Trends To Watch

- [U.S. Exports – Rail] Inland Rail Ramps are having less and less equipment available due to a lack of imports into the midwest. It’s recommended to book 2-3 weeks prior to the Cargo Ready Date (CRD) to ensure a smooth loading and booking experience.

- [ISC – Ocean] November rate levels have been extended through the end of December. Although capacity is constrained due to blank sailings to the U.S. East Coast and high utilization to the U.S. West Coast, market volume remains soft. The expectation is that these rate and volume levels will carry over into Q1 which is India’s traditional peak season. In other news, Q1 supply and demand functions will likely lead to increased rates. There are no major operational issues in the Indian Subcontinent, but we are monitoring the situation in the Middle East and how that may affect shipments moving through the Suez Canal. As of now, there is no impact on ISC cargo moving west via the Suez.

- [TPEB – Panama Canal] Continued drought conditions are causing more restrictions on vessel transits. There are 32 transits a day, down from a normal of 36, and the canal is planning to incrementally reduce that number week over week to a projected 18 per day by February 1. While container traffic has not been impacted to date, further reductions will begin to cause impacts. Carriers are assessing the possibility of adding vessels to their via Suez services or redirecting their via Panama services. Carriers are also enforcing weight restrictions of 8 tonnes on average for containers moving via the canal. Moving via Panama is still the fastest route to the U.S. East Coast. Alternative routings are via Suez services, or via the U.S. West Coast with rail.

Please reach out to your account representative for details on any impacts to your shipments.

