US West Coast longshore labor is flexing its power to seek significantly higher wages and manning changes that would put two workers rather than one on some port equipment, sources said Monday, continuing a fourth day of disruptions at some marine terminals.

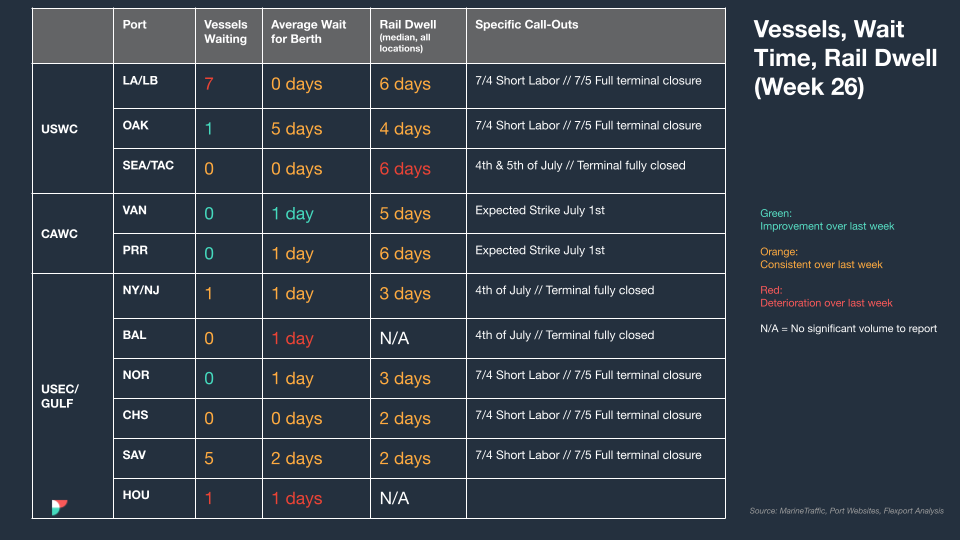

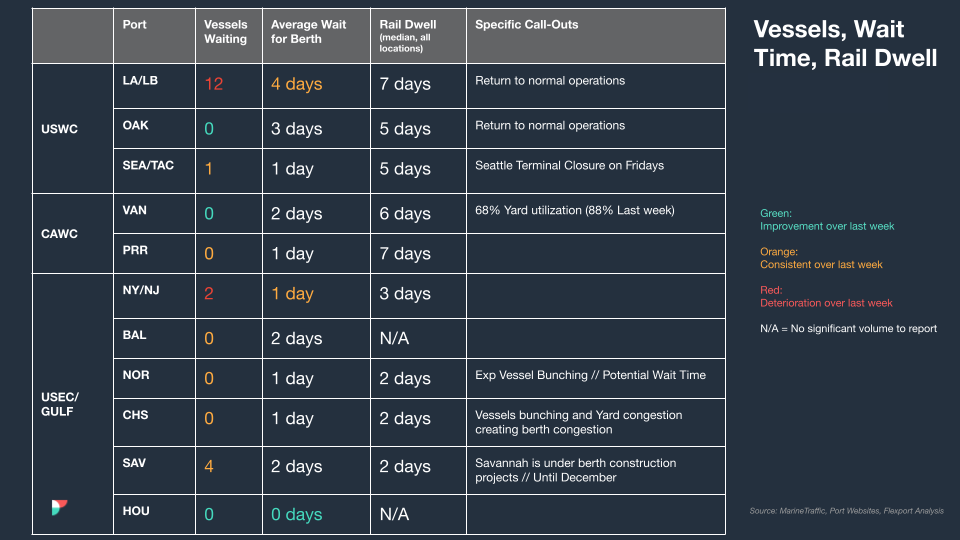

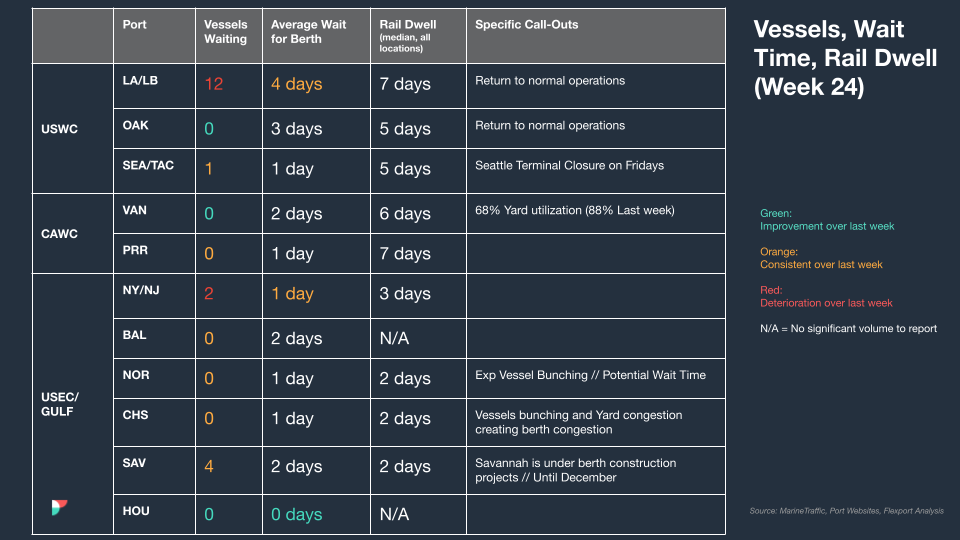

Several container terminals were hit with job actions in Seattle, Long Beach and Los Angeles on Monday, according to sources. While the severity of port disruptions on Monday was less than on Friday when dockworkers shut down a number of terminals along the coast from Long Beach to Seattle, the International Longshore and Warehouse Union (ILWU) and Pacific Maritime Association (PMA) are still far apart on salary and manning levels, according to four sources close to the negotiations.

One operator at a Los Angeles marine terminal said he didn’t receive any of the labor he requested from the ILWU hiring hall on Monday, adding, “We probably will idle the ship today.”

A spokesperson for SSA Marine said labor gangs working four vessels in Seattle were fired on Monday because of low productivity on the cranes. SSA, which operates three terminals in Long Beach, said two of the terminals there have not worked an international ship since Saturday.

The sporadic ILWU job actions that continued over the weekend have included slowing down ship-to-shore crane productivity from the normal 25 to 26 lifts per crane per hour to about 20 lifts per hour, or even lower.

The PMA slammed the ILWU in a statement Monday for continuing “concerted and disruptive work actions.”

