Trends to Watch

[Ocean – TPEB]

- Departures from Asia remain strong, largely supported by the addition of extra loader capacity to alleviate the backlog from the cargo rush between May and July. However, with clients reporting healthy inventory levels, demand may soften in the coming weeks. This is particularly likely as we observe structurally blank sailings due to Cape of Good Hope (COGH) routings and port congestion in Asia and North America. Adverse weather conditions around the COGH are expected to cause further delays and capacity challenges to the U.S. East Coast. On a positive note, water levels at Gatun Lake have recovered, allowing local authorities to ease weight restrictions for the Panama Canal.

- In preparation for the upcoming Golden Week holiday, carriers are implementing blank sailing plans that will impact Weeks 38 through 41 to adjust capacity on the TPEB route. This may lead to changes in sailing schedules or transit times, particularly for transshipment connections, as blank sailings could result in rollovers to the next available schedule.

- Floating rates: The September 1 General Rate Increase (GRI) was withdrawn by carriers Aug 31 As a result, rates from the end of August have been extended.

- Fixed rates: Discussions regarding the Peak Season Surcharge (PSS) remain unchanged at this time. However, if the floating market continues to soften, there may be movement in the fixed market.

[Ocean – FEWB]

- Demand is slowing, with more capacity available in September than in August. If demand remains steady, last-minute deployment adjustments may be necessary to balance demand and supply.

- Floating rates dropped further in the first half of September, but remain higher than in early 2024. Carriers are now being more proactive in adjusting rates to optimize vessel utilization, with the Shanghai Containerized Freight Index (SCFI) dropping by 12% in Week 36, marking the most significant change of 2024.

- Long-term named account business continues to face restrictions from carriers regarding space and equipment priority.

- While equipment shortages are improving, some ports of loading (POLs) with fewer direct calls still anticipate potential shortages for specific container types, such as 20’GPs and 45’HCs. Additionally, weight restrictions, especially for overweight 20’GP containers, are still pending acceptance based on the loading port’s policy and vessel size.

[Ocean – TAWB]

- Our main concern at this time is the potential work stoppage at U.S. East Coast and Gulf Coast ports. Although there has been no official announcement yet, the contracts are set to expire on September 30th.

- Carriers are maintaining high utilization rates for both Northern European and Mediterranean services, leading to rate increases in September, with a follow-up Peak Season Surcharge (PSS) expected in October.

- Schedule reliability has decreased due to delays at West Mediterranean ports.

- Equipment deficits continue to be an issue in certain areas of South and East Germany, as well as the Hinterlands. While no further work stoppages are anticipated at German ports, the equipment shortages remain a challenge.

- To ensure space and equipment availability, it remains advisable to book 2-3 weeks in advance.

[Air – Global]

- Week-on-week tonnage rebound: In week 34 (August 19-25, 2024), global air cargo tonnages increased by +5% compared to the previous week, with a notable +11% week-on-week (WoW) rise from the Asia-Pacific region, largely driven by a +91% WoW recovery in Japan following Typhoon Ampil.

- Regional tonnage contributions: The Asia-Pacific region’s recovery accounted for 40% of the global rebound, with major contributions from South Korea (+16% WoW), mainland China (+7% WoW), and Hong Kong (+3% WoW). Together, these regions contributed 30% to the global tonnage improvement.

- Year-on-year growth: Based on combined data from weeks 33 and 34, global air cargo tonnages increased by +9% year on year (YoY), with significant growth from the Asia-Pacific (+11%), the Middle East & South Asia (MESA, +10%), Europe (+8%), and Central and South America (+8%).

- Stable worldwide rates: Average worldwide air cargo rates remained stable at $2.51 per kilo, up +12% YoY. Rates saw significant increases from MESA (+59%) and the Asia-Pacific (+22%), while rates from Europe and North America decreased by -10% and -9% YoY, respectively.

- Bangladesh and MESA rate increases: Spot rates from MESA to Europe rose by +113% YoY, with rates from Bangladesh to Europe reaching $5.02 per kilo, a +161% YoY increase—the highest level this year. Spot rates from India and Sri Lanka to Europe also saw significant YoY increases of +145% and +106%, respectively.

Please reach out to your account representative for details on any impacts to your shipments.

North America Vessel Dwell Times

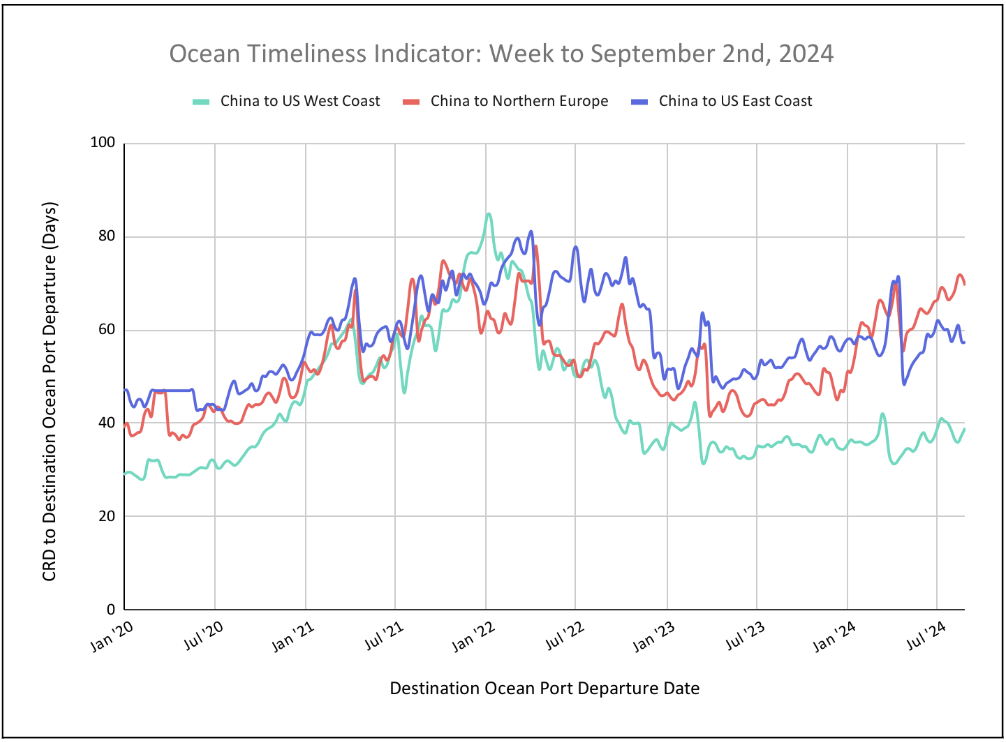

Flexport Ocean Timeliness Indicator

The Ocean Timeliness Indicator is on the rise for China to the U.S. West Coast, while China to the U.S. East Coast stabilizes and China to Europe decreases.

Week to September 2, 2024

This week, the Ocean Timeliness Indicator continues its ascent for China to the U.S. West Coast, rising from 37.5 to 39 days. Meanwhile, China to Northern Europe is on a downward trend, decreasing from 71.5 to 69.5 days. China to the U.S. East Coast has plateaued at 57.5 days, suggesting a potential increase in the coming weeks.

Source from Flexport.com