Trends to Watch

[Ocean – TPEB]

- November is seeing a significant recovery in volumes following the post-Golden-Week lull. This is driven in part by a push from China due to anticipated tariff increases. Rates remain dispersed across routes between China and Southeast Asia.

- East Coast volumes are returning to normal levels, with some carriers and service routes already fully booked or experiencing capacity constraints through November.

- Fixed rates and Peak Season Surcharges (PSSs) are holding steady as we move into the first half of the month.

[Ocean – FEWB]

- Bookings are being pushed to avoid increased freight costs for later November departures, with vessels projected to be full and the roll pool prepared for overflow starting at the end of October.

- A 15-18% capacity cut is expected in November, with ten void sailings announced so far, which will continue impacting market supply.

- The first half of November GRI may settle around $4,400-4,500 per FEU, with carriers planning for a second-half November GRI at approximately $5,400 per FEU.

- The Shanghai Containerized Freight Index (SCFI) rose by $277 per TEU in week 44, and another increase is anticipated in week 45 to reflect GRI adjustments. With space growing increasingly limited, carriers will reintroduce premium services starting November 1 at $2,000 per container for shippers requiring confirmed space on earlier estimated times of departure (ETDs) or specific service transit times.

[Ocean – TAWB]

- Demand in North Europe remains steady, with the typical seasonal peak ahead of the Christmas holidays. Carrier utilization levels are strong, keeping rate levels stable across most services. Some carriers are re-evaluating the Peak Season Surcharge (PSS) applied in October due to the ILA strike.

- In the East Mediterranean, demand is also stable. Utilization is high on certain services, although some loops still face blank sailings due to service reliability issues.

- In the West Mediterranean, demand has increased, and with blank sailings contributing to full utilization, carriers have announced further rate increases for November, continuing the trend from September and October.

[Air – Global] Mon Oct. 14 – Sun Oct. 20, 2024 (Week 42):

- Hong Kong to Europe tonnages: Tonnages increased +25% YoY and +12% since September averages, with spot rates stabilizing above $5 per kilo, reflecting a +13% YoY increase.

- Asia-Pacific to Europe rates and tonnages: Tonnages from Thailand and Vietnam to Europe rose by +27% and +26% YoY, respectively. Spot rates jumped significantly, with Thailand up +87% YoY and Vietnam up +61% YoY.

- MESA to Europe decline: Tonnages from MESA to Europe dropped -8% 2Wo2W, and Dubai to Europe tonnages fell -22% WoW, influenced by geopolitical tensions. Rates to the USA fell from $5.02 to $4.69 per kilo, but are still up +80% YoY.

- China to USA decline: Despite a +4% WoW recovery in total Asia-Pacific-USA tonnages, China-USA tonnages remained down -18% YoY, partly due to tighter U.S. Customs checks. However, spot rates rose +3% WoW to $5.41 per kilo—up +10% YoY.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

