Trends to Watch

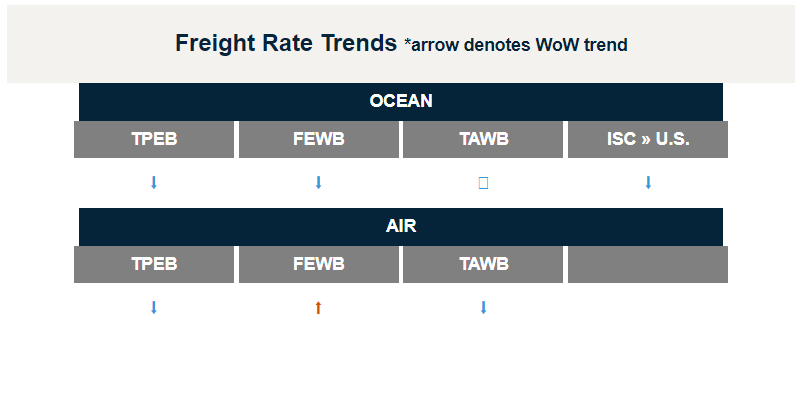

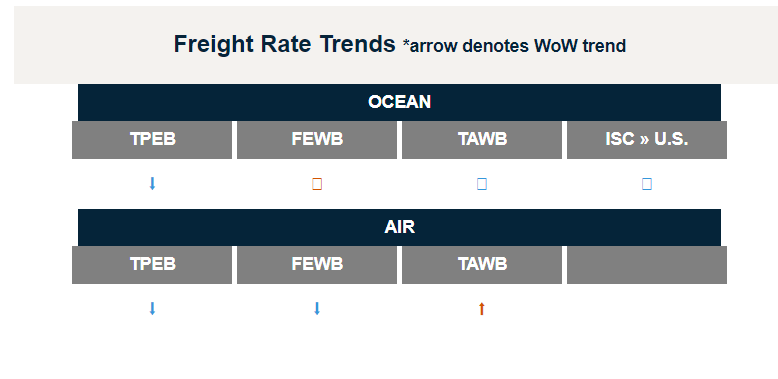

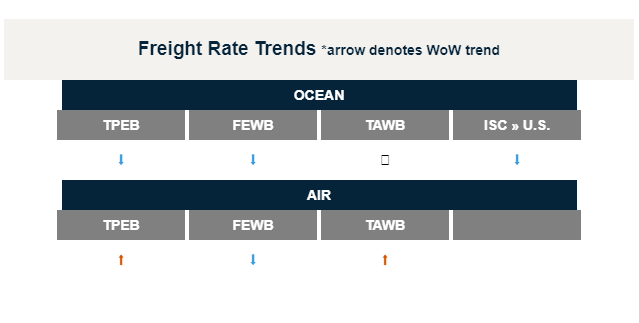

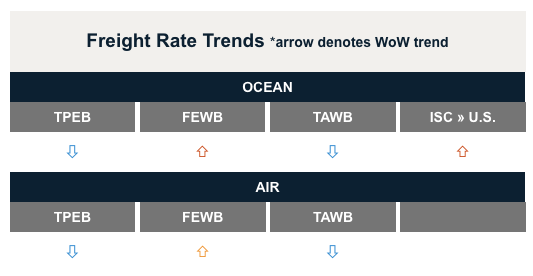

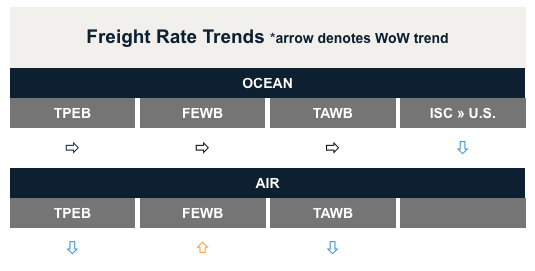

- [Ocean – TPEB] Capacity is at an oversupply as carriers announce more blank sailings. Space remains wide open and rates have dropped to pre-pandemic levels. Expect possible loading limitations on some East and Gulf Coast services surrounding Panama draft and weight restrictions due to drought conditions.

- [Ocean – India] Capacity is available across all carriers and services, with 40ft equipment easier to come by than 20ft. Wet ports are best positioned with a steady supply of imports making equipment available for exports.

- [Air – Asia] The market is stabilizing and rates remain higher than Q1, while demand has recovered through May and we are back to 2022 levels. Freighter capacity is being retired, specifically on TPEB as carriers lose money due to low sell rates and high fuel costs. This situation will continue if the rate and fuel situations do not improve.

- [Air – Europe] The TAWB market continues to soften in both directions while demand continues to decline. A large amount of capacity is being added for the summer schedule by U.S. and Europe-based airlines and rates, which bottomed out mid-May, now show some sign of stabilization.

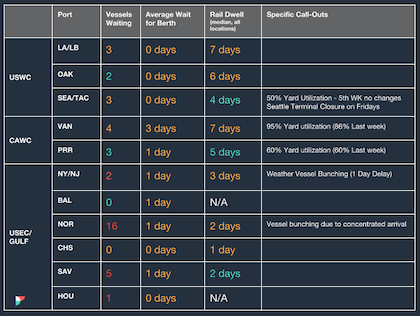

- [Trucking – U.S. Import/Export] Centerm (Vancouver) has implemented a $68 gate fee for day time pulls and $18 for night transactions as of 6/1. Fires in Alberta have delayed rail moves, causing yard utilization to exceed 95% in Vancouver. U.S. wet ports are largely fluid, with truck turn times under one hour at most ports.

North America Vessel Dwell Times

| This Week In News |

| As Back-to-School, Holiday Orders Begin, This Is What May Be the New ‘Normal’ in Peak Retail Trade Season

Back-to-school orders are trending up and many retailers have sold through their inventory gluts. What does this mean for peak season ‘23? Depends who you ask—some logistics managers foresee a peak season on par with 2018-2019 while others are saying not to expect a “normal” peak season until Q3 ‘24. Cargo Shifts Back to US West Coast Ports, but Some Has Gone for Good Stabilizing freight conditions, along with recent positive signs from the talks between ports and labor union leadership have led some shippers who shifted their cargo to U.S. East Coast ports to begin, cautiously, returning some of that volume to the West Coast. Throughput at the Port of Los Angeles/Long Beach was still down 5% year over year (45% of U.S. imports in Q1 2019 compared to 40% in Q1 of this year), per Descartes Datamyne. |

Source from Flexport.com