Trends To Watch

- [Ocean – TAWB] More and more carriers are reacting to the current market situation, calling rate levels ‘unsustainable;’ The expectation is for more blank sailings to hit the market in case demand doesn’t pick up soon. As per the latest Sea Intelligence article, the U.S. inventories are declining but mainly for wholesalers whilst retailers’ inventories are still high. Hopefully, this is a sign that the market will soon turn back with positive demand. In other news, USWC services are not being impacted by the current Panama Canal water situation but we will continue to monitor the status over the next few weeks weeks.

- [Ocean – FEWB] EUR trade: November GRI was initially announced at $1650-1800 but levels are expected to land closer to $1200. The overall EU trade market remains flat but capacity will be slightly impacted due to the vessel deployment change/suspension in SEA; expect rates to keep dropping. Additionally, three more blank sailings were announced by OA in the past week while THEA announced FE5 suspension from week 46 until further notice (but added Cai Mep calling on FE3 service); CMA announced taking out Cai Mep on FAL3 from week 48. Plus, the 2M winter program market capacity is expected to still be down by more than 20% through November; Expect more void plans from OA & 2M if vessel utilization remains flat; MED trade: Following NEUR, MED GRI started at the $2000 level and will most likely land at $1450-1500 for the first half of November; No further void plans were announced for MED trades but current utilization is good and MED rates are expected to drop back to the $1200-1300 level.

- [Air – Global] Global air cargo tonnages and rates have stabilized following China’s Golden Week, with week 42 indicating a +1% increase in both metrics, recovering from a -6% drop during the holiday. Despite this, no strong indications of a Q4 peak season are apparent. Regionally, there were tonnage decreases from Europe to various areas, contrasted by notable increases to and from the Asia Pacific. On a year-on-year basis, the global chargeable weight for weeks 41 and 42 was down by -1%, but overall capacity rose by +12% due to the resurgence of passenger air services. Presently, worldwide average rates are -28% from last year, though they’re up +33% from October 2019, sitting at an average of 2.38 US dollars per kilo.

- [Trucking – LATAM] Hurricane season is in full swing; Tropical Storm Pilar has led to heavy rainfall and flooding over portions of Central America, including El Salvador and Honduras. This has impacted trucking operations across the country but no port closures have been announced as of yet.

- [ISC – North America] Rate levels will remain consistent throughout November as demand and capacity begin to balance due to blank sailings. USEC capacity is constrained due to two blank sailings on the INDAMEX. USWC capacity is constrained due to higher-than-expected demand for TPEB services following Golden Week. General Rate Increase is expected to be implemented in December. Moreover, the ongoing government worker strike in Bangladesh due to road, rail, and sea blockage is expected to last until tomorrow, November 2.

Please reach out to your account representative for details on any impacts to your shipments.

