Trends to Watch

[Air – Global](Data Source: WorldACD)

- January’s worldwide air cargo demand showed a significant increase compared to last year. This rise in demand was seen across all main global regions except for ex-North America traffic.

- Due to disruptions in the Red Sea, some cargo owners are moving Asia-Europe cargo from sea to air or sea-air (e.g. air to ocean conversions). This shift, combined with the effects of the later Lunar New Year in 2024 (February 10) and typical mid-January seasonal trends, contribute to the increase in air cargo demand.

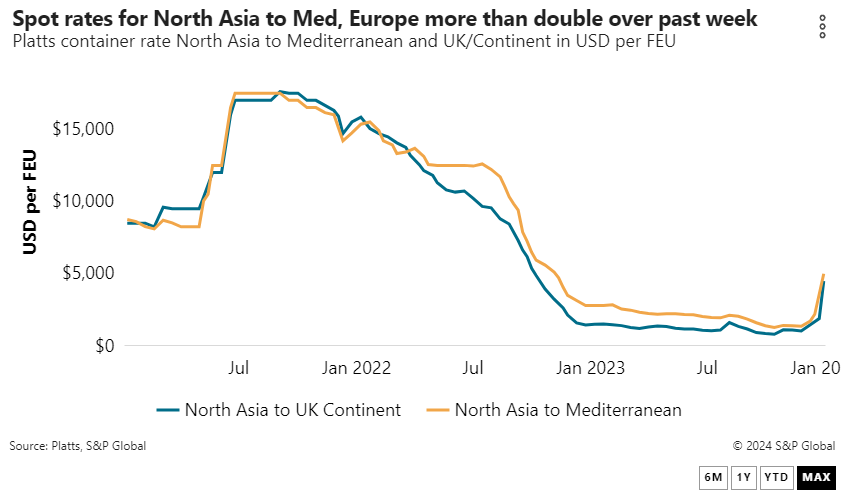

- Despite major disruptions in international container shipping and a tripling of ocean freight spot rates from Asia to Europe, global air cargo rates remain relatively stable. However, ex-Asia Pacific air cargo rates had already risen in late 2023 due to seasonal and product-related demand factors.

- Forwarders are preparing for challenges in the next few weeks, including port delays and cargo build-up in Europe, as the booking window for air freight is closing ahead of the Lunar New Year. This situation may lead to increased reliance on air cargo.

- Comparing weeks 2 and 3 of 2024 with the same period last year, there’s a 6% increase in overall global demand, with notable increases from the Middle East and South Asia, Africa, and Asia Pacific. Average worldwide rates are 22% lower than last year but remain above pre-COVID levels. Air cargo capacity has also seen a significant year-over-year increase.

[Indian Subcontinent to North America – Ocean]

- Ocean freight rates continue to increase into the first half of February as Red Sea disruptions show no sign of mitigation. Vessels that were delayed getting to their destination, and then back to origin, due to diversions around the Cape of Good Hope have created capacity shortages. This short-term disruption is expected to be more challenging, while we expect some normalization in the longer term.

- Container deficits are carrier-specific, but recently there has been an increase in equipment issues being reported across many major wet ports and inland container depots.

- There are several service updates to report, including MSC’s removals of INDUSA (India → USEC) service which is resulting in a capacity crunch on their remaining INDUS EXPRESS service. MSC has also removed the direct Karachi, Pakistan port call which had just been rolled out in late December. OOCL/COSCO removed AWES/ISE service (Mundra → BOS/NY/ORF) due to operational cost increases from Cape of Good Hope diversions. By removing this service there is no longer a direct connection from India to Boston.

[TAWB – Ocean]

- Demand remains stable with no peak expected to occur in February. Carriers are still managing capacity based on the latest Red Sea developments. We expect capacity to be down by an average of 15-20%.

- Rates are expected to increase in February as several Red Sea-related surcharges go into effect on February 1. Indexes are expected to show the same in the next couple of weeks.

