Trends to Watch

[Ocean – TPEB]

- The shipping year began on May 1 with a strong General Rate Increase. This increase in the spot shipping rates was due to strong U.S. import demand and the renewal of long-term fixed contracts, resulting in vessels sailing at or near capacity.

- The Panama Canal Authority announced another increase in daily transits. Shipping lines, however, remain cautious about re-deploying capacity through the canal as demand for ships on westbound (via Cape of Good Hope) transits remain high and vessel weight restrictions remain in place.

- We are keeping an eye on the Canadian railroad contract negotiations. The railway union has announced a possible strike beginning on May 22. A strike would impact all rail services within Canada on both Canadian National and CPKCS railways.

[Ocean – FEWB]

- The Red Sea situation continues to be chaotic with vessels rerouting via the Cape of Good Hope, impacting on-time performance and schedule reliability. Vessels on the water are still at risk of drone attacks. Vessels routed via the Mediterranean Sea might be impacted. We’re closely working with liners for any further deployment updates.

- Bookings remain strong after the Chinese Labor Holiday. Another round of GRI (General Rate Increase) for the second half of May is scheduled for $1000 per 40-foot container. Shippers are pushing cargo for earlier departure to avoid further freight cost increases. For now, vessels are projected full through Week 21 (the last week of May). Week 22 is also filling up. It is highly recommended to place bookings four weeks in advance if possible.

- More equipment shortages were reported by CMA/Evergreen/Hapag Lloyd/Yangming/HMM. Foreseeing the situation will be tough through May until empty containers are fully recovered. It is highly recommended to pick up containers right after the container yard opens, or as soon as EIR (Equipment Interchange Receipt) is available to print per carrier local practice. Don’t wait till the last minute!

[Ocean – FCL U.S. Exports]

- Capacity is available for base-port to base-port moves to Asia, North Europe and Mediterranean ports of discharge.

- Some inland rail locations are spotty on equipment related to global disruption of container flows. When booking to load at an inland rail point, shippers are encouraged to submit bookings 3-4 weeks in advance of CRD (cargo ready date).

[Air – Global] (Data Source: WorldACD)

- Air cargo tonnages from Central & South America (CSA) surged in the final week of April, primarily driven by the upcoming Mother’s Day in North America and other regions. This surge was notably fueled by flower growers, retailers, and logistics providers shipping in flowers ahead of the celebrations.

- According to the latest weekly figures from WorldACD Market Data, total worldwide tonnages rose by a further 5% in week 17 (22-28 April), following a 4% increase in week 16. This growth trend helped offset previous declines experienced in the preceding weeks due to various holiday periods like Easter and Eid.

- Average worldwide air cargo rates slightly dropped by 1% to US$2.47 per kilo in week 17, dipping fractionally below the level observed in the equivalent week last year (US$2.52). However, rates still remain notably higher compared to pre-COVID levels, showing a 37% increase compared to April 2019.

- Analysis by WorldACD indicates that outbound tonnages from CSA to North America rose by 48% on a 2-week comparison basis, primarily driven by the demand for flowers ahead of Mother’s Day. This surge in export traffic from CSA accounted for around 30% of the worldwide growth recorded in week 17.

- Pricing patterns also saw significant shifts, with rates from CSA to North America experiencing a 12% rise, contributing to a 6% overall increase in total air export rates from CSA. Additionally, Asia Pacific outbound rates increased by 7% year-on-year, while rates from MESA to Europe soared by 42%, attributed to strong demand and supply disruptions in container shipping.

- Certain Asia-Europe sea-air hubs, notably Dubai, have been experiencing exceptionally high air cargo demand to Europe since the beginning of the year, largely due to disruptions in Asia-Europe container shipping. Despite slight fluctuations due to holiday periods and other disruptions, demand for air cargo from these hubs remains robust, indicating ongoing challenges in sea freight reliability.

Please reach out to your account representative for details on any impacts to your shipments.

