Trends To Watch

- [Ocean – TPWB] Rates for December are expected to increase following a heavy blank sailing program implemented by ocean carriers in November. Space is tight on some key services to the US East Coast due to blank sailings, but differentiated services and carriers are available in the market to avoid delay. US West Coast services shared with the TPEB market are seeing a high utilization rate due to a demand increase from China and South East Asia.

- [FEWB] The market remains flat and capacity will be slightly impacted due to the vessel deployment change, and in some cases suspension, in South East Asia. We expect rates to drop slightly but liners are still planning for a General Rate Increase (GRI) in December (Quantum from $500-700 to $400-600 increment per different carriers per latest update; more to follow). Plus, one more blank sailing was announced by the Ocean Alliance in the past week while THE Alliance (THEA) announced FE5 suspension from week 46 until further notice but added Cai Mep Facilities and Far East – Europe 3 (FE3) service. In other news, CMA-CGM announced taking out Cai Mep on FAL3 from week 48 plus the Winter Program from 2M Alliance (Maersk + MSC). Market capacity will still be down by at least 20% through November, but vessel utilization has improved. If there are any further changes, carriers will announce more void plans to support the rate increment and so far no further capacity cut announced so assuming the GRI will not hold plus the holidays are approaching.

- [MED trade] Following North Europe, MED GRI started with a $700-800 increment and the same action will be applied for December. No further void plan has been announced for MED, but utilization is not as ideal as liners expected. Freight of All Kinds (FAK) rates may drop further in the second half of November, and we expect a cargo rush prior to the December GRI being implemented in the last week of November. Same as EUR trade, December GRI may not hold.

- [Air – TPEB and FEWB] A surge in holiday demand for consumer goods has led to a critical shortage of capacity for air freight routes from Hong Kong and Vietnam to the US and Europe. The situation has been exacerbated by a series of freighter cancellations in the past week, leading to a tightened market. As a result, spot market prices for air freight have increased dramatically, with a 30% rise in rates from Hong Kong to the US since the beginning of November. Additionally, a severe snowstorm in Anchorage, Alaska, in early November disrupted air traffic, causing delays and cancellations. This has prompted several Asian carriers to place embargoes on new bookings and cancel several flights. Compounding these difficulties, a volcanic eruption near the Kamchatka Peninsula has sent volcanic ash into the atmosphere, leading to further cancellations of eastbound and westbound flights.

Please reach out to your account representative for details on any impacts to your shipments.

