Trends to Watch

[ILA Work Stoppage Watch]

- If the International Longshoremen’s Association (ILA), which represents 45,000 workers at U.S. East Coast and Gulf Coast container ports, and the United States Maritime Alliance (USMX), which represents the area’s longshore employers (including carriers, marine terminal operators, and port associations), fail to finalize a new master contract by the September 30 deadline, the union intends to proceed with a work stoppage on October 1.

- An ILA work stoppage could upend U.S. supply chains, and even lead to pandemic-level bottlenecks. Beyond strained U.S. West Coast ports (where many shipments will be rerouted), we could see chassis shortages, skyrocketing trucking and air freight rates, and a number of other dire outcomes.

- Please refer to our live blog for a comprehensive guide to the situation, including detailed guidance for Flexport customers. There, you’ll also find live updates from our experts. Flexport will continue to provide timely updates and work closely with our customers to take proactive action and plan ahead in the event of a potential ILA work stoppage.

[Ocean – TPEB]

- Ocean Network Express (ONE) recently announced a new Asia-Europe, Transpacific, and Asia-Middle East trade lane service line-up, slated to launch in February of 2025.

- Additionally, beginning in February 2025, ONE will cooperate closely with HMM and Yang Ming. Together, they will comprise the Premier Alliance.

- Floating rates continue to decrease, and will be extended until the end of September. The market is moving rates further, downtrending with promotional and bullet rates, which have been implemented by most carriers. Volume remains flat, as we did not see the typical pre-Golden-Week peak.

- In light of uncertainties surrounding the potential ILA work stoppage, some BCOs are shifting volumes from the East Coast to the West Coast where possible. We’re seeing East Coast rates decrease faster than West Coast rates.

- Blank sailings impact 22-28% of the capacity being pulled out for weeks 41 and 42 in October for Golden Week.

[Ocean – FEWB]

- Market trends have shifted, and spot rates are falling rapidly. The core challenge currently faced by carriers is the slowdown in demand. Although carriers have increased capacity through the Cape of Good Hope to address growing demand within Asia-Europe trade, it seems that demand has already reached its peak.

- Floating rates for 2H September dropped further, but remain on the higher side compared to early 2024. Carriers are being more proactive in adjusting rates to optimize vessel utilization. The Shanghai Containerized Freight Index (SCFI) dropped by almost $1000/TEU over the past 2 weeks.

- Long-term named account business continues to face carrier restrictions surrounding space and equipment priority. Depending on further market developments, carriers may be open again to negotiations.

- Equipment shortages are getting better, but some ports of loading (POLs) with fewer direct calls still foresee potential equipment shortages for certain container types, such as 20’GPs and 45’HCs. Weight restrictions, especially for overweight 20’GPs, are still pending acceptance per loading port policies and vessel size requirements.

- As part of its new product/service launch in February 2025, ONE—alongside fellow Premier Alliance members HMM and Yang Ming—will cooperate with MSC to improve service across Asia-Europe trade lanes.

[Ocean – TAWB]

- In the event of an ILA work stoppage, there is no guaranteed solution for maintaining 100% of volumes ex Europe to the U.S. East Coast. Carriers will try to offer services via Canada, but space/connections are limited and may not absorb all volume.

- Carriers are seeing good utilization for both Northern European and Mediterranean services. September increases have been implemented, and most carriers have already announced October increases.

- We’re expecting to see new networks from carriers on the TAWB in 2025. So far, MSC and the Gemini Cooperation have already made announcements regarding new ocean network options.

- Equipment deficits in certain areas of South/East Germany and the Hinterlands remain an issue. At German ports, there are no further work stoppages expected at the moment.

- To protect space/equipment, we recommend booking 2-3 weeks in advance.

[Air – Global] (Freight Update Mon 26 Aug – Sun 01 Sep 2024 (Week 35)

- Year-on-year growth: Worldwide air cargo demand in August 2024 exhibited a +10% increase in tonnage compared to the same period last year, with rates rising +12% year-on-year (YoY).

- August vs. July 2024 trends: Compared to July 2024, August saw a slight decline in chargeable weight (-2%), but a +1% rise in average yields to $2.49 per kilo. Prices from Asian-Pacific origins rose by +1%, reaching $3.26 per kilo, and Middle East & South Asia (MESA) rates increased by +3%, reaching $2.81 per kilo.

- Regional price increases: Rates from Asian-Pacific origins were +22% higher YoY at $3.26 per kilo, and MESA origins saw rates rise +58% YoY to $2.81 per kilo, despite a slight tonnage decline in August (-3% and -2%, respectively).

- Week-on-week trends (week 35): Overall tonnage in week 35 (26 August – 1 September) slipped by -1%, with a notable -4% WoW decrease from North America due to the Labor Day holiday. Rates in North America increased by +4%, while capacity fell by -5% WoW.