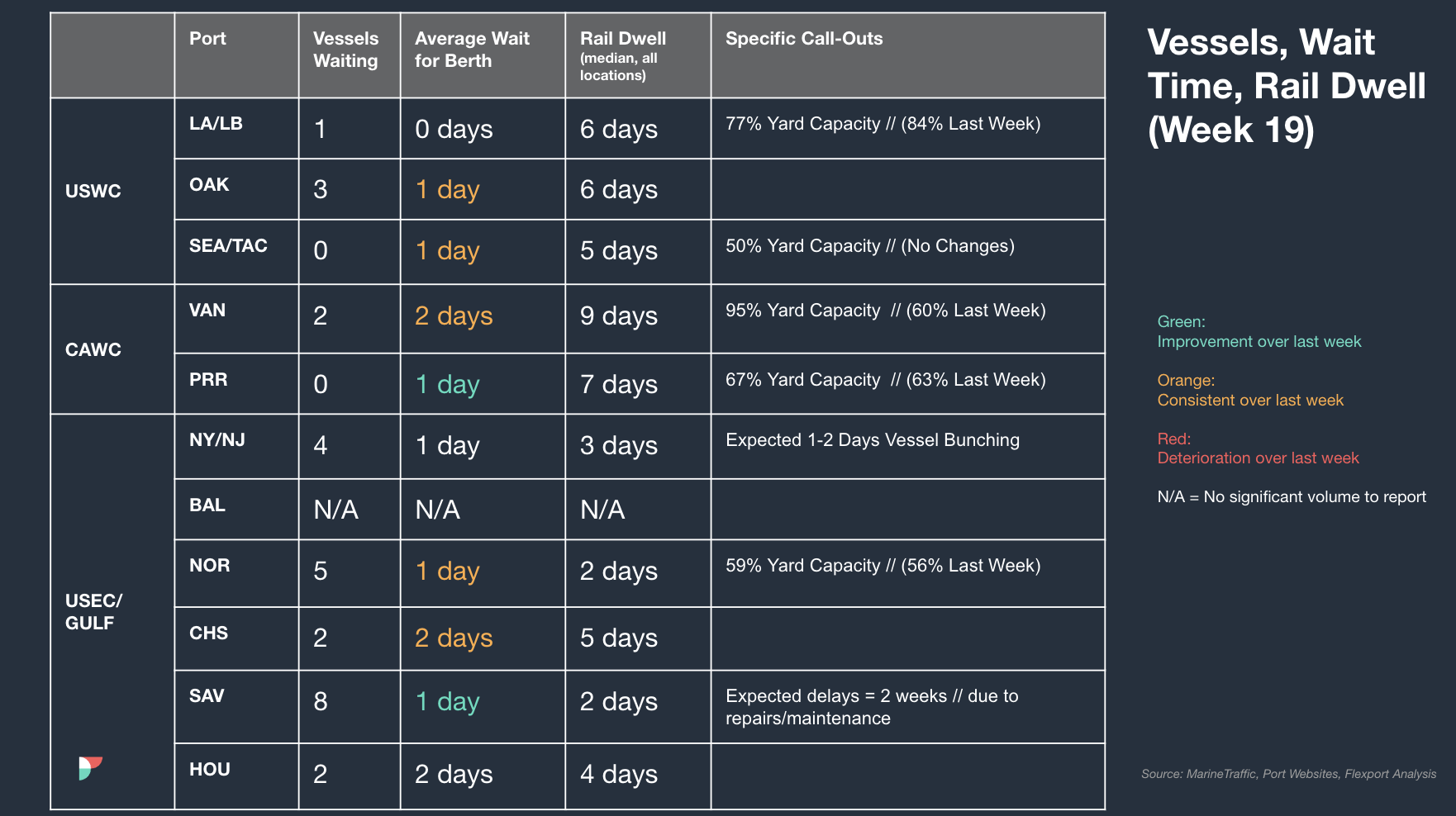

North America Vessel Dwell Times

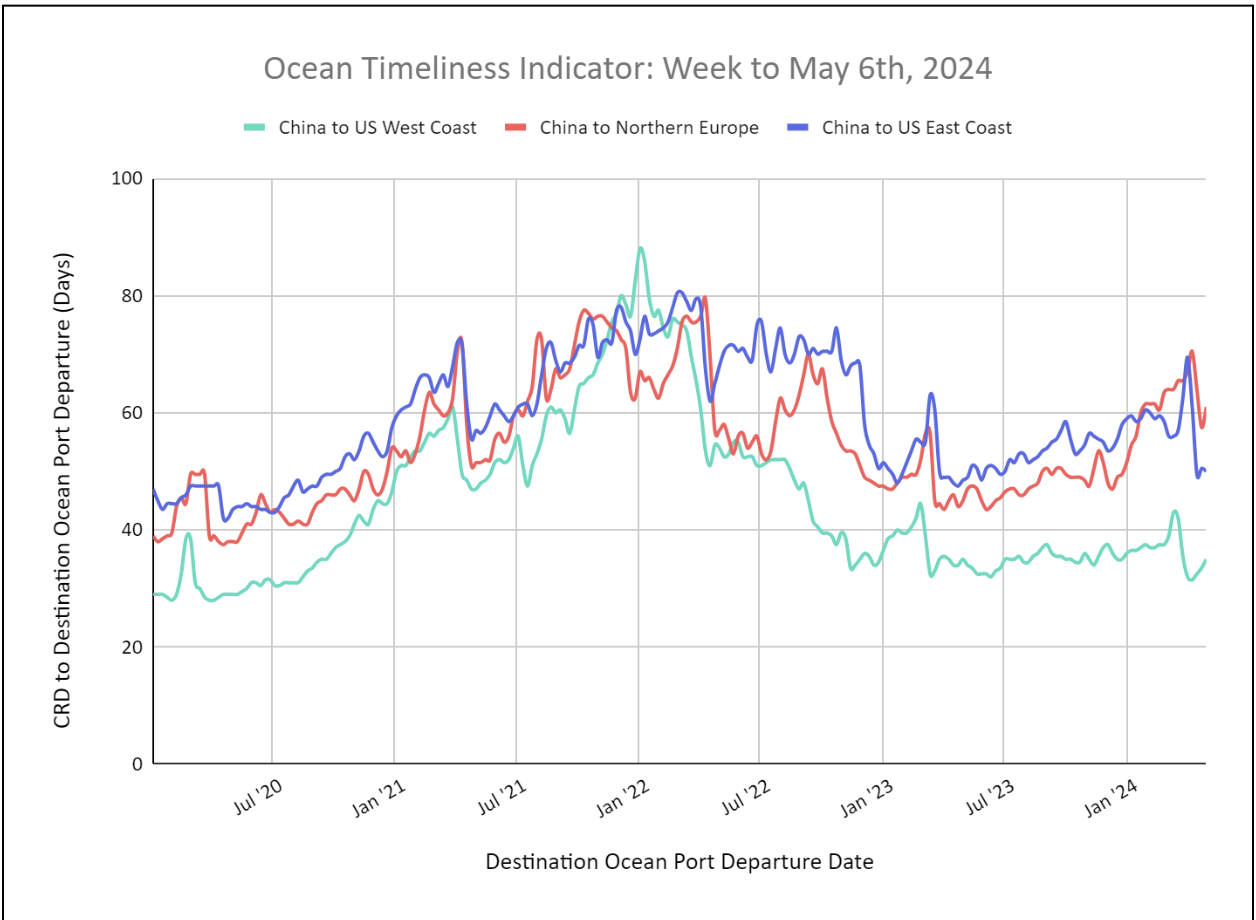

Flexport Ocean Timeliness Indicator

Ocean Timeliness Indicators Decrease for China to Europe but increase for China to U.S. West and East Coasts

Week to May 9, 2024

This week, the OTI for China to Northern Europe increased to 61 days, due to routing around the Cape of Good Hope and the OTI for China to the U.S. West Coast increased to 35 days. The OTI for China to the U.S. East Coast remained stagnant at 51 days.