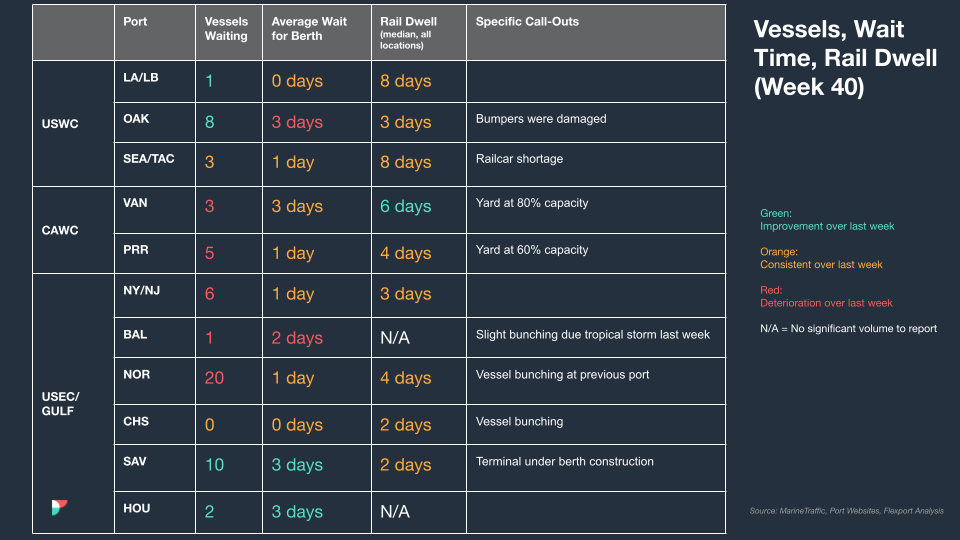

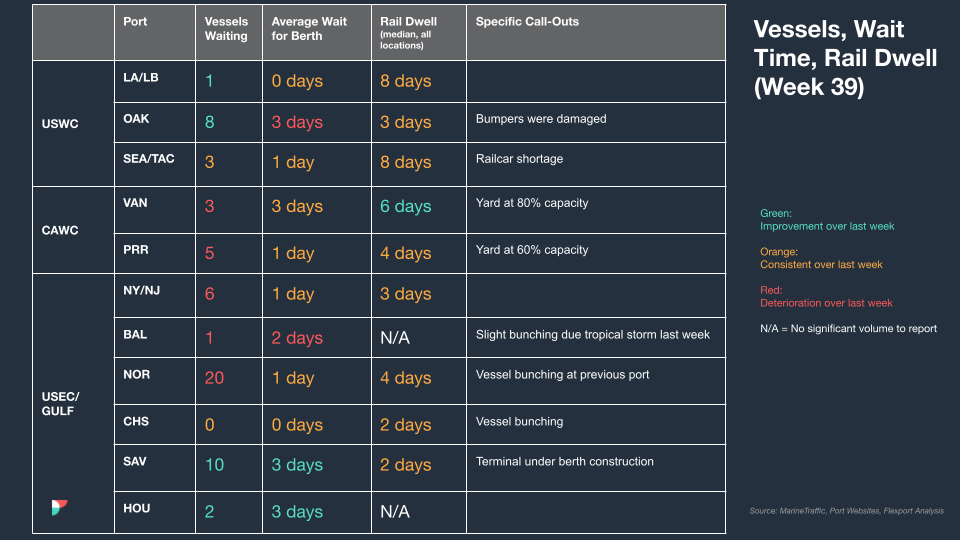

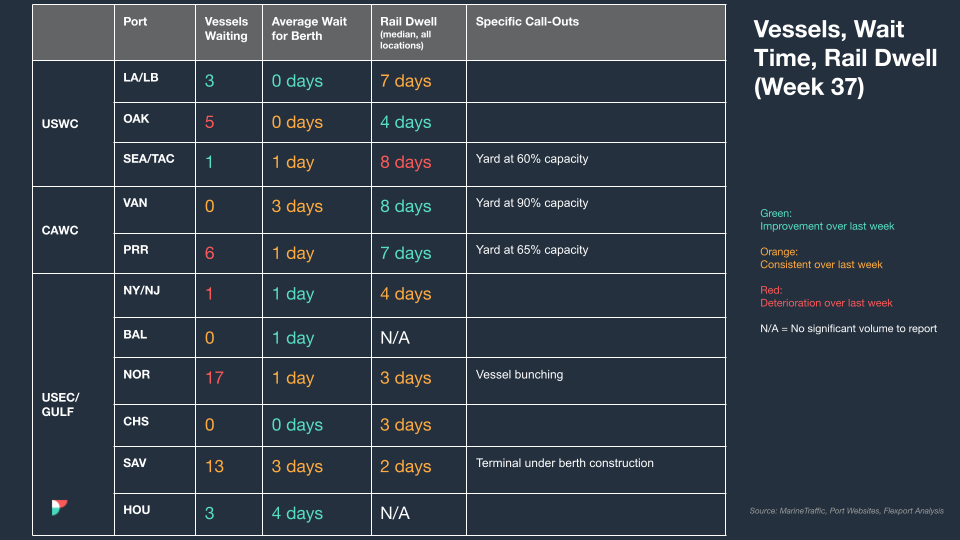

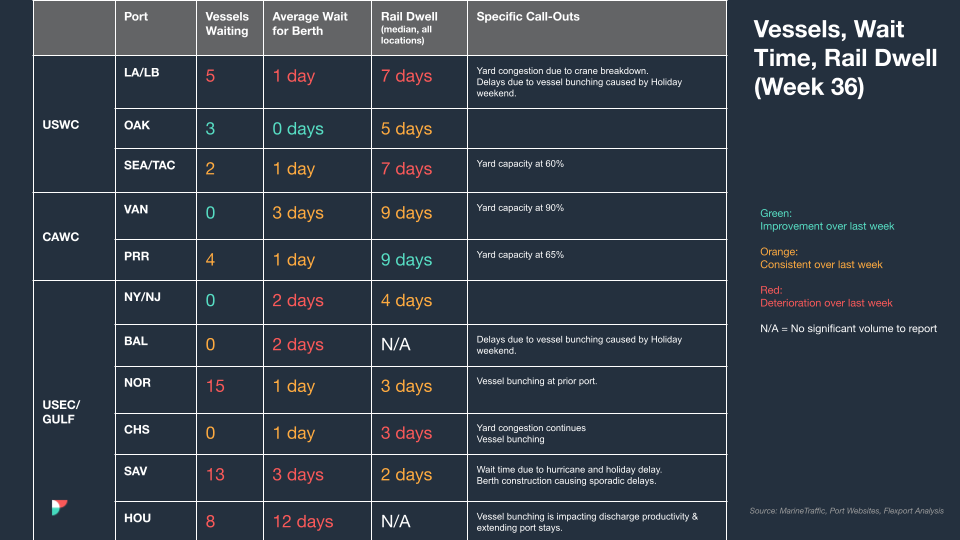

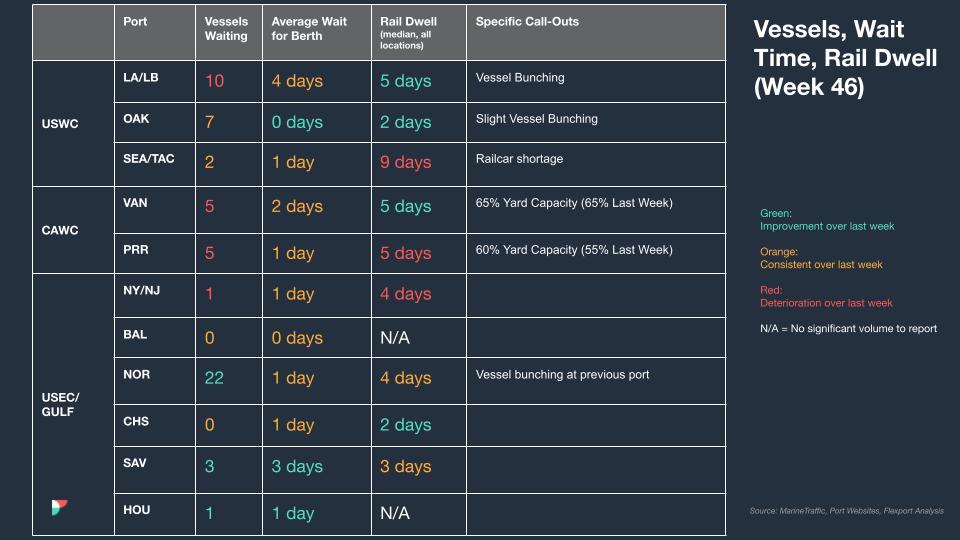

North America Vessel Dwell Times

The Week In News

Forwarders Losing Out On The Ecommerce Business Driving Airfreight Demand

The airfreight industry is experiencing a surge in demand, particularly in ecommerce, as rates from China to the US increased by 14% and to Europe by 11% last week. While global airfreight volumes have seen a 4% decline on average this year, Hong Kong Airport’s ground handler, HACTL, only saw a 1.3% drop, attributed to the rise in ecommerce-driven tonnage.

US Washout On Indo-Pacific Trade Deal Opens The Door To China

The Biden administration’s plan for the Indo-Pacific, aimed at countering China, is facing challenges as talks on enforceable trade rules slow down. President Biden and leaders of 13 other countries signed an agreement to cooperate on supply chain issues and made progress on environmental and governance issues. However, concerns arise among allies about the administration’s ability to secure a trade deal due to domestic opposition.

LMI Showing Transportation Market Flip Is Coming

According to the Logistics Managers’ Index (LMI), a domestic transportation market flip is coming, suggesting the equilibrium of supply and demand may be reached soon. The LMI, a diffusion index based on surveys of over 300 supply chain professionals, with values above 50 indicating expansion, showed a recent October price reading of 44.4 (indicating contracting prices, albeit at a slower pace compared with 28 in April) and a capacity value of 56.7 (significantly lower than 71 in May). The past five years have seen transportation markets oscillate between tight and loose conditions, largely attributed to COVID.

Crippling Port Strike Could Hit 1 Month Before Presidential Election

The International Longshoreman’s Association (ILA), which represents 45K East and Gulf Coast dockworkers, warned of the possibility of a coastwide strike in October 2024––just a month before the U.S. presidential election. The strike would coincide with the expiration of the union’s current six-year agreement as it seeks a new contract from the United States Marine Alliance (USMX) that includes prohibitions against terminal automation and tightened language ensuring all work at new terminals goes to ILA members.