Trends to Watch

[Tariffs Update]

- On Wednesday, President Donald Trump agreed to exempt automobiles from the 25% tariffs on Mexico and Canada for one month.

- More than one in five cars and light trucks sold in the U.S. were built in Canada or Mexico, according to S&P Global Mobility. The tariffs could drive up prices for some models by as much as $12,200.

- Additionally, the reciprocal tariffs are set to start on April 2. Follow our live blog for the latest updates.

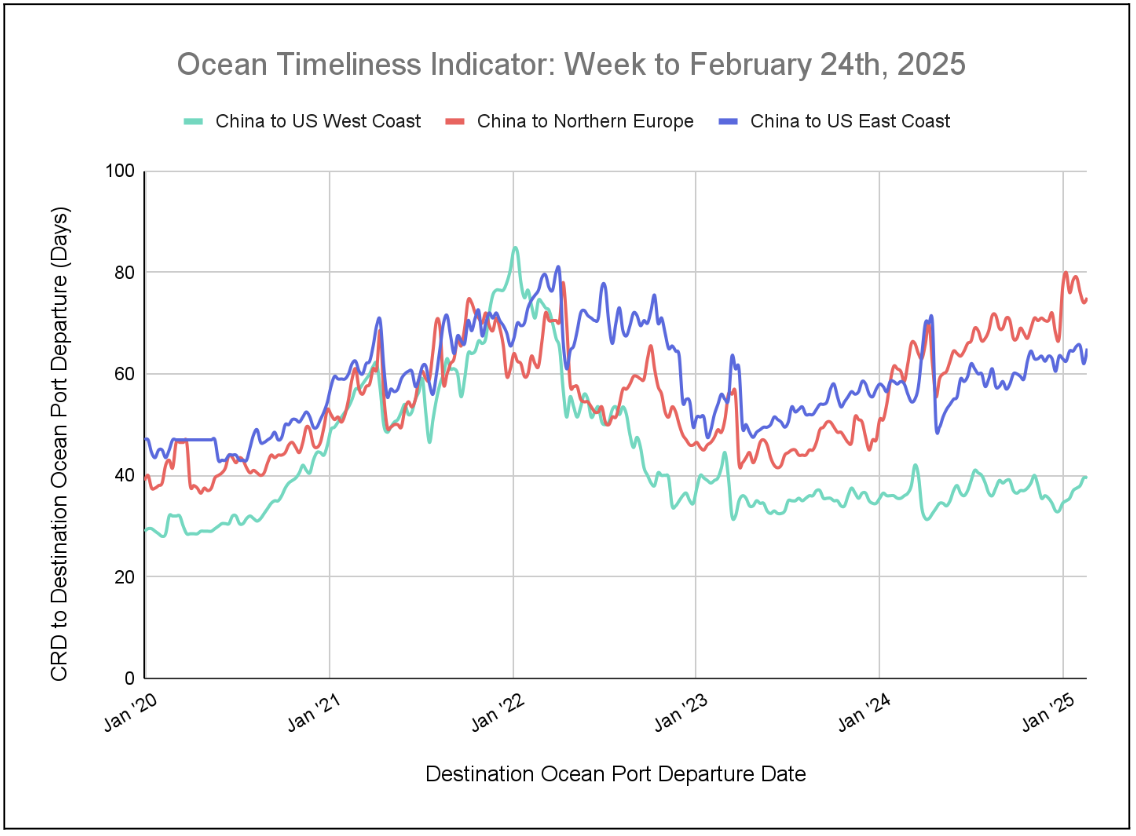

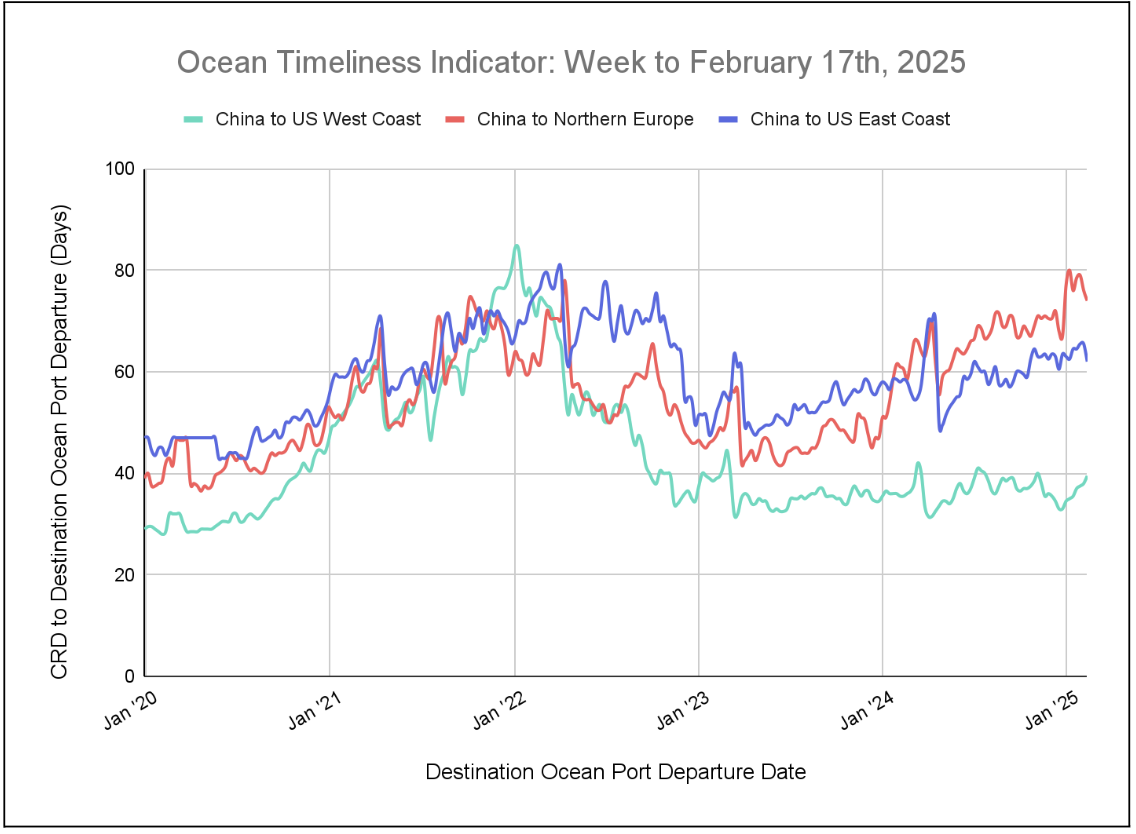

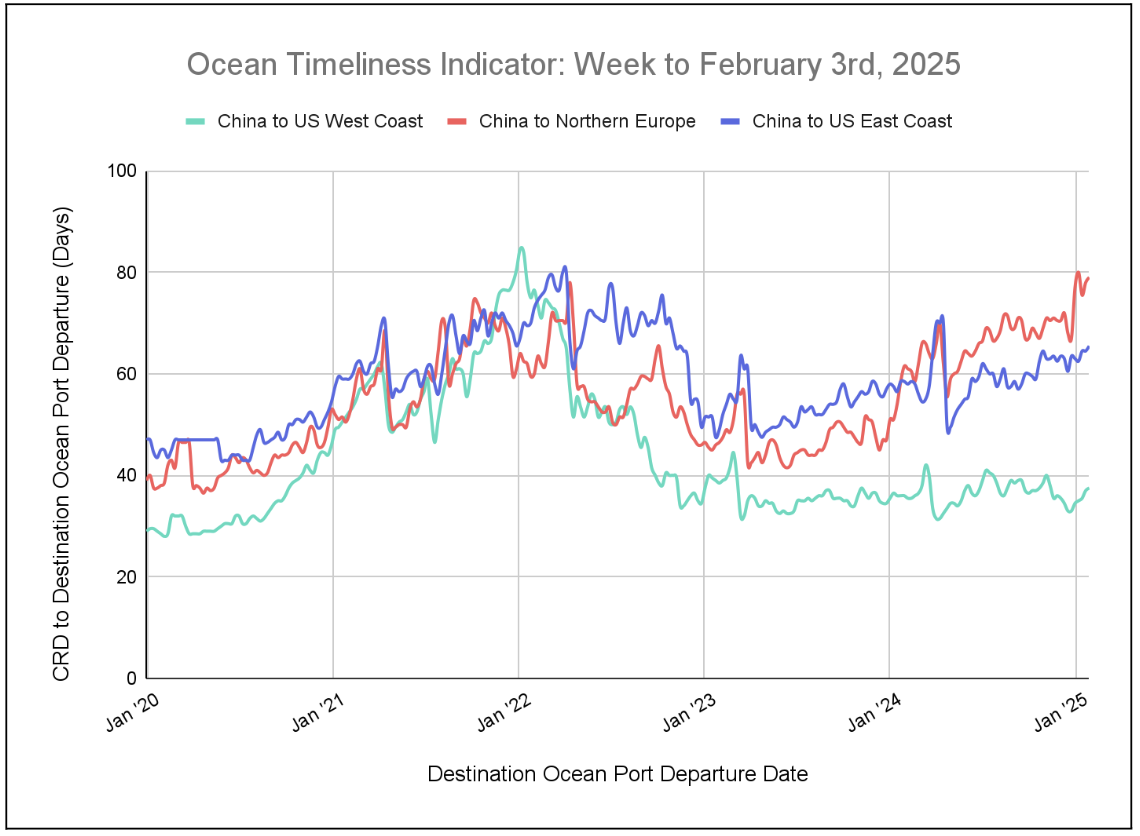

[Ocean – TPEB]

- Capacity and market: Demand is slowly improving but hasn’t yet reached pre-CNY levels, while capacity has returned and stabilized to over 90%, with space available at all gateways. It’s expected that shipping volumes may shift from China to Southeast Asia.

- Rate trends: Floating rates are steadily declining, with some carriers extending rates until the end of March. Due to the drop in floating market rates and ample capacity, the Peak Season Surcharge (PSS) has been reduced for March.

- Equipment: There is currently ample equipment supply across most origin gateways, with no major shortages expected.