- Two-week-on-two-week (2Wo2W) changes: Combining weeks 34 and 35, tonnages and rates both rose +1%, driven largely by a +5% rebound in demand from the Asia-Pacific, with intra-Asian-Pacific volumes up +8%, primarily due to recovery from Japan, Hong Kong, and South Korea.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

North America Vessel Dwell Times

Webinars

North America Freight Market Update Live

(Today) Thursday, September 12 @ 9:00 am PT / 12:00 pm ET

Navigating Peak Season: Essential Omnichannel & Fulfillment Strategies for Success

Tuesday, September 17 @ 9:00 am PT / 12:00 pm ET

Thursday, September 19 @ 8:00 am PT / 11:00 am ET / 16:00 BST / 17:00 CEST

Navigating Peak Season: Expert Insights on Ocean and Air Shipping Trends

Wednesday, September 25 @ 10:00 am PT / 1:00 pm ET

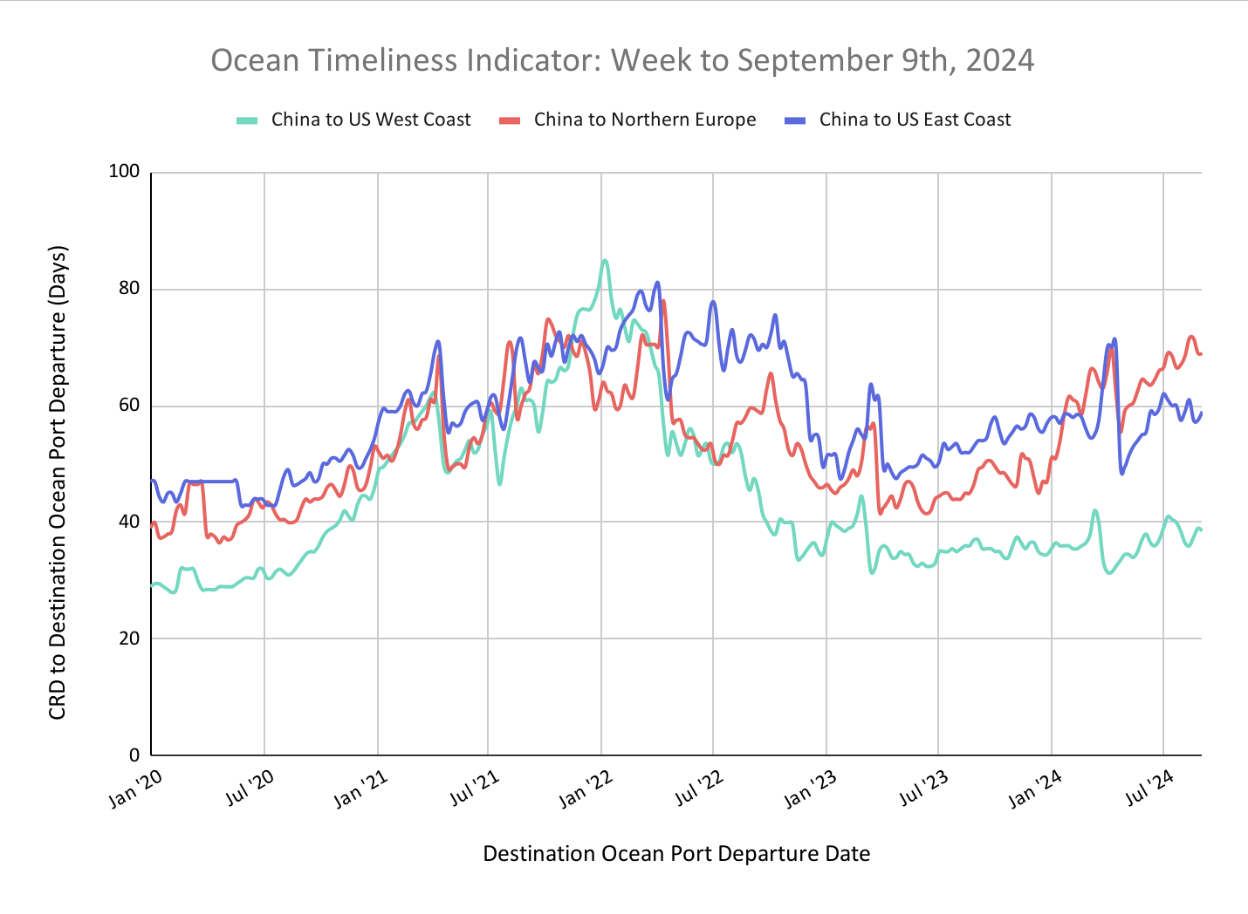

Flexport Ocean Timeliness Indicator

The Ocean Timeliness Indicator has plateaued for China to the U.S. West Coast and China to Europe, and increased for China to the U.S. East Coast.

Week to September 9, 2024

This week, the Ocean Timeliness Indicator (OTI) for China to the U.S. West Coast and China to North Europe has plateaued at 38.5 and 69 days, respectively. Meanwhile, China to the U.S. East Coast has risen from 57.5 to 59 days.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

Source from Flexport.com