Trans-Pacific container lines are trying to push up sagging spot rates with an April 15 general rate increase (GRI), sparking a spike in cargo shipments as US importers seek to avoid higher rates and nudging them to wrap up annual service contracts.

How successful carriers are in securing GRIs — ranging from $600 to $1,200 per FEU — comes down to the health of so-called green shoots of demand and the effectiveness of increased blanking of capacity. General rates increases are noteworthy, but a recent uptick in vessel utilizations has raised carrier hopes that they’ll be able to get some traction on this round due to a presumptive return of shipping patterns with carriers canceling nearly 50 sailings this month.

For a standard 40-foot container, Mediterranean Shipping Co., CMA CGM, and HMM have each filed notice of a $600 GRI effective April 15, according to customer notices. For the inland rail move, both MSC and CMA CGM are charging an additional $200 on top of the GRI. Smaller carriers Wan Hai Lines and ZIM Integrated Shipping have filed notice of a $1,000 and $1,200 GRI, respectively, also effective for the same date.

Utilization rates on the Asia to US West Coast routing have ticked up in recent weeks to over 85 percent, outpacing a similar spike seen ahead of the April 15 GRI two years ago, but tracking below the high 80s seen in the same period in 2022, according to maritime analyst Linerlytica.

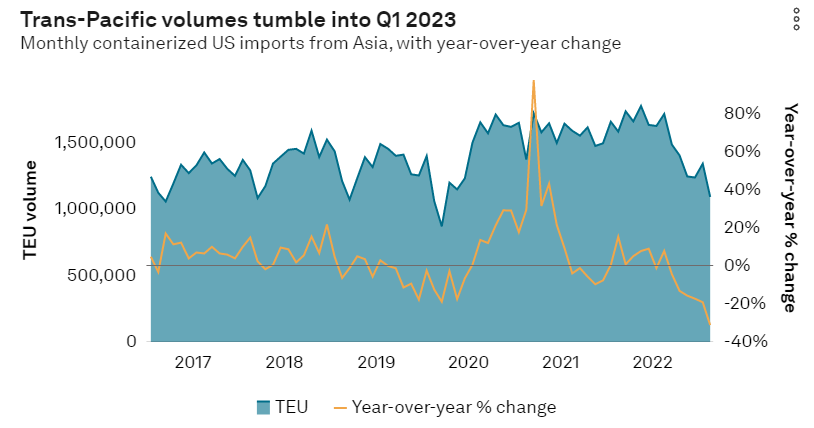

The utilization spike ahead of the April 15 GRI dropped in the following weeks of 2022 and 2021. The extent of the likely drop this year will provide a hint to how well carriers have been able to recalibrate oversupply to weakening Asia import demand, which was down 31.1 percent in February year on year, according to PIERS, a sister company of the Journal of Commerce within S&P Global. PIERS volume data for March imports will be published later this week.

US retailers are forecasting that US imports will be down compared to last year until at least August, according to the Friday release of Global Port Tracker, created by Hackett Associations on behalf of the National Retail Federation.

As service contracting power has shifted from the carrier to shippers, many importers have held off on signing trans-Pacific service contracts, hoping to leverage the sagging spot rate market and learn at which rate ranges the largest US big box retailers signed. Carriers and shippers traditionally try to complete service contracts by the end of April since the lifecycle for most deals begins May 1.

Shippers emboldened by lower spot rates

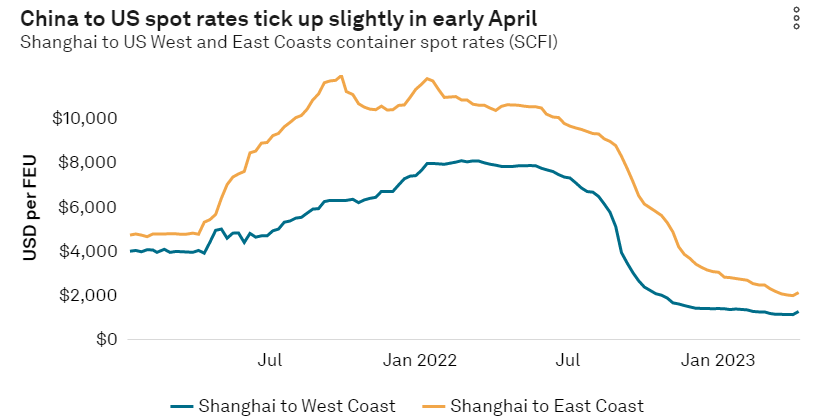

Robert Khachatryan, CEO and founder of forwarder Freight Right, said in late March while some of his company’s larger BCO clients — those with upwards of 5,000 TEU — received discounted rates of $1,600 to $1,700 to the West Coast, they were easily dismissed by shippers because the spot rate for most forwarders at the time was about $1,100 to $1,300.

Sagging rates, to some extent, have emboldened shippers to seek more competitive contract rates.

“Considering recent projections that spot market rates are nearing the bottom and should level out by the middle of this year, it is reasonable to expect that the contract rate for mid-size forwarders and mid- to large BCOs will eventually land about $1,500 to $1,600 and $2,500 to $2,700 for the West Coast and East Coast, respectively,” Khachatryan wrote in a Journal of Commerce commentary.

Marc Bibeau, chief executive of OEC Group, told the Journal of Commerce that relative to previous GRIs issued in April, which ranged from $300 to $500, the current ones are “aggressive,” but serve as an opening gambit to get shippers to contract at a rate somewhere between spot rates and the spot rate plus the GRI.

Given the sharp drop in West Coast imports, Bibeau said it was still unclear whether carriers will be able to get the full GRI when shippers tender their containers. But he said that he understands that carriers need to get rates back to a level where they can maintain reliable schedules and provide enough capacity to the market.

“The current market conditions are not conducive to any cost escalations,” Bibeau said. “But the carriers are now back in a loss-making position with the FAK (freight-all-kind) rate and need to get a breakeven rate where service won’t be compromised.”

Smaller shippers that are now in contract talks with ocean carriers focus more on spot rates because they can more easily switch their cargo between their long-term contract and a forwarder’s spot rate, James Caradonna, vice president at M + R Forwarding, told the Journal of Commerce.

“Increasing short-term rates helps carriers accelerate BCO (beneficial cargo owner) contract negotiations, especially for those BCOs unsure about the proposals in front of them,” Caradonna said.

Cargo rolling occurring

Eastbound trans-Pacific spot rates have been in a slight descent or flatlining, according to an analysis of rates from Drewry, Platts, Xeneta, and the Shanghai Shipping Exchange. As of April 7, the Shanghai to US West Coast rate sat at $1,292 per FEU, according to the Shanghai Shipping Exchange, up from the 2023 low of $1,148 per FEU on March 31.

According to Caradonna’s estimates, about 70,000 TEU of ocean capacity, accounting for 25 percent of capacity to the US Pacific Southwest ports, has been blanked weekly since the end of January. To the Pacific Northwest ports, ocean carriers have cut about 30,000 TEU of sailings over the same time, amounting to 30 percent of capacity from Asia. The volume drop has resulted in Pacific Northwest marine terminals cutting their operating hours.

“This is a big reason that carriers are rolling cargo to the West Coast,” Caradonna said. “The ships are full, but it is in large part due to blank sailings.”

Trans-Pacific services to the US East Coast have seen about 45,000 TEU per week cut, amounting to 20 percent of capacity.

Cargo rollover, when higher-paying spot cargo is loaded instead of lower-paying freight, is occurring at “varying degrees” at Shanghai, Ningbo, Yantian, and Xiamen, Caradonna said.

Source from Journal of Commerce