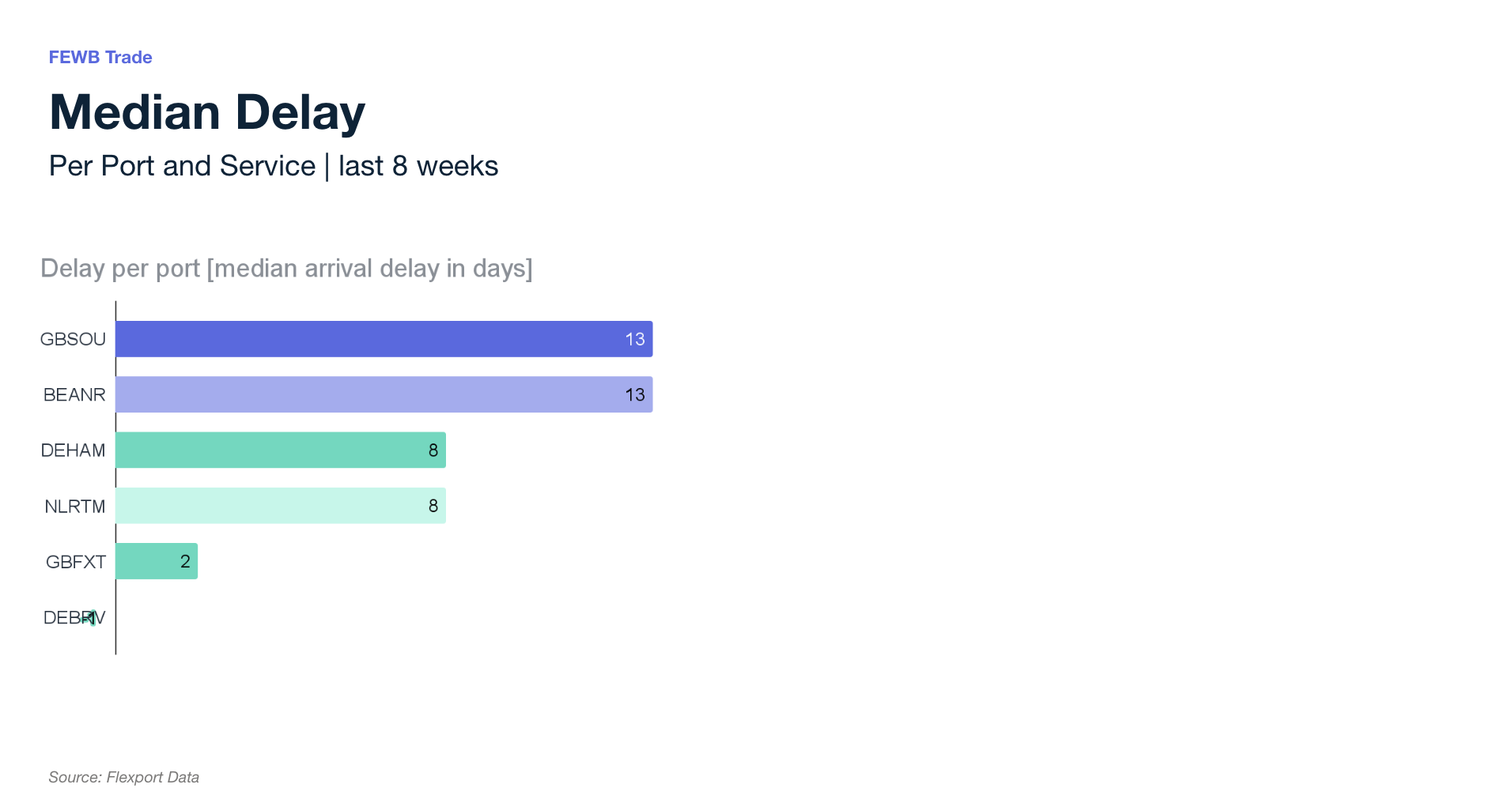

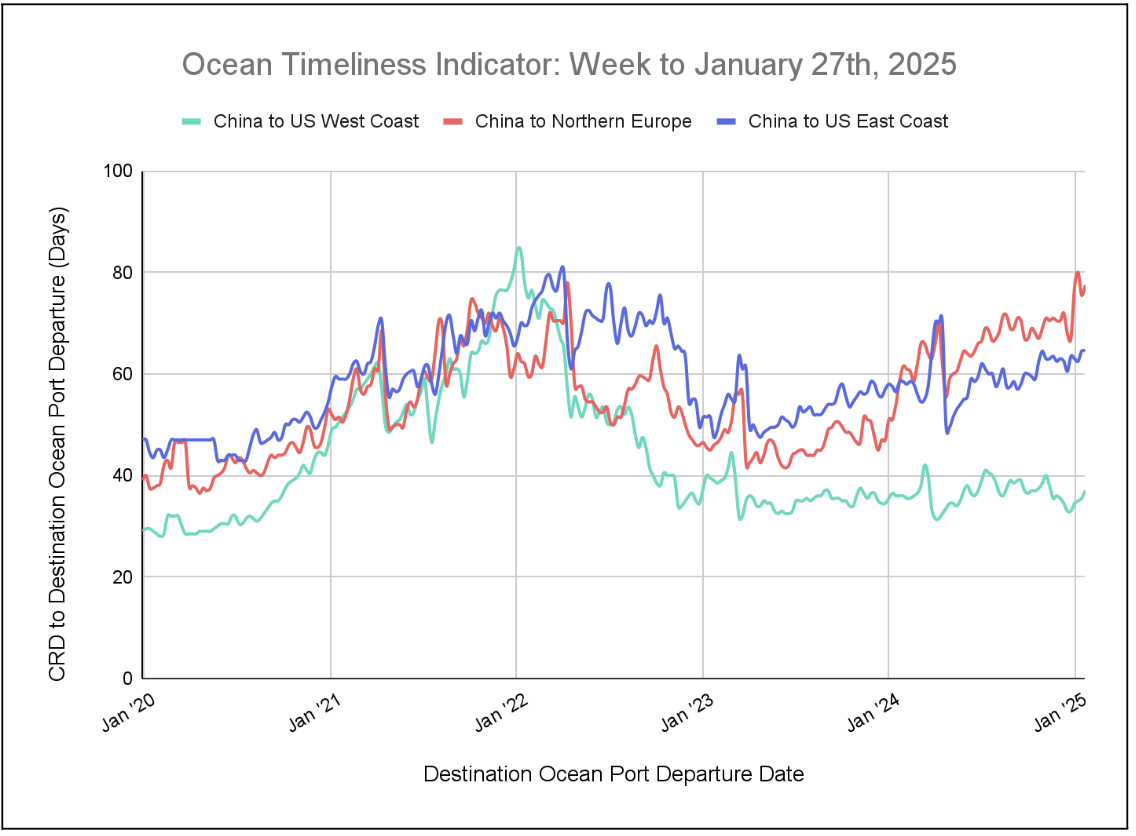

[Ocean – FEWB]

- Capacity outlook: In early March, the overall utilization of carrier vessels was lower than initial expectations. A flat market prompted carriers to withdraw their March GRI and adopt a more competitive stance to attract cargo. Several void sailings in March slightly eased the oversupply situation, but did not result in a significant capacity shortage. The market continued showing an overall oversupply. Additionally, as the U.S. Trade Representative (USTR) proposed imposing fees and restrictions on international maritime transport services involving Chinese ship operators and Chinese-built vessels, carriers have begun adjusting their trade capacity deployment between the TPEB and FEWB. However, the broader impact on the FEWB trade remains uncertain at this stage.

- Demand outlook: Demand on the FEWB trade has almost recovered to normal levels following the CNY slowdown. On the export side, production is back at full capacity, but in Europe, order delays are occurring due to inventory buildup issues. Furthermore, weaker shopping demand in Europe this summer, along with fewer major international events compared to last year, has reduced the need for early purchasing and shipping, leading to higher inventory levels. This has contributed to softer market demand and a shortage of cargo volumes in March.

- Market development outlook: Given current flat market conditions and the potential impact of the USTR proposal on carrier capacity adjustments, the market is likely to experience short-term fluctuations with heightened uncertainty. Additionally, carriers are expected to attempt to push up rates through GRIs in mid-to-late March or early April to improve vessel utilization. Unless significant events occur, such as the reopening of the Red Sea route, current FAK spot rates are not expected to be further lowered.

[Ocean – TAWB]

- Capacity / demand: Blank sailings have been reduced, and we expect more stable capacity in March. These blank sailings are primarily concentrated in South Europe services, particularly in the East Mediterranean.

