: Given current supply-demand dynamics, we believe the March FAK rate is unlikely to experience such a sharp increase. However, this GRI could effectively halt further rate declines and potentially lead to a slight market uptick in March. Shippers are advised to book earlier in February to secure current rates and available space while mitigating the risk of higher rates in March.

[Ocean – TAWB]

- Capacity/demand: Capacity has surged in the last two weeks of February, with many vessels fully booked on the North Europe–U.S. East Coast trade. This increase is linked to the upcoming steel and aluminium tariffs that the U.S. administration will implement on March 12. Meanwhile, in the Mediterranean, utilization remains strong, with no signs of overbooking.

- Rates: Some carriers have postponed the March Peak Season Surcharge (PSS) to April, while others have implemented it selectively for certain regions. Market skepticism remains regarding the PSS, which currently affects only exports from North Europe.

- Equipment: Equipment shortages persist in parts of Central Europe, particularly in Austria, Slovakia, Switzerland, Hungary, and Southern/Eastern Germany. For shipments originating from these areas, carrier haulage is recommended to mitigate equipment challenges.

[Air – Global] Mon 03 Feb – Sun 09 Feb 2025 (Week 6) (Source: worldacd.com):

- Global rebound & pricing decline: Air cargo tonnages rebounded by +3% week on week in Week 6 (Feb 3–9, 2025) after the Lunar New Year dip, while overall worldwide rates dropped –5% WoW to US$2.30 per kilo (+1% YoY).

- Asia-Pacific impact: The rate drop was largely driven by the Asia-Pacific, where prices fell –11% WoW; spot rates in this region dipped –8% WoW to US$3.56 per kilo, though both global and regional spot rates are +4% higher YoY.

- Middle East & South Asia (MESA) trends: MESA origins saw a slight –1% WoW dip in tonnage (–7% YoY), with spot rates falling –4% WoW to US$2.99 per kilo, but these remain +26% higher YoY. Trade to Europe shows tonnages –21% lower YoY, with spot rates still +32% higher YoY.

- China/Hong Kong to USA & Europe:

- To USA: China-origin tonnages dropped –20% WoW in Week 5 and –28% WoW in Week 6 (–41% YoY), with spot rates falling to US$3.99 per kilo.

- To Europe: China/Hong Kong tonnages fell significantly (up to –30% WoW in Week 5 and further in Week 6), though spot rates remained relatively stable around US$3.91 per kilo.

- Other East Asian Markets recover: Countries like South Korea, Taiwan, and Vietnam experienced steep tonnage declines during Week 5 (ranging from –42% to –60% WoW) but rebounded in Week 6, with increases of +21% to +68% WoW. Their spot rates remain well above last year’s levels.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

