Trends to Watch

[Canada Railroad Strikes]

- Nearly 10,000 Canadian rail workers represented by the Teamsters Union may strike early next week, pending a ruling by the Canada Industrial Relations Board (CIRB) on Friday, August 9.

- The dispute involved the Canadian National Railway Company (CN) and Canadian Pacific Kansas City Limited (CPKC), over issues related to working conditions, wages, and fatigue management.

- Canadian railways transported half of the country’s exports in 2022, totaling more than $276 billion dollars’ worth of goods, according to the Railway Association of Canada.

- A strike or lockout could greatly affect both imports and exports in Canada. Importers and exporters looking to get cargo moving will need to resort to other modes of transport to move their goods. The CIRB will determine what essential services, if any, will be required to move if a stoppage of work goes into effect.

- Significant impacts could be felt across many industries, including the agriculture sector, an industry that relies heavily on rail to transport goods.

- Moving goods within the country would be primarily supported by transloading, and trucking goods to final destinations. These solutions would be costly and time-consuming, however, and are not a long-term strategy for most importers. Both CN and CPKC are firmly committed to reaching a negotiated agreement that prevents any work stoppage.

[Ocean – TPEB]

- Volumes remain strong, exceeding last year’s numbers on the Transpacific route. We’re seeing structurally blank sailings due to Cape of Good Hope (COGH) routings and port congestion in Asia and North America. Due to weather conditions around the COGH, please expect further delays and capacity challenges en route to the U.S. East Coast (EC).

- Since extra loader (XL) space was injected into the Transpacific trade lane, we’ve seen less space pressure on the U.S. West Coast (WC), specifically the Pacific Southwest (PSW), from China’s main ports.

- A positive note: water levels at the Gatun Lake in Panama have recovered, and local authorities have softened the Panama Canal’s weight restrictions.

- Floating rates: Shipping lines have continued to decrease spot rates to the EC, WC, and the Gulf Coast to match supply and demand. A General Rate Increase (GRI) has been announced for the second half of August.

- Fixed rates: Peak Season Surcharge (PSS) discussions are very intense at the moment, as the gap between FAK and NAC rates do not support mitigations, specifically in light of a potential GRI in August.

[Ocean – FEWB]

- THE Alliance announced three more void plans for September due to vessel delays, continuously impacting available capacity in the market.

- Demand for the last week of August and early September has slowed down a bit, compared to the June and July market. Floating rates remain on the higher side, and with blank sailings in place, the outlook for space remains tight.

- Long-term named account business remains restricted by carriers for space and equipment priority.

- Equipment shortages have ceased a bit since May and June. For some port of loadings (POLs) with less direct calling, we still foresee potential equipment shortages for certain container types, such as 20’GPs.

- For urgent cargo with a target delivery date, we recommend selecting premium options as soon as possible for an earlier estimated time of departure (ETD) and space with higher equipment priority.

[Ocean – TAWB]

- The congestion in the Mediterranean and North Europe, along with schedule reliability issues and blank sailings, remains the same, leading to increased rates for September 1st.

- Equipment deficits in certain areas of South/East Germany and the Hinterlands remain an issue. At German ports, there are no further strikes expected so far.

- Of primary concern is the potential strike in the U.S.

- To ensure the smoothest loading experience, we recommend booking 1-2 weeks in advance for bookings ex North Europe, and 2-3 weeks in advance for bookings ex Mediterranean that are loading at a coastal port.

[Ocean – U.S. Exports]

- Capacity has tightened from the U.S. to the Indian subcontinent, Middle Eastern ports, and North European ports, related to vessel omissions and blank sailings. Service strings relying on feeder services to final ports of discharge (PODs) are losing capacity as the appropriate vessels are being shifted to headhaul trades and congestion continues to deteriorate the repeat serviceability of the feeder lanes.

- Continual changes to earliest return dates (ERDs) present ongoing challenges for U.S. exporters.

- To ensure the smoothest loading experience, we recommend booking 2 weeks in advance for bookings loading at a coastal port, and 3-4+ weeks in advance for bookings loading at an inland rail point.

[Air – Global] Air Freight Update Mon 22 July – Sun 28 July 2024 (Week 30)(Source: WorldACD)

- Worldwide tonnage stability and regional variations: Worldwide air cargo tonnages remained stable in the last week of July after a -2% decline the previous week, with an overall -5% decrease compared to the end of June. Tonnages from four of the six main world regions fell, with Central and South America seeing a -4% decline and the Asia-Pacific, North America, and Africa each experiencing a -1% drop. Meanwhile, Europe and MESA saw increases of +2% and +1%, respectively.