- Utilization: Most carriers are experiencing good utilization in both North and South Europe, with some reaching 100% utilization for March sailings. This indicates an increase in demand, which is more pronounced in North Europe. Additionally, the potential implementation of tariffs by the U.S. administration on EU goods is expected to further impact trade demand.

- Rates: Most carriers in North Europe have decided to postpone the March PSS to April. However, some carriers have mitigated the delay and plan to implement the surcharge for shipments to the U.S. East Coast and U.S. Gulf. March FAK rate levels reflect skepticism regarding a potential PSS. In the Mediterranean, certain carriers have announced plans to introduce a PSS in April, following the lead of North European carriers.

- Equipment: Equipment shortages persist in parts of Central Europe, particularly in Austria, Slovakia, Switzerland, Hungary, and Southern/Eastern Germany. For these origins, carrier haulage is recommended. Meanwhile, Southern European ports are not currently experiencing any equipment shortages.

[Air – Global] Mon 17 Feb – Sun 23 Feb 2025 (Week 8) (Source: worldacd.com):

- Asia-Pacific rebound: Air cargo tonnages from Asia-Pacific origins continued their recovery post-Lunar New Year, with a +6% increase in Week 8, following a +20% jump in Week 7. Asia-Pacific to Europe tonnages grew +5%, while Japan to Europe surged +19% WoW. Other key markets, including South Korea (+7%), Vietnam (+8%), and Thailand (+18%), also saw gains.

- Asia-Pacific to USA recovery: Tonnages on this lane rebounded by +5% in Week 8, after a +28% increase in Week 7, bringing volumes back to mid-January levels. Notable increases came from Japan and Hong Kong (+11% each), as well as South Korea and Taiwan (+9% each).

- Rate trends: Spot rates from the Asia-Pacific to the USA rose +4% WoW to $4.99/kg, with China to USA recovering +9% to $4.08/kg. Meanwhile, Asia-Pacific to Europe rates dropped slightly to $3.99/kg, driven by declines from China (-3%), Hong Kong (-3%), and Japan (-6%).