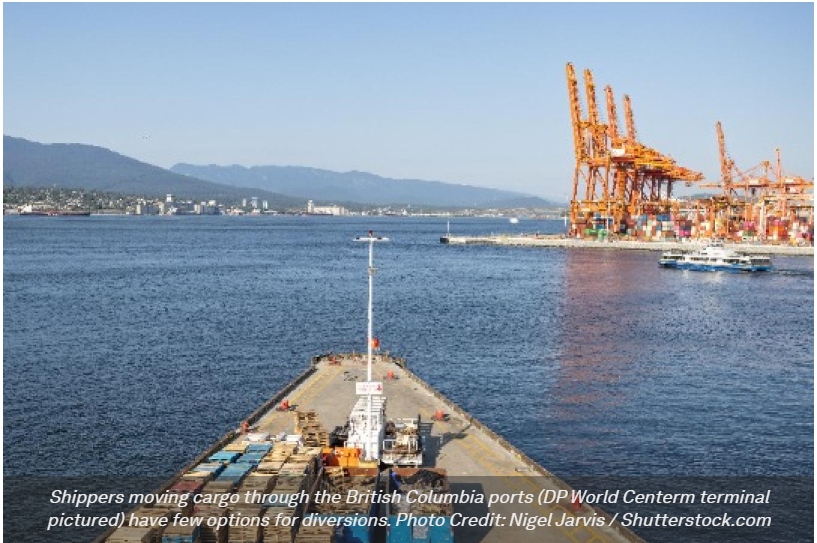

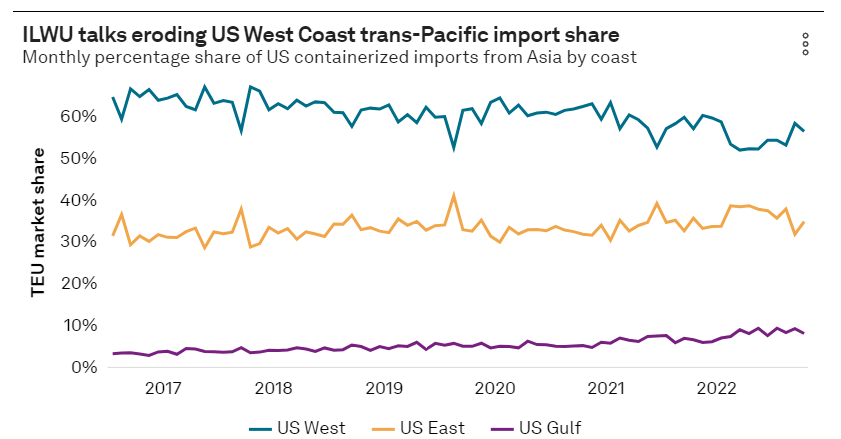

“Union leaders are implementing many familiar disruption tactics from their job action playbook, including refusing to dispatch workers to marine terminals, slowing operations, and making unfounded health and safety claims,” PMA said. “The ILWU’s coast-wide work actions since June 2 are forcing retailers, manufacturers and other shippers to shift cargo away from the West Coast in favor of ports on the Atlantic and Gulf coasts. Much of the diverted cargo may never return to the West Coast.”

The ILWU declined to comment. But the International Longshoremen’s Association (ILA) issued a statement saying it “stands in solidarity” with the ILWU, claiming the union has been “disparaged by the PMA through a calculated media campaign designed to boost its contractual leverage at the expense of West Coast dockworkers.”

Spokespersons at port authorities said most of their terminals that were affected Friday and over the weekend received full labor allocations for Monday’s day shift.

White House monitoring situation

During a briefing Monday, White House Press Secretary Karine Jean-Pierre said the Biden administration was monitoring contract negotiations closely and pointed to both sides tentatively agreeing on undisclosed “certain key issues.” The White House was “going to continue to encourage all parties to work in good faith toward a mutually beneficial resolution that ensures that workers get fair benefits, equality of life and the wages they deserve,” Jean-Pierre said.

The job actions taking place on the West Coast in recent days prompted the National Retail Federation (NRF) on Monday to send its third letter to the Biden administration urging federal intervention in the negotiations between the ILWU and the PMA, which represents shipping lines and terminal operators, since the coastwide contract negotiations began in May 2022.

“As we enter the peak shipping season for the holidays, these additional disruptions will force retailers and other important shipping partners to continue to shift cargo away from the West Coast ports until a new labor contract is established,” David French, the NRF’s senior vice president of government relations, said in a letter to the Biden administration. “It is imperative that the parties return to the negotiating table. We urge the administration to mediate to ensure the parties quickly finalize a new contract without additional disruptions.”

Union seeking significant salary hike