- The equipment situation in Europe is tightening (mainly in Germany and various locations in Eastern Europe). This is a direct consequence of transit time increases caused by the Red Sea situation.

- On-time performance decreased from 72% in July 2023 to 50% in December 2023 (based on Sea Intelligence data). This is quite normal during winter months as it is mainly caused by weather-related issues.

[FEWB – Ocean]

- The Red Sea crisis continues to impact freight market development. Vessels traveling back to Asia continue to face delays. Moreover, carriers have started announcing a lack of equipment availability ports ex-South China and some outports in Asia. Shippers should remain flexible and accept container substitutions to avoid further delays. Demand remains flat for the second half of February as the Lunar New Year approaches. As a result, carriers are adjusting rates to cater to fresh cargo from the first half of February and to prepare for roll pool to fill vessels in the second half of February, despite massive void plans (weeks 8 and 9 are expected to see a 30% decrease on average). To mitigate the disruption of operational challenges (sailing schedule adjustments, vessel downsizes, equipment shortages, rollover, etc.), shippers should explore premium services offered by liners with higher costs. This approach will help guarantee space and equipment and shorten delays.

- In other news, although the German rail strikes ended on January 29, there’s now a protest by German farmers blocking access to key ports which is impacting road transportation and imports/exports.

- Following North Europe, MED floating rates remain on the higher side despite trending slightly lower from week 6 onwards to fill up ships before the Lunar New Year. Additionally, roll pool preparation is now expected to take place in the second half of February onwards due to weak demand and holidays in Asia.