- Global stability: Overall worldwide tonnages rose +1% WoW, with Asia-Pacific’s +6% gain offset by declines from North America (-2%) and Central and South Asia (-6%). Average global air freight rates increased +2% to $2.32/kg, with the Asia-Pacific being the primary driver. Year-on-year comparisons remain skewed due to different Lunar New Year timings.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

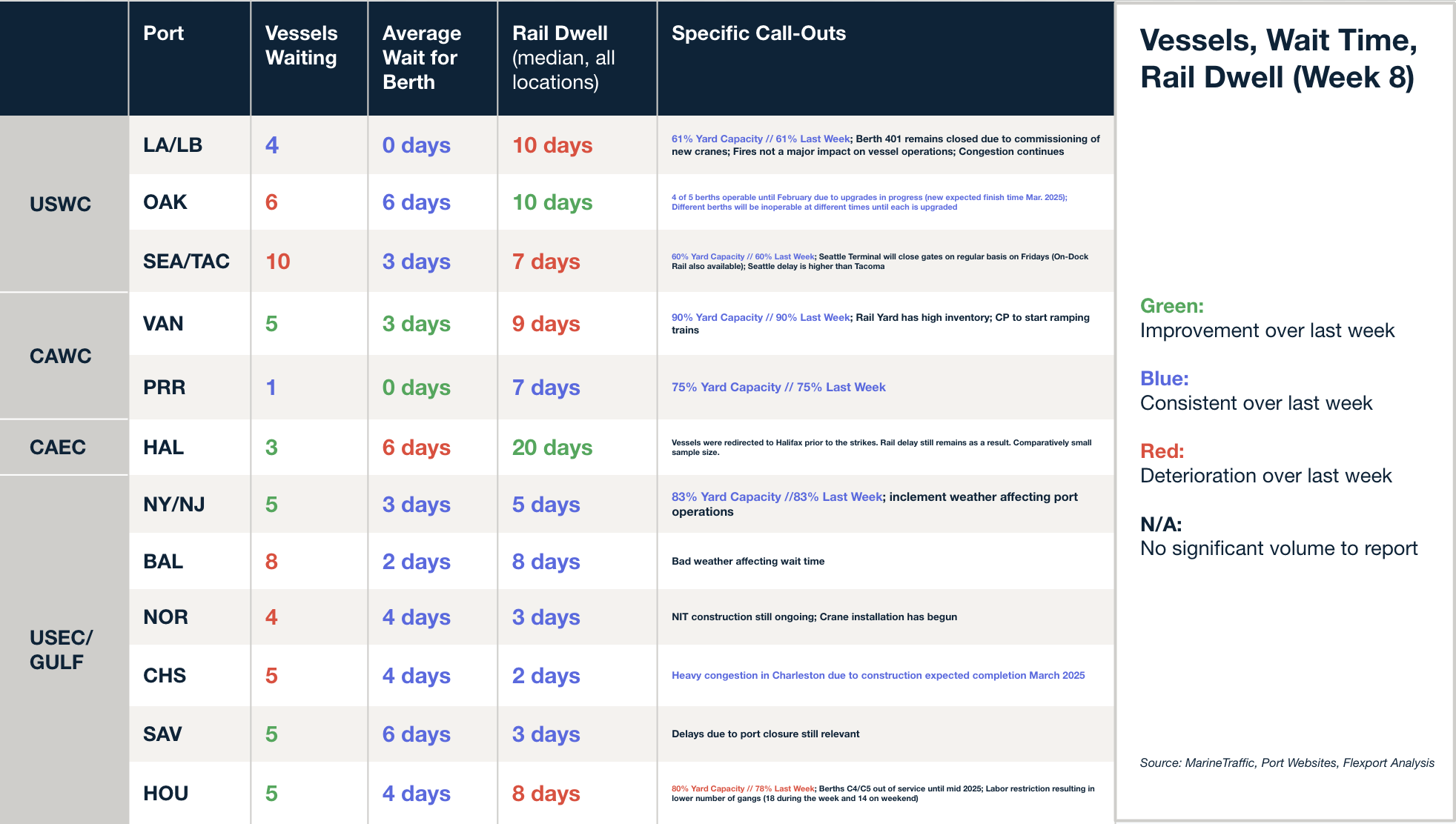

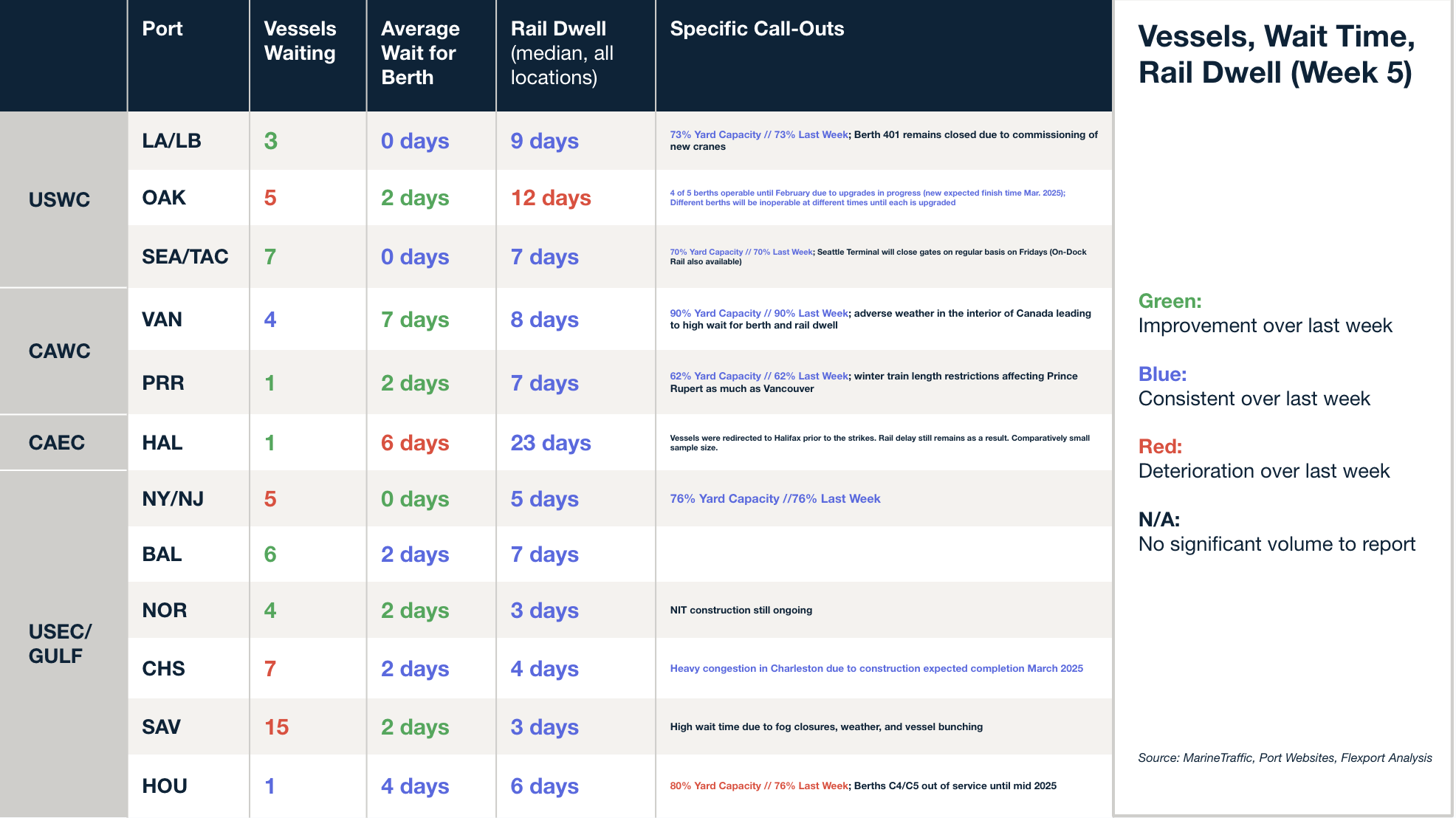

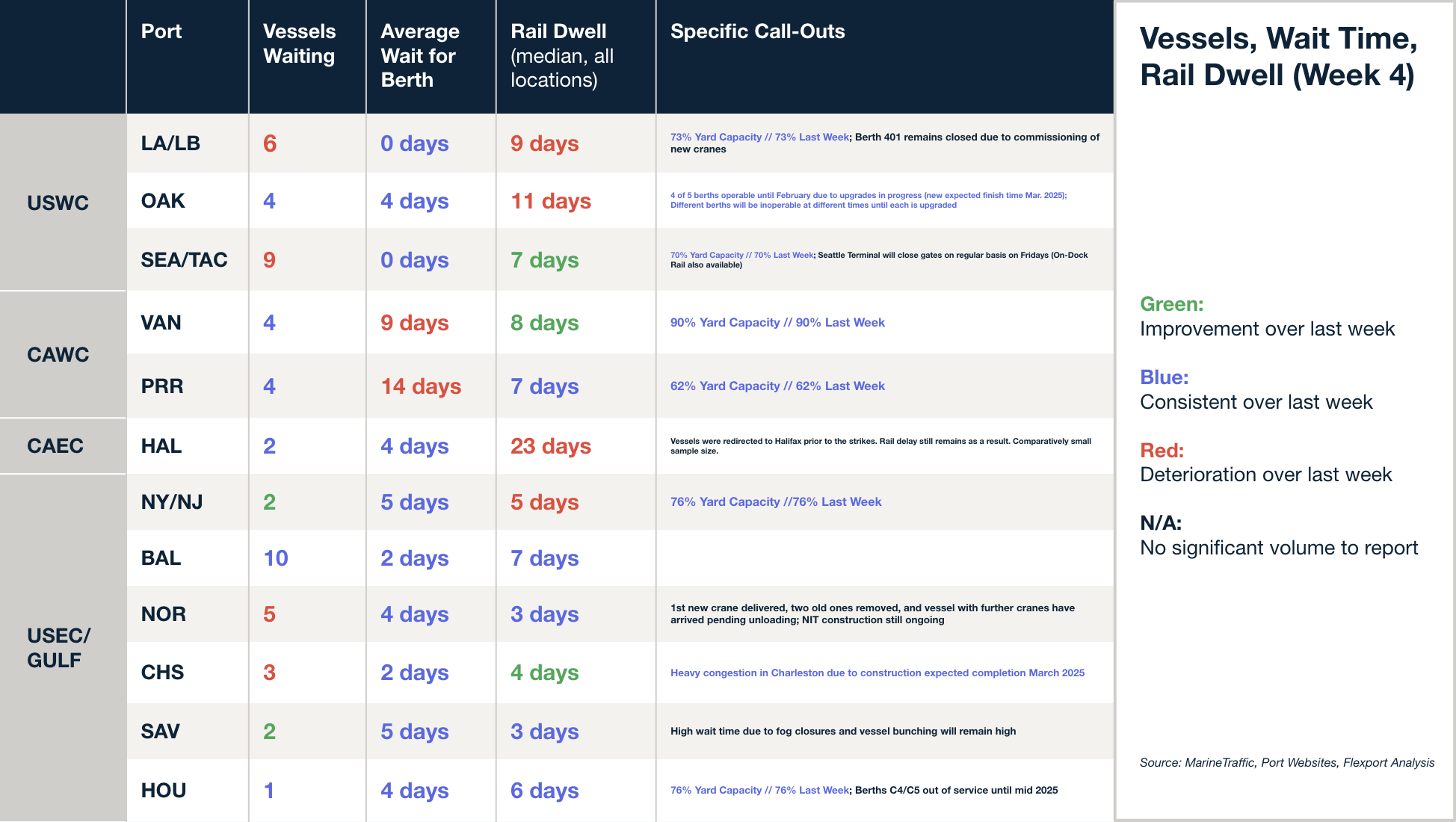