Negotiations are said to be hung up over an unprecedented demand by the ILWU for a wage increase of $7.50 per hour for each year of the proposed six-year contract, which would increase longshore wages by close to 100% over the life of the contract. Two sources close to the talks confirmed the union’s wage demand.

By comparison, wage increases over the past 20 years have been in the range of 50 cents to $1.50 per hour for each year of the contract, according to the PMA’s annual report.

The ILWU is looking to take advantage of the record profits carriers booked in 2021 and 2022 amid pandemic-induced disruption in the global supply chain that came amid historic import levels from Asia and massive consumer spending. But those profits have since diminished as the ocean shipping market returned to normalcy with consumers pulling back on spending their discretionary income on merchandise.

The ILWU is also reportedly demanding that certain cargo-handling equipment, such as yard tractors, be assigned to two dockworkers. That has long been a practice with ship-to-shore cranes, which require a higher level of skill. Under the ILWU’s demand, two drivers would be assigned to each yard tractor, which means one longshoreman would work for four hours and get paid for eight, and the second longshoreman would work the remaining four hours of the shift and get paid for eight.

Another significant issue in the negotiations involves retroactive pay, sources say. In each contract negotiation, there has been an unspoken agreement between the PMA and ILWU that whatever wage increase is agreed upon in the new contract, it would be retroactive back to the expiration of the previous contract, a source told the Journal of Commerce. That means the PMA and ILWU have been operating under the assumption that the wage increase being discussed for the new contract would be retroactive to July 1, 2022, when the prior deal expired.

But with negotiations now past the one-year mark, the PMA has reportedly told the ILWU that retroactive pay will be off the table as of July 1 if a tentative contract is not reached by then, according to the source. That PMA strategy is designed to provide a sense of urgency so the ILWU will reach an agreement soon rather than dragging the negotiations out further, the source said.

Terminal operators told the Journal of Commerce that if ILWU job actions stopped and cargo handling went smoothly Monday, coastwide negotiations between the union and PMA would resume on Tuesday. But it’s uncertain if that will happen now.