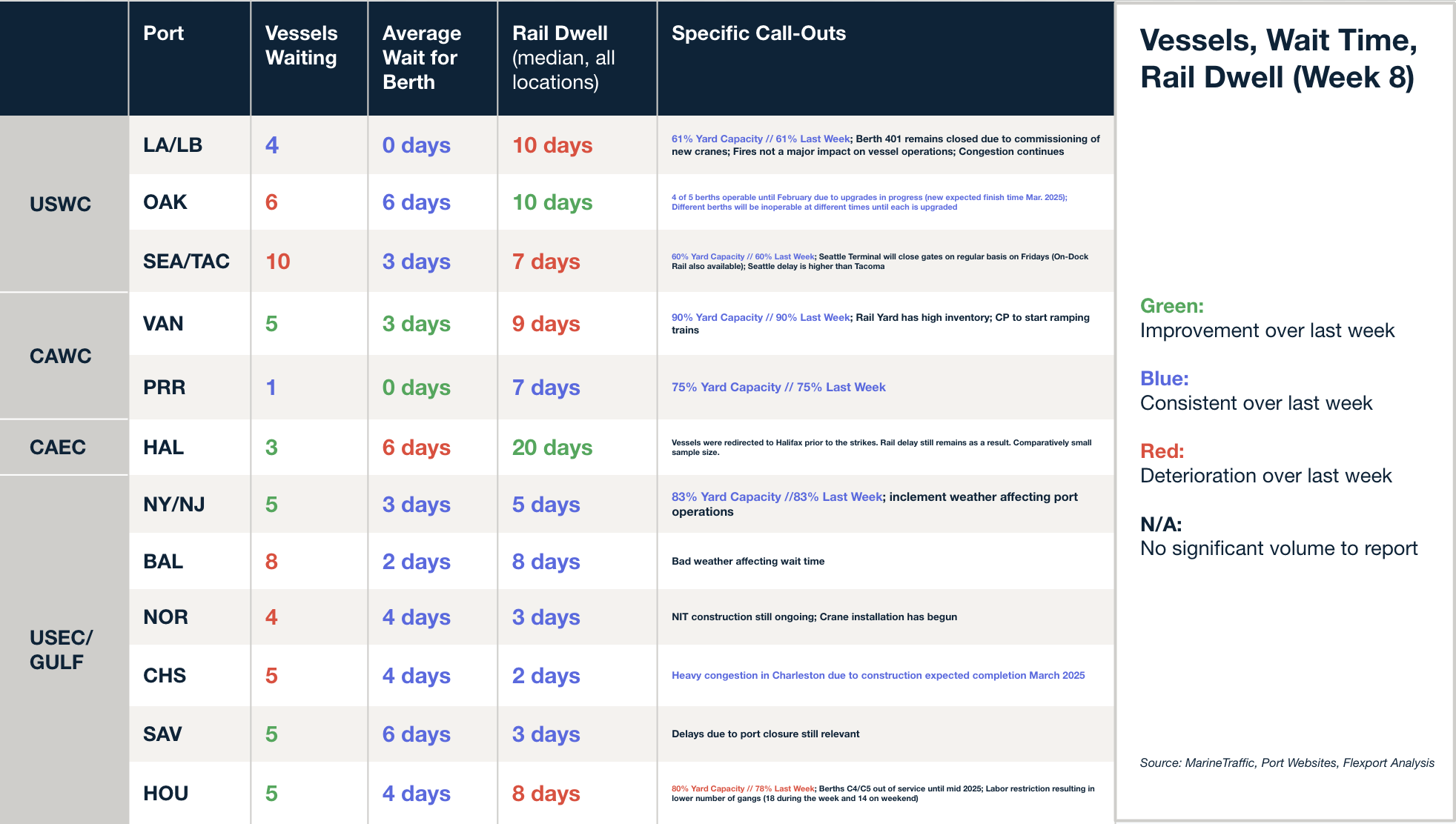

North America Vessel Dwell Times

News This Week

Ocean carriers’ ever-tightening grip on capacity control shows no signs of loosening

Container shipping has become more expensive and less reliable over the past 25 years due to shrinking capacity. In the early 2000s, carriers prioritized meeting demand, but after the 2008 financial crisis, they slowed ships to cut costs. Since then, blank sailings and port congestion have further reduced capacity, while external shocks like COVID-19 and geopolitical conflicts have made things worse. With new environmental regulations ahead, carriers may pass rising fuel costs onto shippers, adding to their challenges.

US regulator reopens truck broker-transparency proposal for new comments

U.S. regulators are reopening public comments on a proposed rule requiring freight brokers to disclose shipper-paid rates and broker margins to trucking companies. The Federal Motor Carrier Safety Administration (FMCSA) extended the comment period until March 20 following a request from the Small Business in Transportation Coalition. The rule seeks to improve transparency by mandating electronic records and access to transaction details within 48 hours. However, the FMCSA declined to ban broker contracts that waive carriers’ rights to this information.