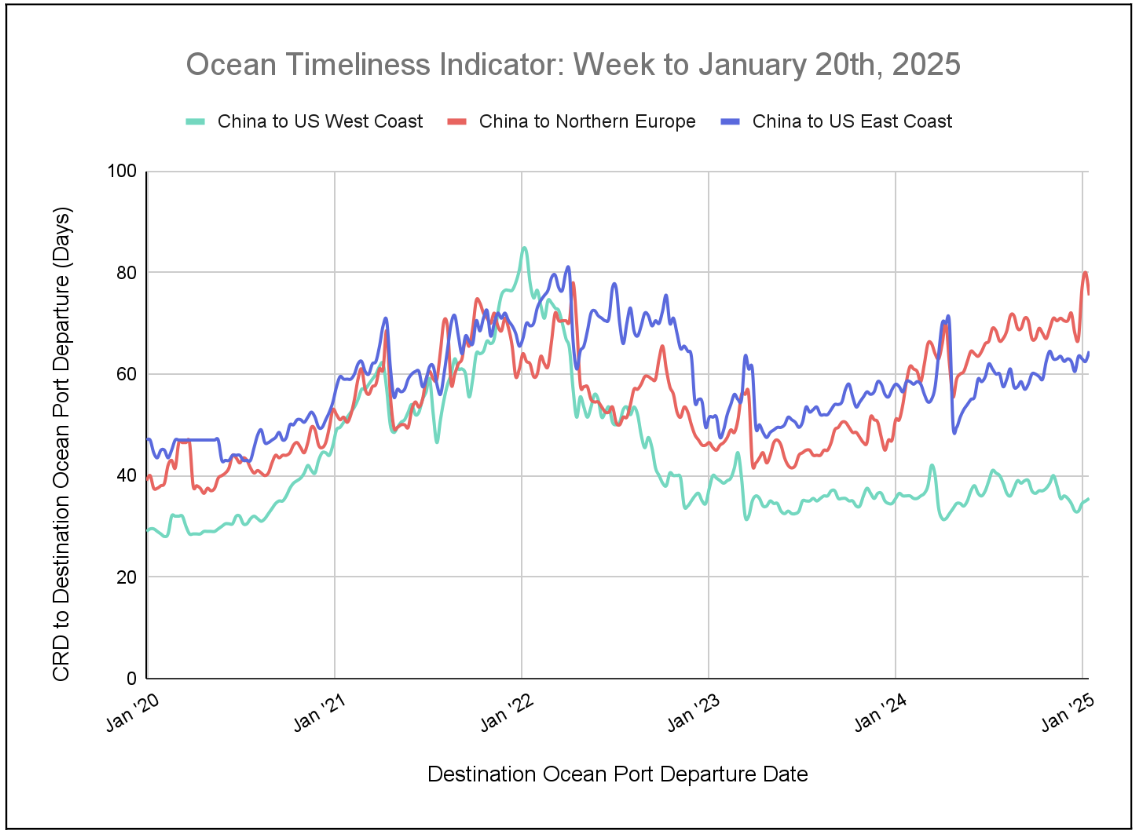

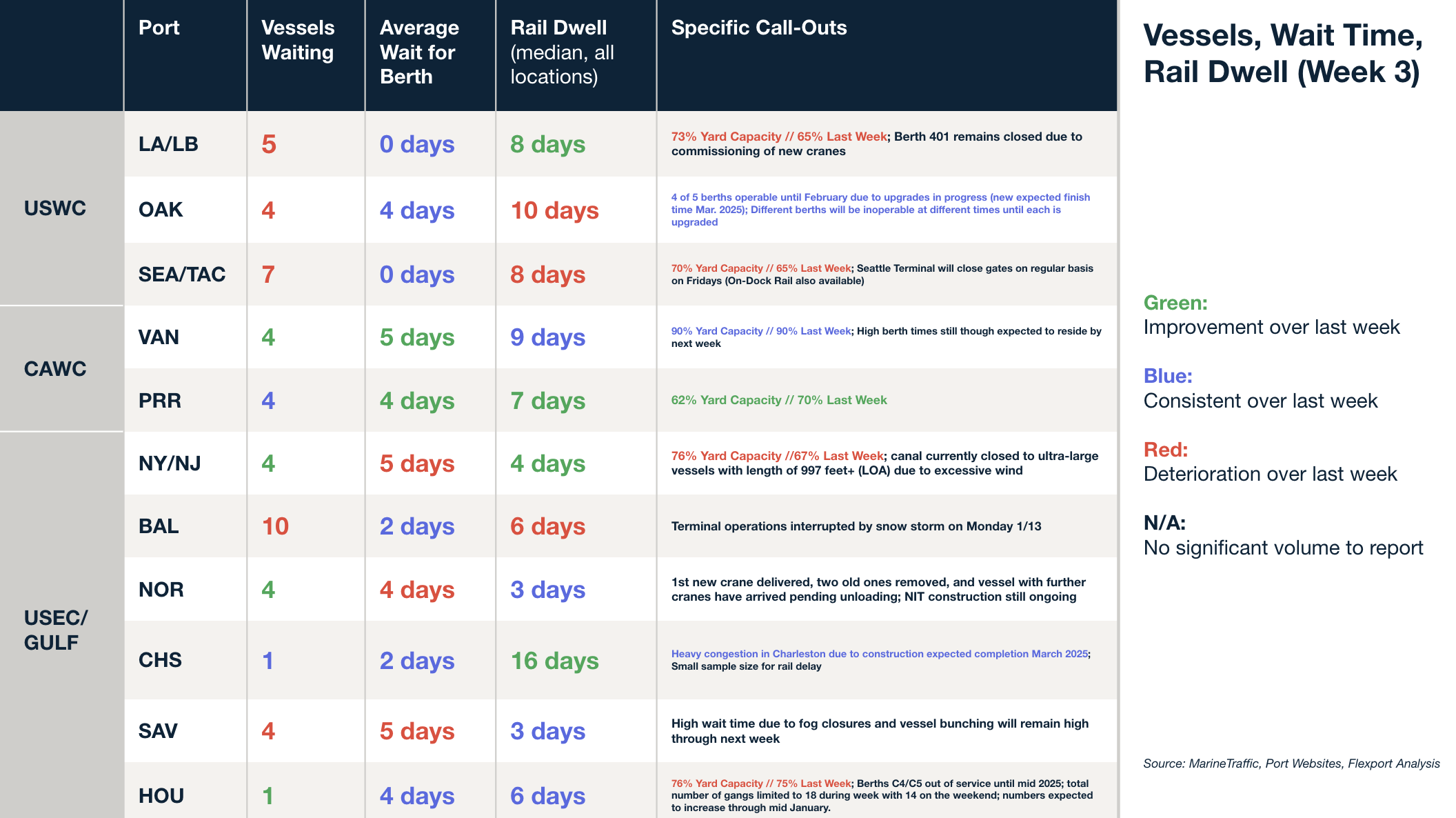

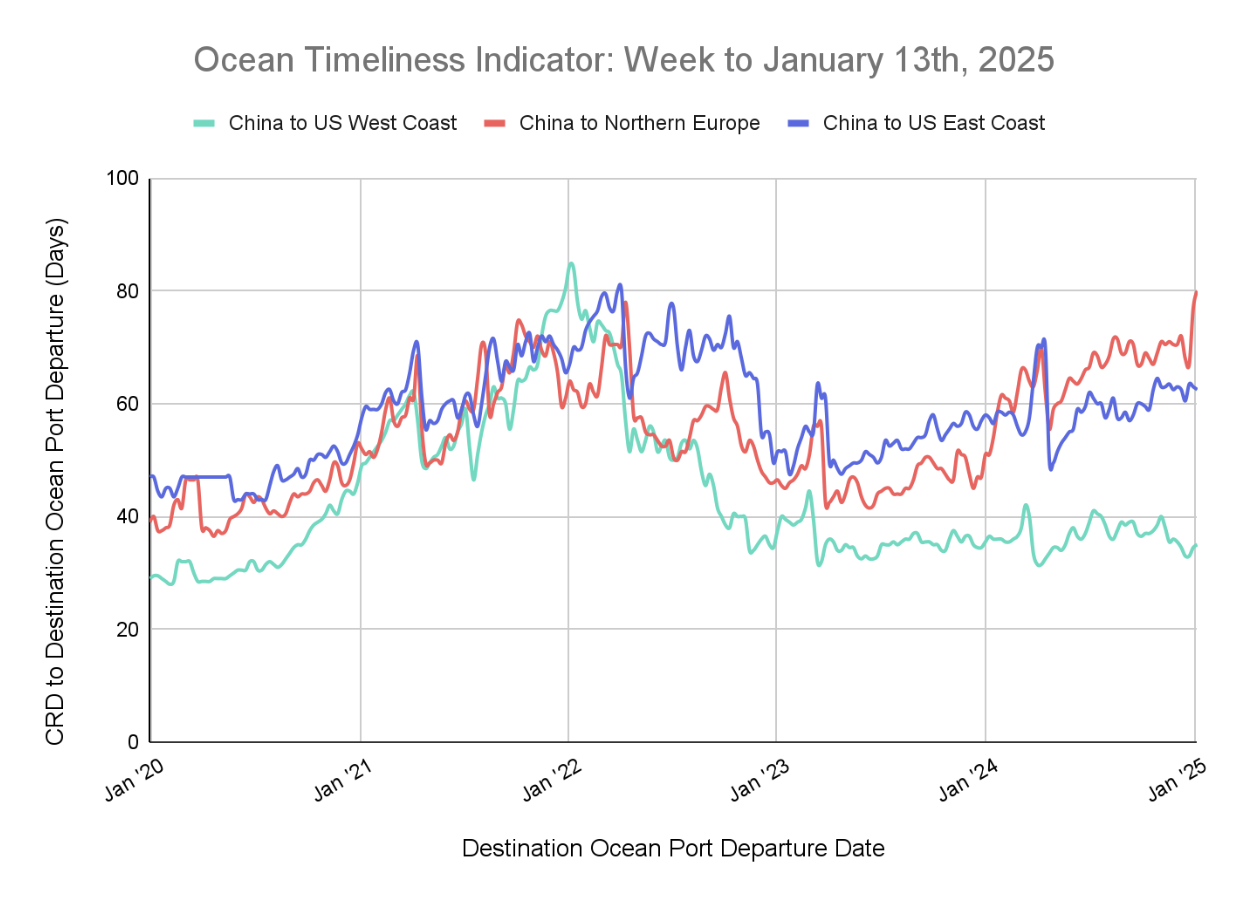

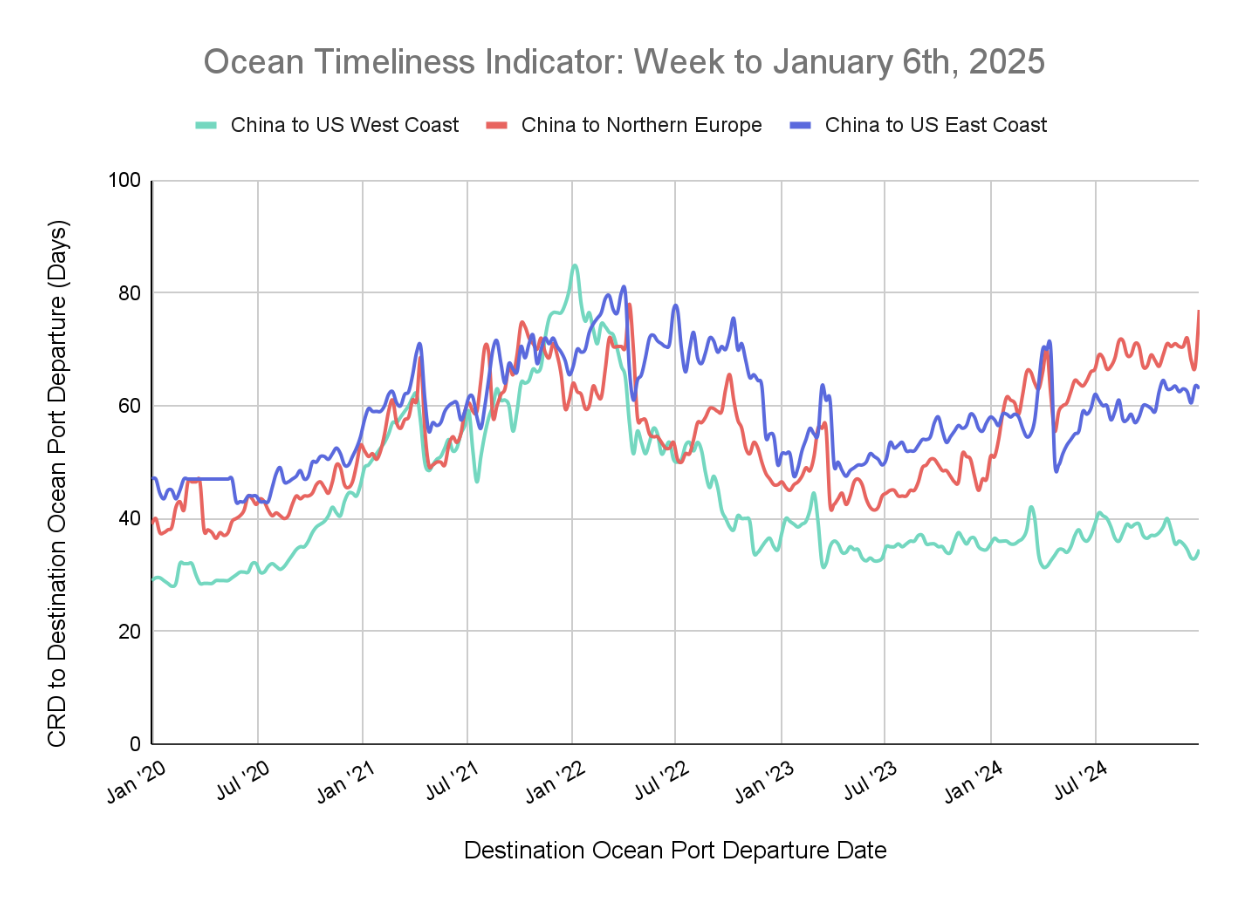

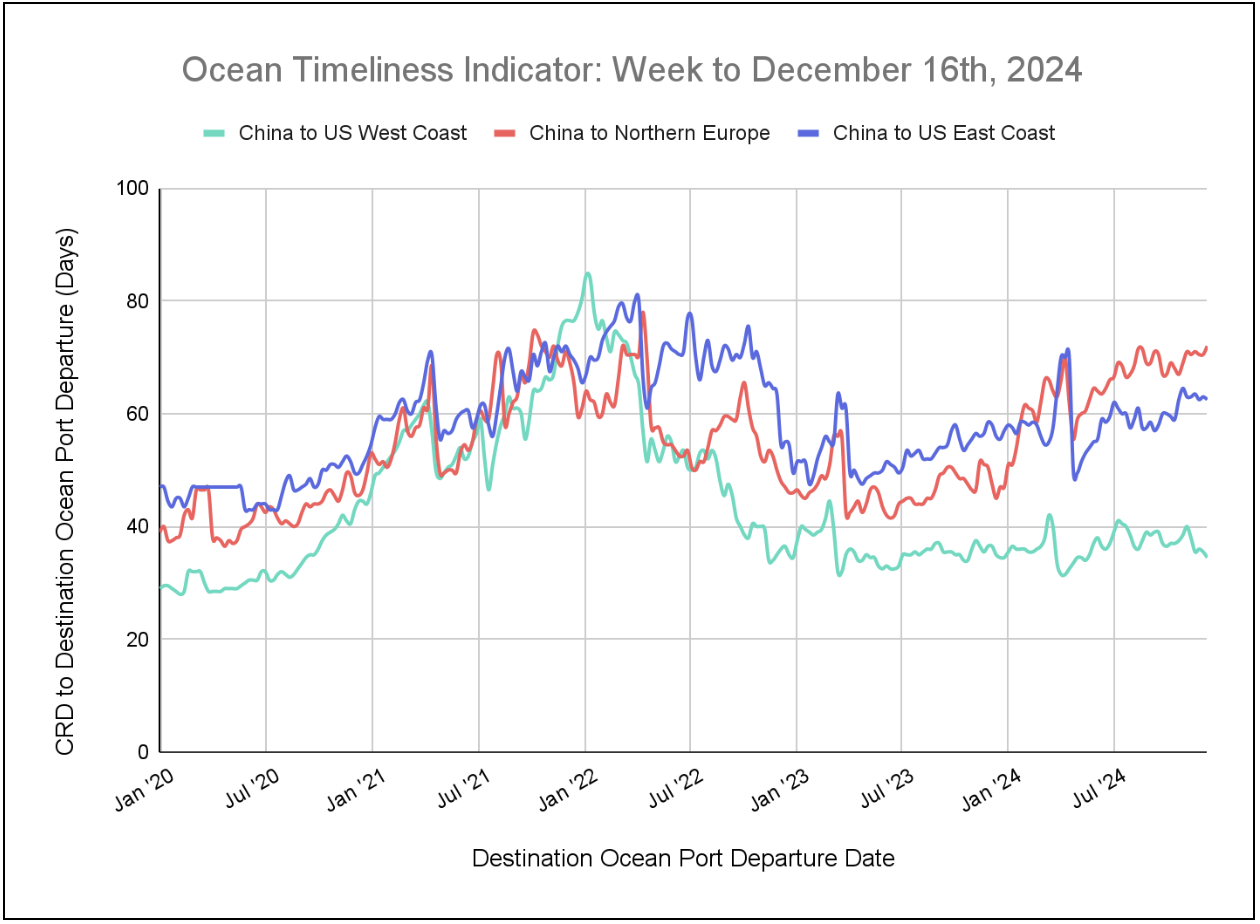

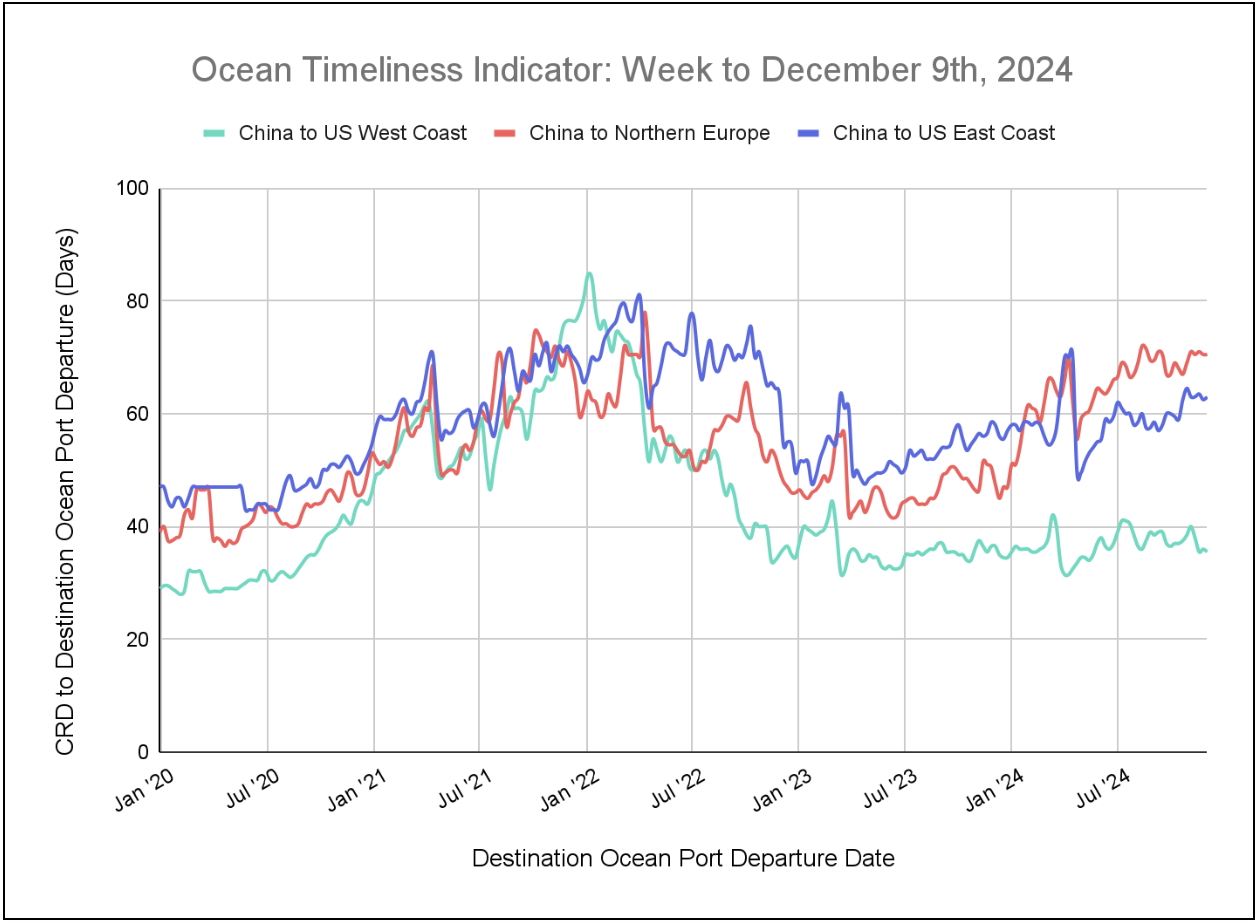

North America Vessel Dwell Times

News This Week

Flexport CEO: ‘Every single member on your team should be using AI

Flexport launched 20 AI-driven products to transform logistics, including Flexport Intelligence for AI-powered reporting and Flexport Control Tower for multi-provider freight management.