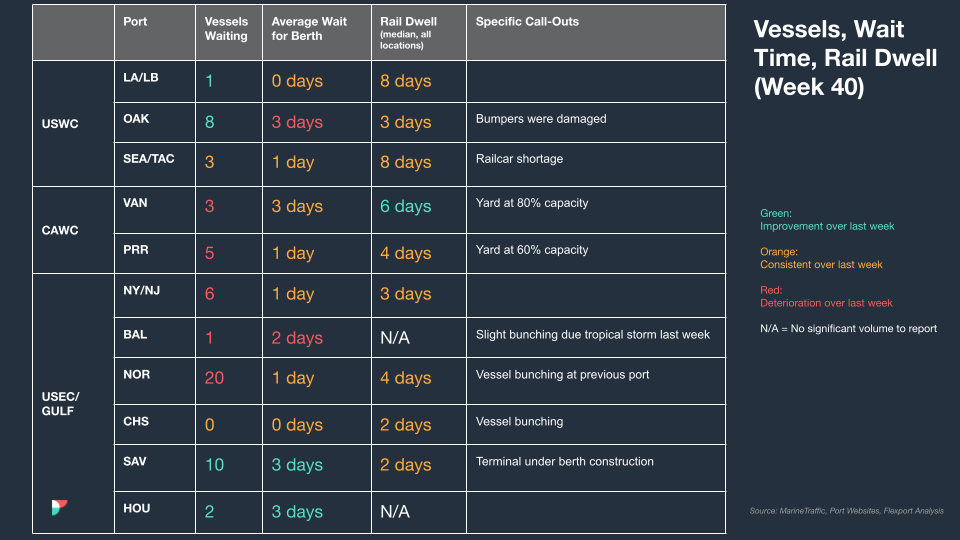

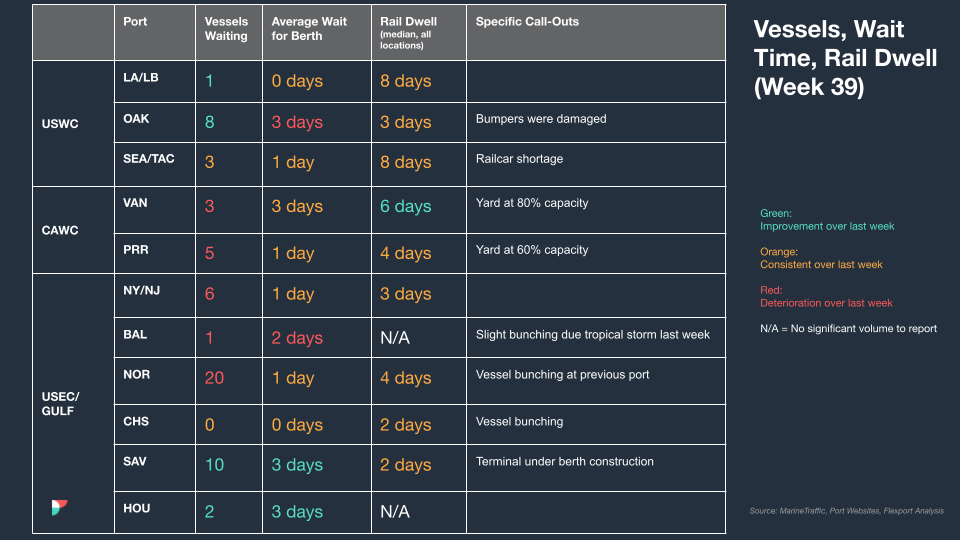

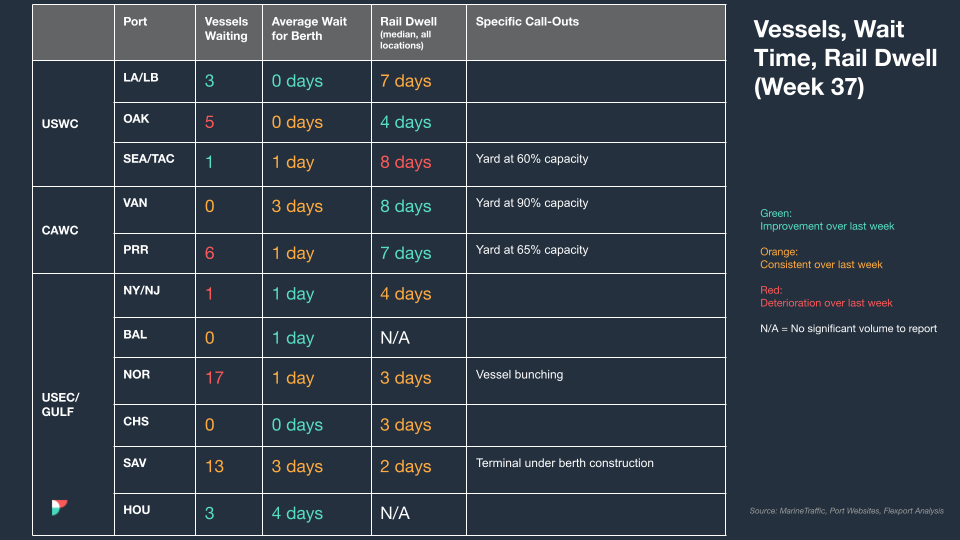

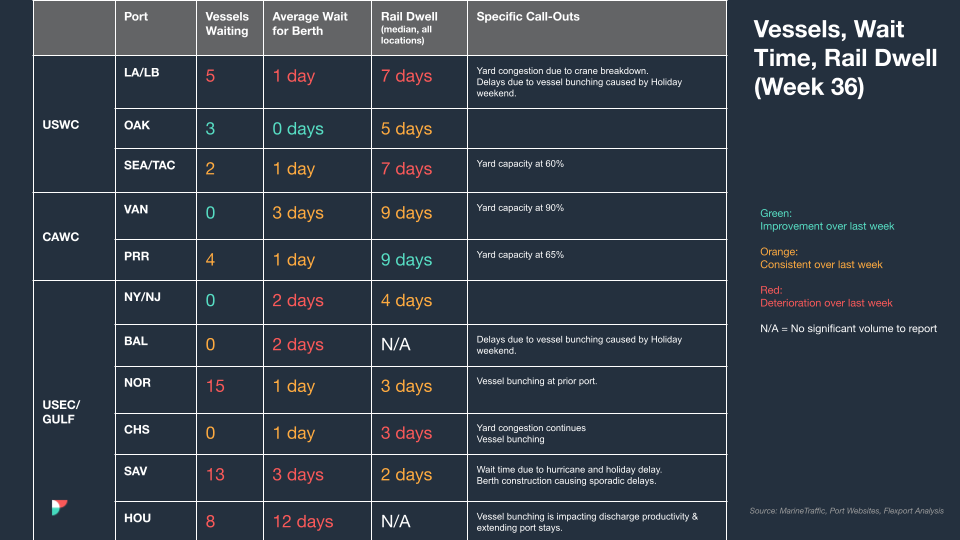