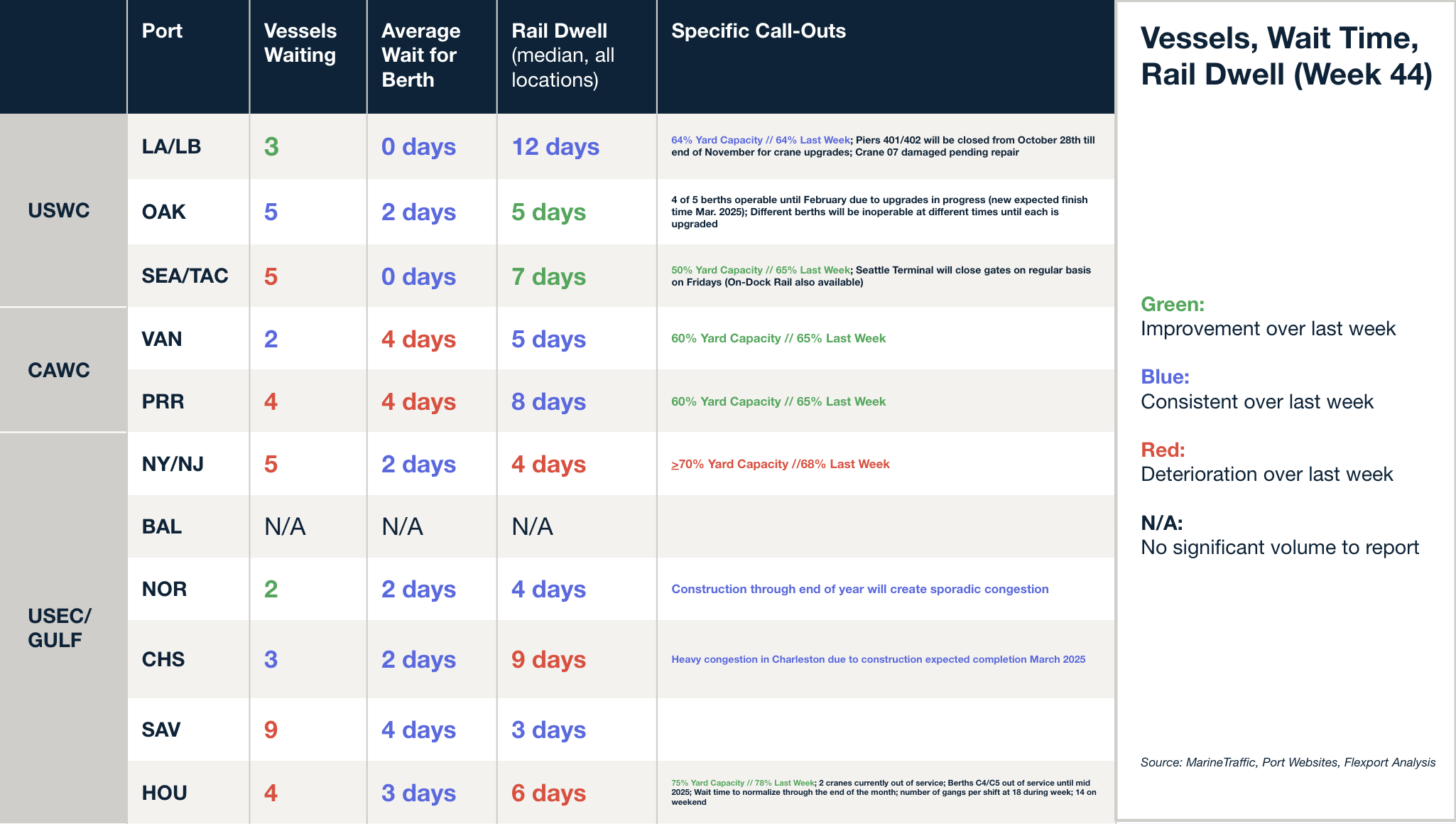

North America Vessel Dwell Times

Webinars

North America Freight Market Update Live

Thursday, November 14 @ 9:00 am PT / 12:00 pm ET

This Week in News

Montreal dockworkers target MSC’s terminals for strike this week

A work stoppage at Montreal’s Maisonneuve and Viau marine terminals, both operated by Termont International, will commence Thursday, following a vote by Local 375 of the Canadian Union of Public Employees (CUPE) to authorize an indefinite strike. This action targets nearly half of the port’s container capacity, impacting over 1 million TEUs of Montreal’s 2.3 million TEUs in capacity. Termont urged shippers to retrieve cargo by Wednesday evening. The strike affects Mediterranean Shipping Co. (MSC) trans-Atlantic and north-south routes, including services from Italy, Mexico, and U.S. Gulf ports, with at least four MSC vessels scheduled to arrive at the impacted terminals.

Houthis Resume Attacks on Ships in Red Sea

Houthi rebels launched an attack on a Liberian-flagged container vessel, the Montaro, in the Red Sea on October 28, marking their first assault on shipping since a U.S. air strike on their bunkers earlier in October. Multiple explosions were reported near the ship as it traveled through the Red Sea Gulf of Aden strait, although no damage or injuries occurred. Houthis also claimed attacks on two other Liberian-flagged vessels in the Arabian Sea the same day, though these remain unverified. Based in Yemen, Houthi rebels have reportedly conducted nearly 100 maritime attacks in the region over the past year, resulting in two sunken ships and four crew fatalities.

Air freight demand largely unfazed by ILA port strike

The recent three-day strike by the International Longshoremen’s Association (ILA) at U.S. ports had a limited impact on air freight demand, as many companies had already taken steps to mitigate potential disruptions. However, experts warn that if a master contract agreement is not reached by January 15, 2025, a second potential strike could cause more significant disruptions to supply chains. They advise companies to monitor port backlogs, prepare alternate logistics options, and communicate with suppliers to manage potential disruptions and cost increases.

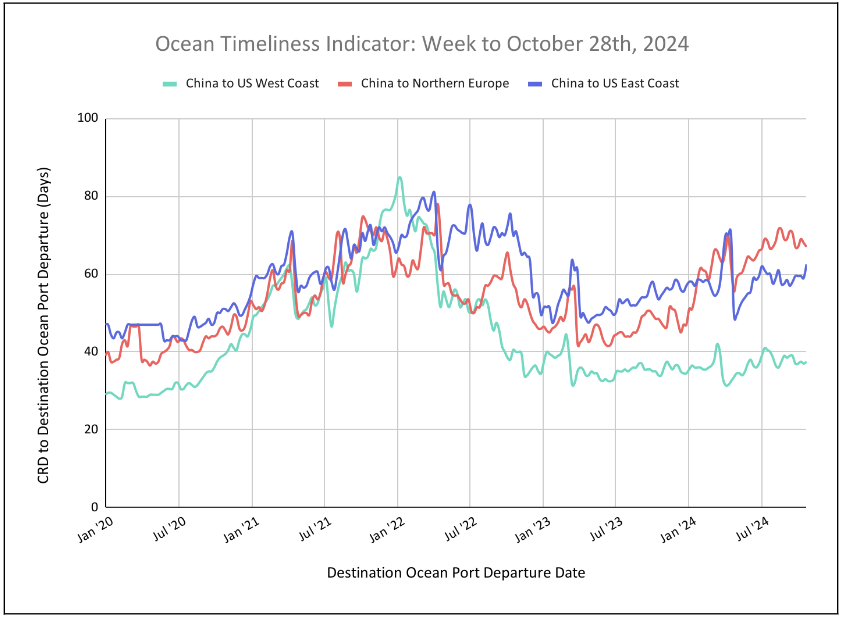

Flexport Ocean Timeliness Indicator

This week, OTIs from China to both the U.S. East and West Coasts have increased, while China to North Europe has decreased.

Week to October 28, 2024

This week, the Ocean Timeliness Indicator (OTI) has shown a small uptick for China to the U.S. West Coast, rising from 37 to 37.5 days—a return to the previous week’s figure. Meanwhile, China to North Europe fell further from 68 to 67 days, and China to the U.S. East Coast jumped from 59 to 62.5 days.

Source from Flexport.com