- Impact of Bangladesh disruptions: Between weeks 28 and 29, tonnages from Bangladesh to Europe fell by -29% due to political protests and internet blackouts. In week 30, they rebounded by +6%. Weeks 29 and 30 were both down by around -50% year-on-year (YoY).

- Year-on-year tonnage growth trends: Worldwide tonnages for week 30 exhibited a +6% YoY increase, which remains below the +12% average for the first half of 2024. Combined, weeks 29 and 30 demonstrated a +7% YoY increase, indicating a potential slowdown. Preliminary July estimates predict a YoY increase of +9% to +10%.

- Air cargo rates: Global rates fell slightly by -1% in week 30, but remained stable on a two-week basis (2Wo2W). Compared to last year, rates increased by +13% YoY, with significant rises from MESA (+55%) and the Asia-Pacific (+24%). Average worldwide rates are +45% higher than pre-COVID levels (July 2019).

- Significant regional rate increases: Spot rates from the Asia-Pacific to the U.S. decreased by -3% in week 30, but are still up +62% YoY. Rates from Singapore to the U.S. surpassed $9 per kilo—more than double last year’s levels. Rates from MESA to Europe have more than doubled YoY, with Bangladesh, Sri Lanka, India, and Dubai seeing some of the highest increases due to strong demand and limited capacity.

Please reach out to your account representative for details on any impacts to your shipments.