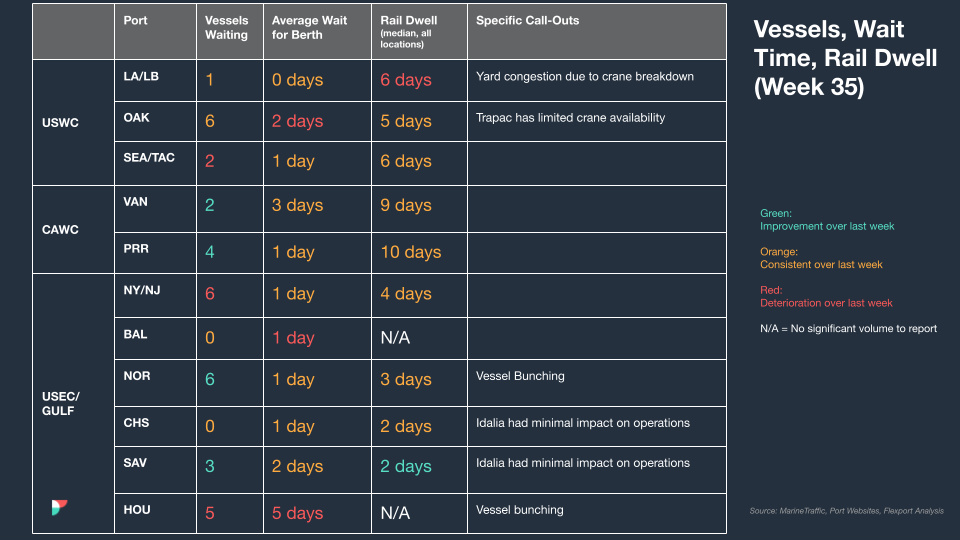

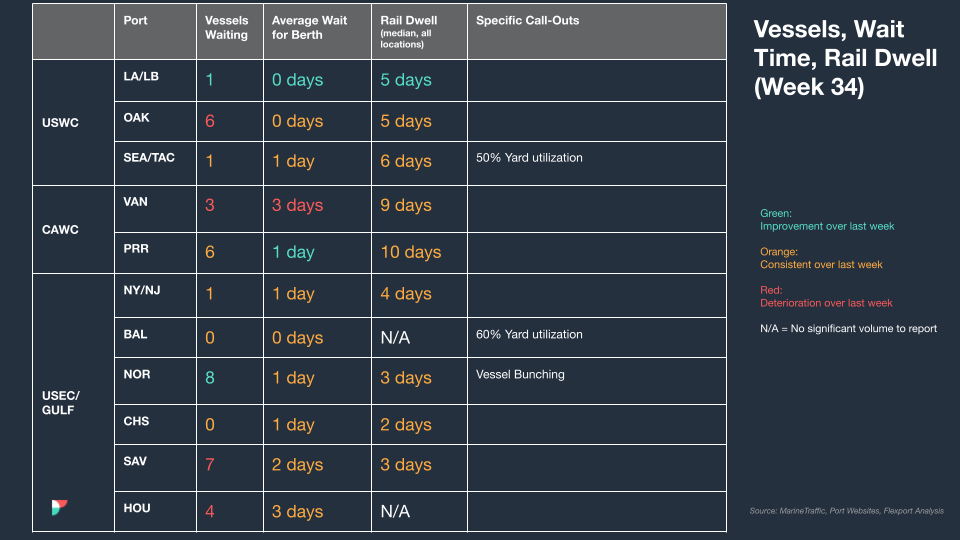

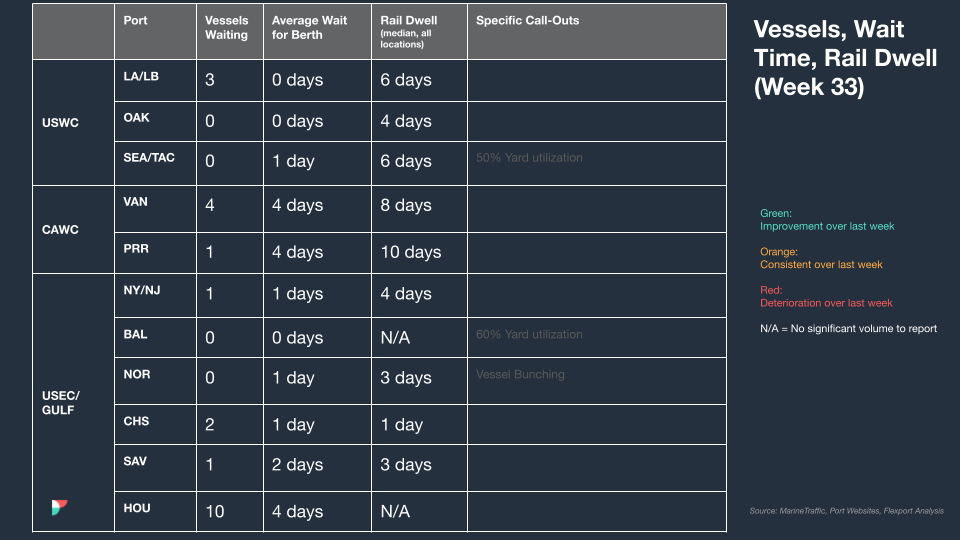

North America Vessel Dwell Times