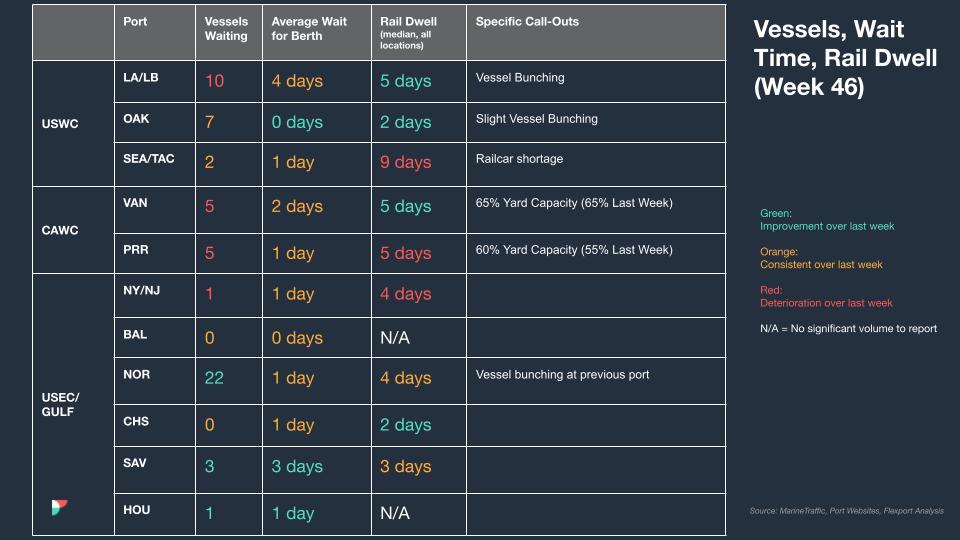

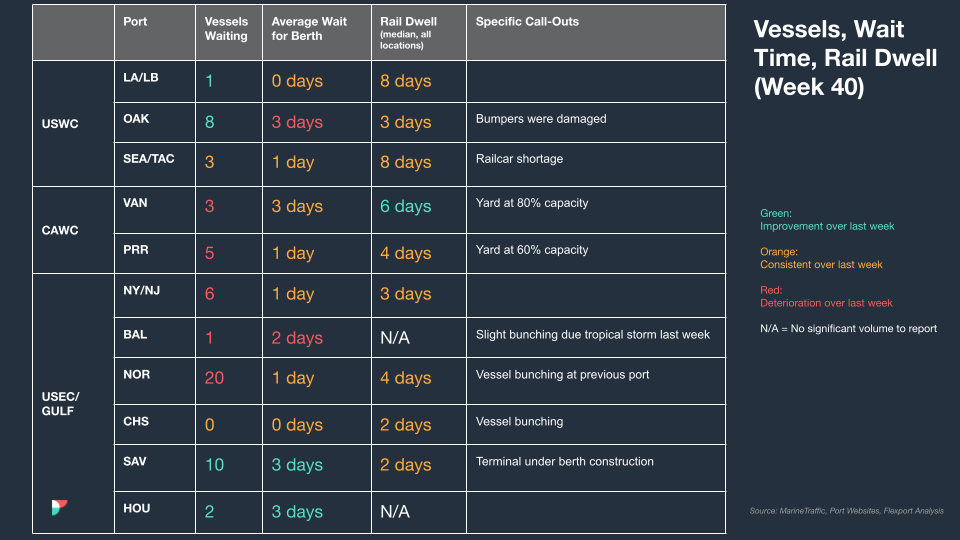

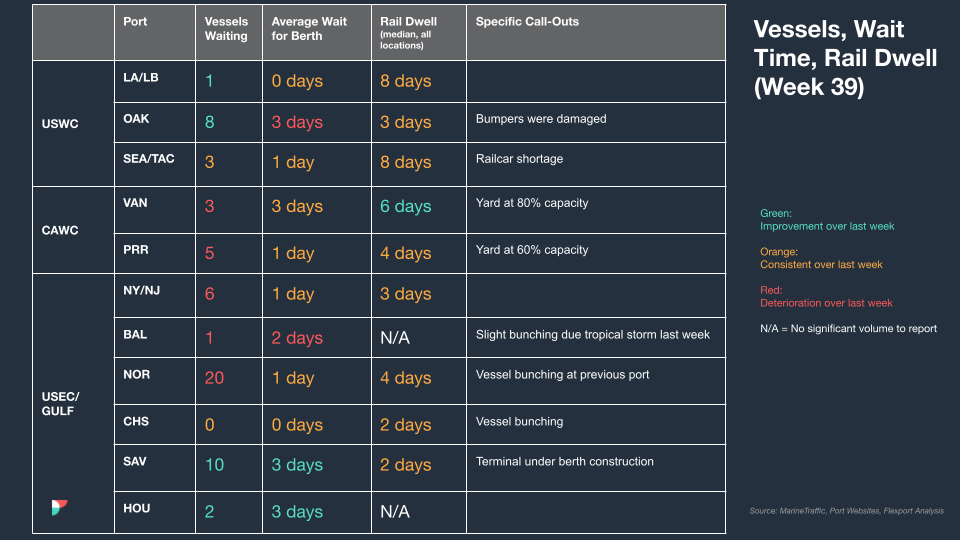

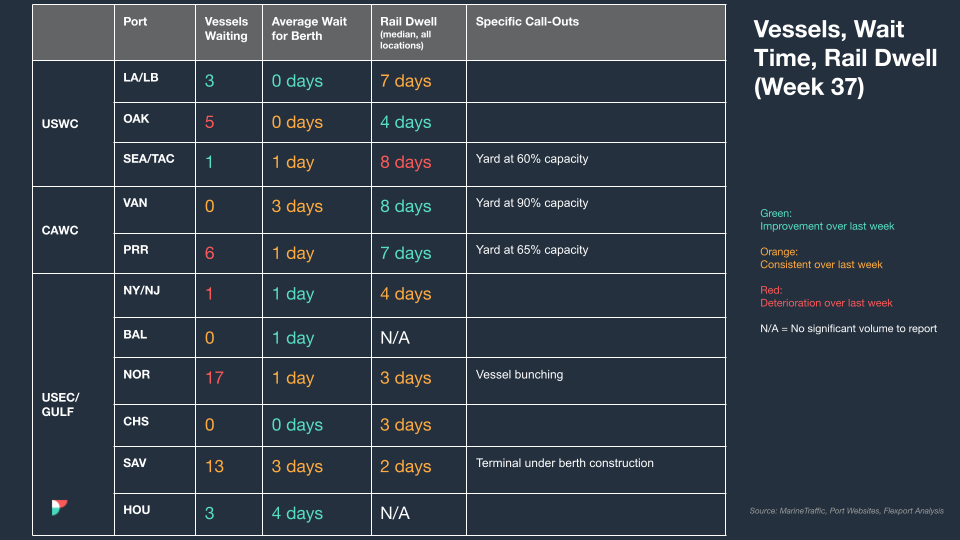

North America Vessel Dwell Times

The Week In News

Biden Will Convene His New Supply Chain Council and Announce 30 Steps To Strengthen U.S. Logistics

President Biden hosted the first meeting of his supply chain resilience council on Monday, November 27, where he announced 30 new measures aimed at enhancing access to medicine, economic data, and other programs related to the production and transportation of goods. The initiative, led by the White House National Economic Council, seeks to address supply chain challenges that contributed to heightened inflation during the U.S. post-pandemic recovery in 2021. The actions include improving the federal government’s ability to monitor and assess risks to supply chains through the sharing of data among agencies via new tools from the Commerce Department in partnership with the Energy Department on the supply of renewable energy resources.

Record Online Shopping Fuels Another Massive Black Friday

Holiday shopping on Black Friday generated a record $9.8 billion in eCommerce sales in the U.S., up 7.5% from last year, with $5.3 billion of that total (or 79% of all shopping traffic, including browsing+buying) coming from mobile devices. More American consumers have turned to buy now, pay later tools to extend their holiday budgets, up 47% from last year for a total of $79 million––a sign of resilience in the post-Covid economy for the fintech sector. Analysts expect eCommerce sales to continue through Cyber Monday, with an estimated $12 billion in sales, a 5.4% increase over last year.

‘Stay Cautious’ Warning to Carriers After Suspected Drone Attack on Box Ship

Israel-linked ships are facing increased risks in the Red Sea as targets for Iran-linked factions amid the ongoing conflict in Gaza. Over the weekend, three vessels tied to Israel experienced incidents: a suspected drone attack targeted the CMA CGM Symi, a container ship owned by Israeli billionaire Idan Ofer; a Zodiac Maritime tanker was reportedly boarded by Houthi rebels and diverted to Hodeida, and Iranian warships demanded a Japanese bulk carrier change course. The incidents highlight escalating tensions in the region and pose challenges for shipping companies operating in the area.

‘Dire’ Scenario for Shipping Lines More Likely as Spot Rates Fall Back

As the global composite of Drewry’s World Container Index (DCI) fell 6% in the past week, next year’s container annual contract rates are expected to reset much lower than this year’s, suggesting negative financial effects on liners as shipping lines’ attempts to use general rate increases (GRI) in November to improve their negotiating hand for annual contract resets have failed. If Asia-Europe annual contracts reset in the vicinity of Q4 spot rates starting in January, and if Asia-U.S. contract rates don’t improve—or fall further—when they reset in May, container lines would face steep losses in 2024, particularly as costs are up 25-30% versus pre-COVID levels.

Source from Flexport.com