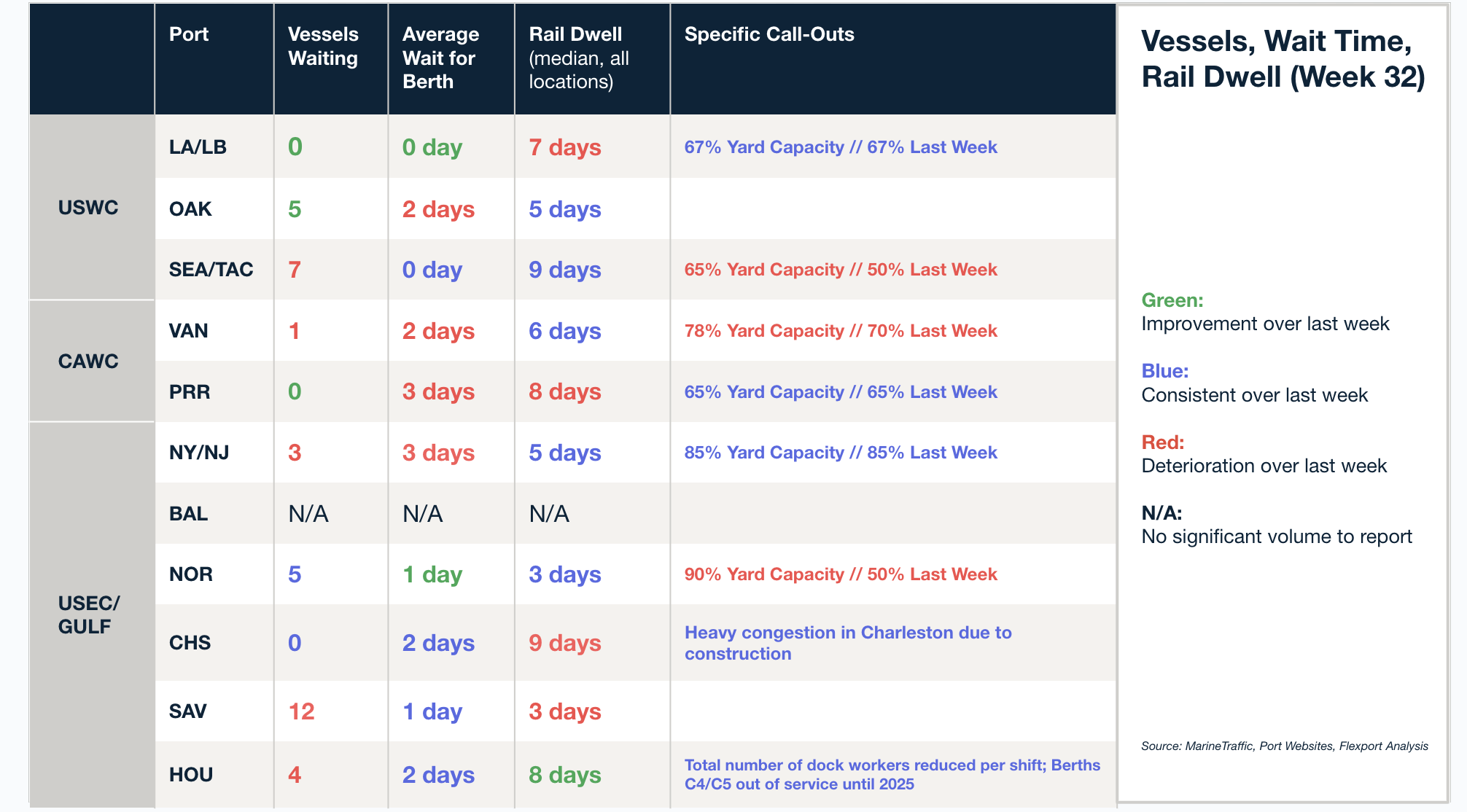

North America Vessel Dwell Times

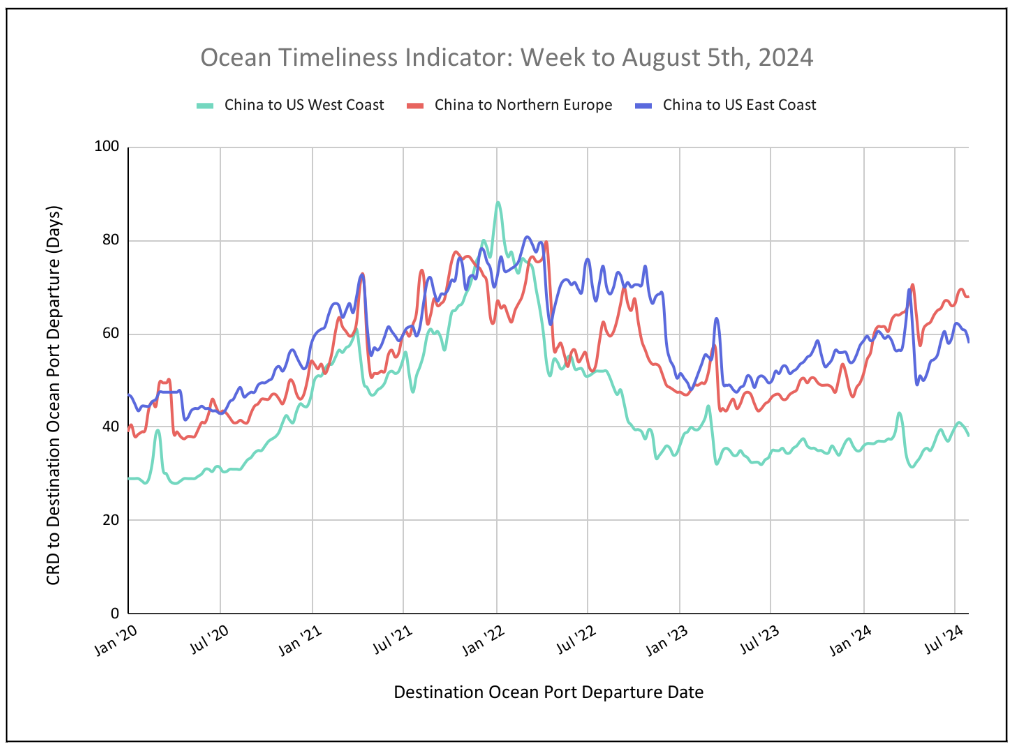

Flexport Ocean Timeliness Indicator

Ocean Timeliness Indicators maintain downward trends for China to the U.S. West Coast and China to the U.S. East Coast, and remain stable for China to Europe.

Week to August 5, 2024

This week, the Ocean Timeliness Indicator for China to the U.S. East Coast and China to the U.S. West Coast have accelerated their downward trends for the third week in a row, falling from 60.5 to 58 days and 39.5 to 38 days, respectively, due to extended COGH transit times and existing port congestion across Asia and the U.S. Meanwhile, the OTI for China to Northern Europe has remained stable for the past two weeks, at 68 days.

Source from Flexport.com