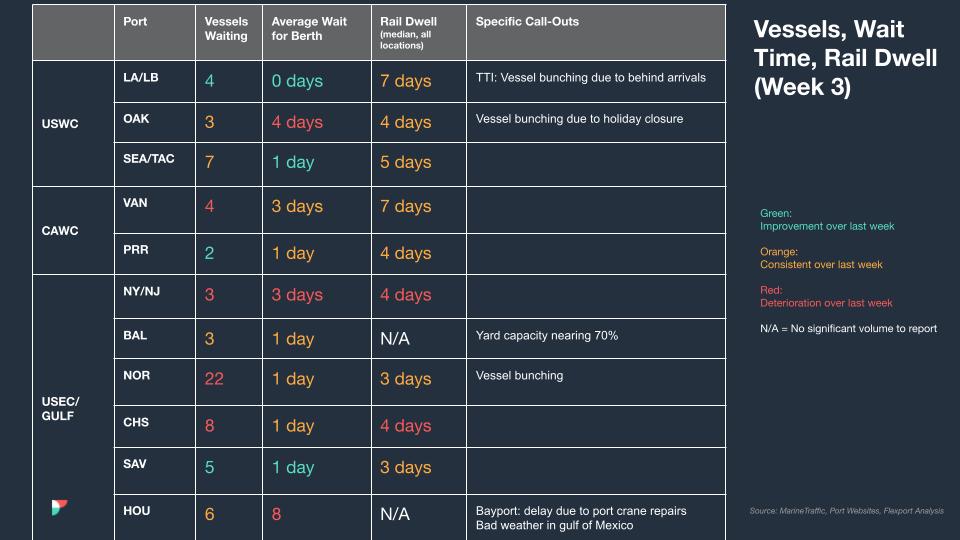

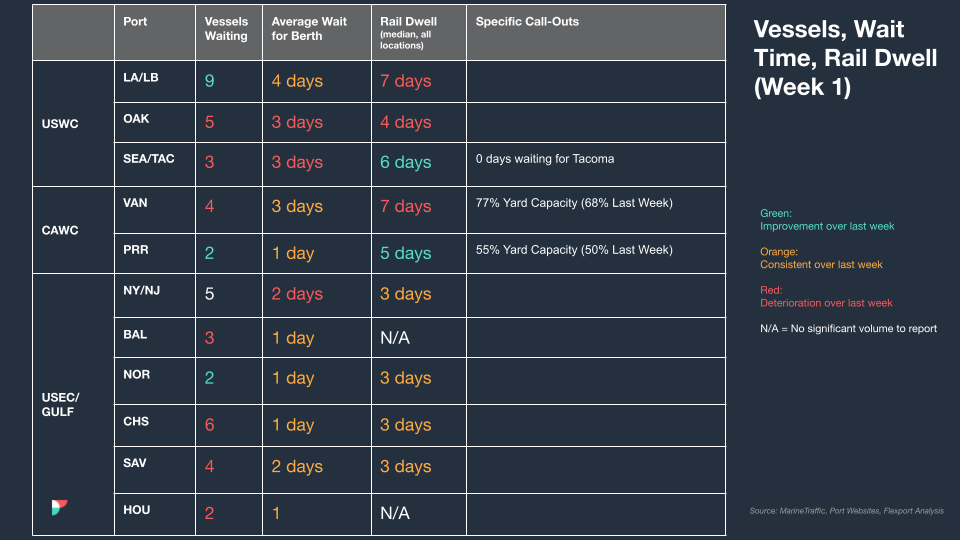

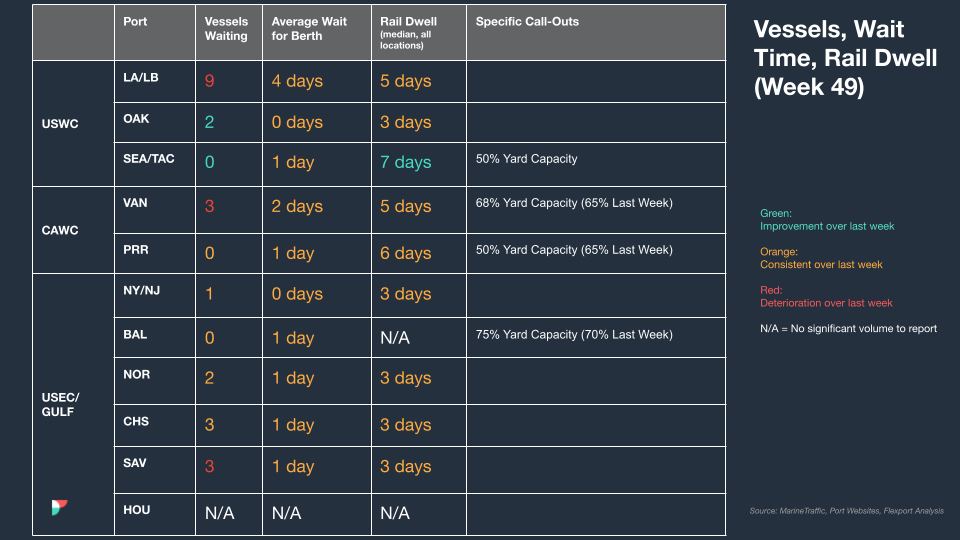

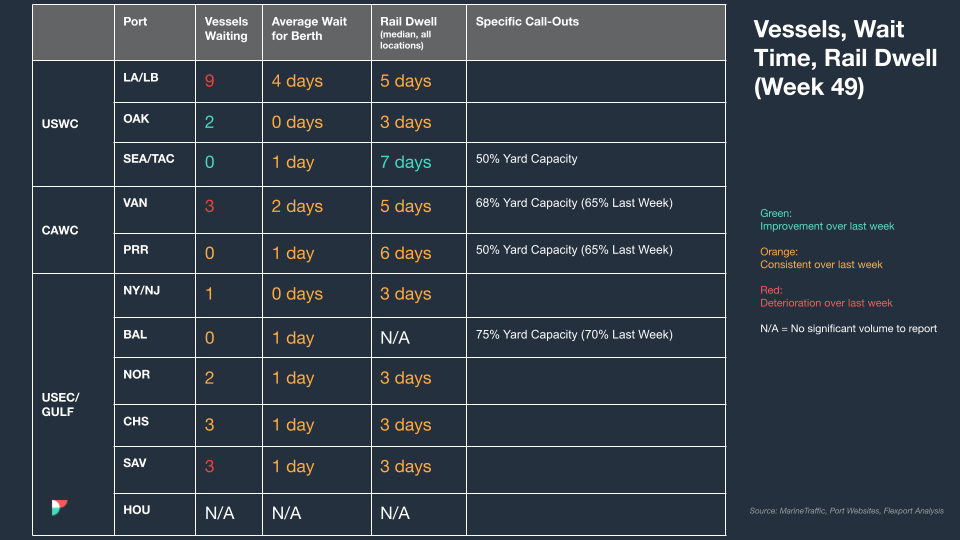

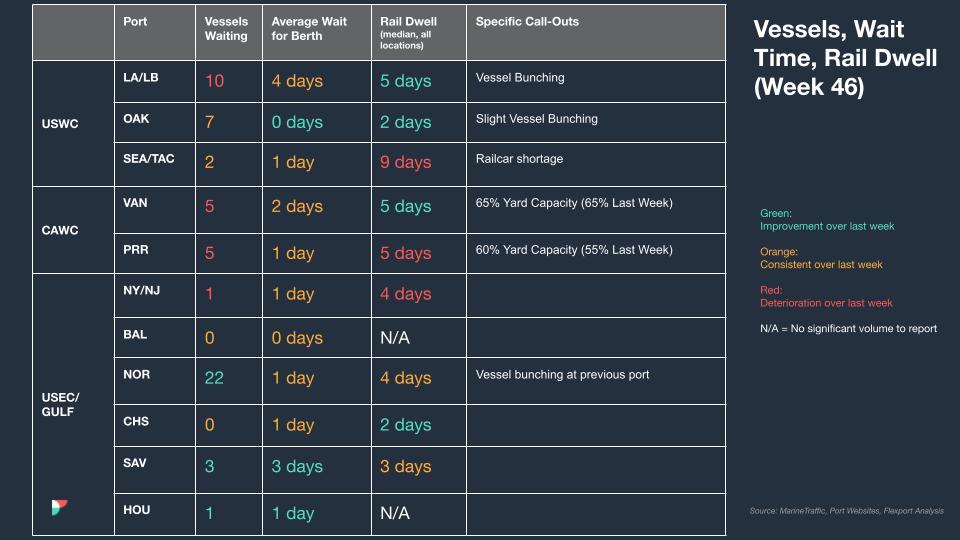

North America Vessel Dwell Times

This Week In News

Congested Ports Choking the Supply Chain

In January 2024, the ports of Los Angeles and Long Beach faced increased congestion, threatening the U.S. economy. The ITS Logistics U.S. Port/Rail Ramp Freight Index reveals a surge in trans-Pacific volumes due to restocking for the Lunar New Year, combined with rerouted shipments avoiding the Suez Canal crisis.

Not All Shipowners Able to Trade EUAs, Despite EU ETS Already in Effect

The implementation of the EU Emission Trading System (ETS) this month poses challenges for shipowners, with many not yet prepared for the new emission regulations. Shipowners under the EU ETS are required to pay for EU allowances (EUAs) corresponding to their ships’ carbon emissions at EU ports, underscoring the need for emissions data verification to ensure the accuracy of annual reporting.

FTR Shippers Conditions Index Hits Highest Level Since June

The Shippers Conditions Index (SCI), an indicator reflecting market influences on the transport environment for shippers, reached a solid reading of 6.3 for November, according to freight transportation consultancy FTR. The SCI, which considers readings above zero as favorable for shippers, showed the most favorable market conditions since June 2023, driven by a decrease in diesel prices.

Source from Flexport.com