Looking ahead, the company plans for deeper freight-fulfillment integration and AI-driven inventory financing, maintaining rapid innovation.

Potential US tariffs ignite US-Canada cross-border spot truck rates, volumes

Freight volumes and spot rates between Canada and the U.S. are surging ahead of 25% U.S. tariffs that took effect on March 4. Businesses are rushing shipments to avoid cost hikes, driving a 57% jump in Toronto-to-Chicago dry-van spot-market volumes and rising rates. Spot rates from the US to Canada have risen by 18% since the US election and by 6% in the past two weeks, reaching their highest point in two years. Cross-border shipments made up 72% of loads in January at Canadian load-board operator Loadlink, and Loadlink’s Canada spot market freight index spiked 40%. In contrast, U.S.-Mexico rate increases remain modest.

Trans-Pacific carriers reaching higher in early 2025–26 contract talks

Trans-Pacific container lines are seeking 20-30% rate hikes for 2025-26 contracts, aiming for $2,000 per FEU to the West Coast and $3,000 to the East Coast. Many importers plan to finalize contracts by March, while some retailers are delaying talks, anticipating moderate import growth and increased vessel capacity. Spot rates have been dropping, with West Coast rates at $2,450 per FEU (-37% YoY) and East Coast at $3,575 (-38% YoY). Carriers are using General Rate Increases (GRIs) and Peak Season Surcharges (PSSs) to stabilize prices, but competition is driving discounts below $2,000 per FEU.

Source from Flexport.com