Small Warehouses Are Getting Harder to Find

The vacancy rate for warehouses under 100,000 square feet is just 3.9%, compared to 6.7% overall and 10.1% for larger buildings. Developers have focused on building big warehouses to meet ecommerce demand, leaving a shortage of smaller spaces, especially in urban areas. As companies seek smaller warehouses to cut costs and improve delivery times, finding space remains a major challenge.

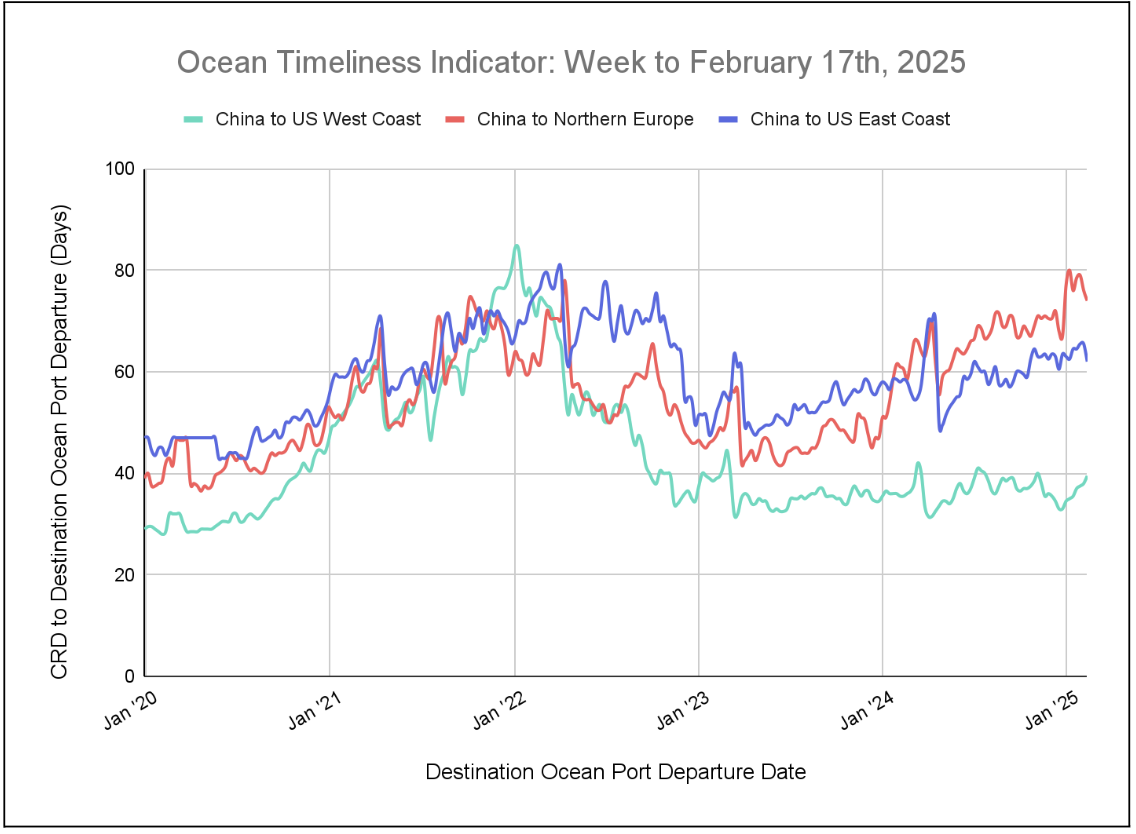

Flexport Ocean Timeliness Indicator

This week, the Flexport OTI maintains its ascent for China to the U.S. West Coast, while declining for China to North Europe and China to the U.S. East Coast.

Week to February 17, 2025

This week, the Ocean Timeliness Indicator (OTI) for China to the U.S. West Coast has risen from 38 to 39.5 days. Meanwhile, China to the U.S. East Coast and China to North Europe have fallen from 65.5 to 62 days and 76 to 74 days, respectively.

Source from Flexport.com